Commodity linked bull and bear bonds Help for Embedded

Post on: 23 Июль, 2015 No Comment

Commodity linked notes are the new instruments in the world of finance that offer security of principal amount if money which is similar to a fixed income security and as a return on investment based on a change in price of a stock market index or a commodity. In the past nine months, the par value of issued index and commodity-linked notes has exceeded $300 million.

Its very important to know that how does it work? First of all an issuer combines strip bond which is also known as a non-interest bearing note with an equity or commodity component. It consists of long term call and put option. From these components the future and the types of maturity can be known from the marketers. This process tells earlier the risks and benefit of the market I current scenario because call and option is used is used when market ups and down condition, so knowing the commodity link the investors get to know the overall idea about current scenario of the maturity rate in stipulated time frame. The price movement become very important for the call and put option because it gives lots of option for the investment for the marketers. The maturity date on the non-interest bearing notes and the exercise date on the option are identical.

At the maturity of the money the investors get par value on the non-interest bearing note plus a variable return based on the percentage change in the equity or commodity component.

For example, if an underlying stock market index rises 30% between the issue date and the maturity date, investors with an unleveraged index-linked note will realize a 30% return. Under a worst case scenario, the stock market index declines between the issue date and the maturity date and investors simply receive their original investment.

Bull-bear bond

The bull bear bond is defined as the principal amount of money which is repaid is linked to the price of another security. The bonds are generally issued in two tranches. The first tranches increases repayment with the price of the other security, where as in the second tranche repayment decreases with the price of the other security.

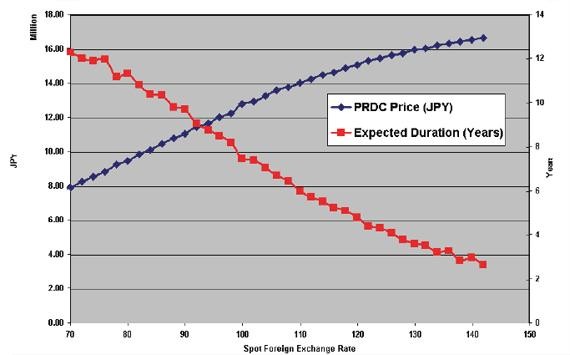

Graphical presentations of Commodity Linked bull and bear bonds

www.Transtutors.com provides timely home work and class work project at affordable charges with detailed answers to your Finance Subject problems to understandassignments in better way. Our teaching help line is open for 24X7 so that you can avail our service anytime, anywhere in the world.