Commodities That Move The Markets_3

Post on: 23 Апрель, 2015 No Comment

The following advisory was sent today to editors at AP member news organizations:

Starting next month, The Associated Press will take a fresh approach to its coverage of global financial markets.

Instead of two separate stories each day – one about U.S. markets and the other about international markets – AP will produce a single story that reports and analyzes the most important global news and trends.

(AP Photo/Mark Lennihan, File)

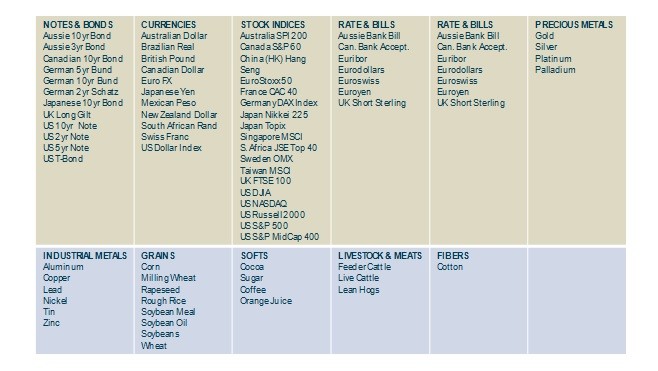

The global financial markets story will be updated throughout the day in Asia, Europe and the U.S. and will include coverage of stocks, bonds, oil and other commodities.

The story will move under the slug BC-Financial Markets, beginning on Monday, July 28. It will replace BC-US-Wall Street, BC-World Markets, BC-Oil Prices and BC-Commodities Review. (AP will no longer write separate daily stories on oil and commodities.)

Just like the current Wall Street story, the new Financial Markets story

will feature an easy-to-read format suited to the Web and mobile devices. It will include a market summary, followed by brief sections that highlight key news and trends. (See two examples below.)

This format gives readers lots of information with continuous updates and catchy headlines.

After markets close each day in the U.S. the AP will continue to publish a more traditional, narrative-style story that summarizes and analyzes the most important events in financial markets. A narrative-style story about markets can run at any time, in any global region, when warranted by major news events

Here’s an example of how the new format for the BC-Financial Markets story might have looked like on June 11 at around 5 a.m. Eastern time, reflecting moves in Asian and European markets:

LONDON (AP) — Global stock markets turned skittish Wednesday after the World Bank lowered its global growth forecast and a militant takeover of a key Iraqi city pushed oil prices higher. The World Bank cut its 2014 growth forecast to 2.8 percent, citing a bitter American winter and the political crisis in Ukraine. The weaker outlook sent Asian markets mostly lower, except for Japan, which closed slightly higher.

KEEPING SCORE: Germanys DAX dropped 0.6 percent to 9,969 and the CAC 40 in France fell 0.7 percent to 4,563. Britains FTSE 100 shed 0.5 percent to 6,839. In the U.S. stock index futures sagged in pre-market trading after a run of record highs. Dow Jones futures fell 0.3 percent to 16,894 and S&P 500 futures were down 0.4 percent to 1,943. Earlier, Asian indexes closed mostly lower.

WEAKER FORECAST: The World Banks gloomier outlook dampened investors’ enthusiasm for stocks, which had been on the upswing. The bank cut its forecast for growth this year to 2.8 percent from the 3.2 percent it forecast in January.

OIL SPIKE: Oil prices rose ahead of an OPEC meeting in Europe that is expected to keep production levels steady for the year. Benchmark U.S. oil for July delivery rose 30 cents to $104.65 a barrel in electronic trading in New York, extending Tuesdays large gain. Energy markets were also affected by al-Qaida-inspired militants overrunning much of the Iraqi city of Mosul on Tuesday. Mosul lies in an area that is a major gateway for Iraqi oil.

THE TAKEAWAY: IG Group analyst Ryan Huang said the broader outlook for the global economy remains strong, especially after the European Central Bank announced additional monetary stimulus. Last weeks monetary policy decision by the ECB to cut rates should also set the eurozone on course for recovery and help developing countries as a market for their exports, Hwang said in a market commentary. That will be a further boost for China.

ASIA: Hong Kongs Hang Seng closed down 0.3 percent at 23,257.29 and Australias S&P/ASX 200 dropped 0.3 percent to 5,454. Seouls Kopsi inched up 0.1 percent to 2,014.67 and Chinas Shanghai Composite posted equally anemic gains, rising 0.1 percent to 2,054.95. Japans Nikkei 225 rose 0.5 percent to 15,069.48, helped by indications that a downturn from a sales tax hike instituted in April might not be as severe as originally expected.

CURRENCIES: The dollar fell to 102.06 yen from 102.33 late Tuesday. The euro slipped to $1.3534 from $1.3544.

And here’s what a version might have looked like on June 11 at about 1:30 p.m. Eastern time, reflecting trading in U.S. markets:

NEW YORK (AP) — U.S. stocks slipped and government bond prices rose after the World Bank downgraded its forecast for the global economy this year, citing a bitter American winter and the political crisis in Ukraine. Markets also slumped in Europe and Asia, except for Japan, where indexes ended slightly higher.

KEEPING SCORE: The Standard & Poors 500 index fell six points, or 0.3 percent, to 1,944 as of 1:20 p.m. Eastern time. The Dow Jones industrial average dropped 99 points, or 0.6 percent, to 16,846. The Nasdaq composite fell four points, or 0.1 percent, to 4,333. Markets also closed lower in Europe and Asia.

GLOBAL GROWTH: The World Bank said late Tuesday that it expects the world economy to grow 2.8 percent this year, below the 3.2 percent expansion it had predicted in January.

TAKING A PAUSE: Despite declines Tuesday and early Wednesday, the S&P 500 has been on a slow and steady rise since April and is now up 5.2 percent for the year. In recent weeks, encouraging economic reports have pushed the index to a string of all-time highs, with its latest record of 1,951.27 occurring Monday.

KEEPING THE FAITH: The rally in stocks should continue this year as the economy strengthens, said James Lui, global market strategist at JPMorgan Funds. In the last month, stock gains have been led by the technology and consumer discretionary sectors, which should benefit more from stronger growth. This move is going to be what drives the market further along, Lui said.

BEST BEHIND US: Boeing fell $2.88, or 2.1 percent, to $134.37 after brokerage RBC cut its outlook on the plane makers stock. Analysts at the bank say that after three years of record orders and no new planes in the pipeline, the good news for Boeing is already out there.

TAX BOOST: H&R Block jumped $1.34 cents, or 4.4 percent, to $32.07 after the tax preparation company reported earnings that beat analysts expectations. The companys fourth-quarter net income surged as more people used its services and its prepaid card.

TOUCH-SCREEN TECH: Synaptics jumped $18.16, or 27 percent, to $84.68 after the maker of touch-screen technology said it would buy smartphone and tablet chipmaker Renesas SP Drivers for $475 million. Because of the deal, Synaptics also raised its fourth-quarter revenue outlook.

BONDS, COMMODITIES AND CURRENCIES: As stocks fell, government bonds rallied. The yield on the 10-year Treasury note eased to 2.64 percent from 2.65 percent late Tuesday. The price of oil was little changed at $104.34 a barrel. The dollar fell to 102.10 yen from 102.33 late Tuesday. The euro slipped to $1.3514 from $1.3544.

Contributors

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48 /% Erin Madigan White

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48 /% Emily Leshner

- 3A%2F%2F2.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48 /% Michael Oreskes

- 3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48 /% Paul Colford

- 3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D48 /% Tom Kent