Collateralized Debt Obligation

Post on: 23 Апрель, 2015 No Comment

Collateralized debt obligation

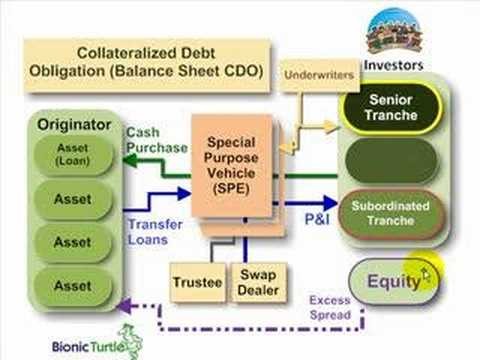

Collateralized debt obligations (CDOs) are a type of structured asset-backed security (ABS) with multiple tranches that are issued by special purpose entities and collateralized by debt obligations including bonds and loans. Each tranche offers a varying degree of risk and return so as to meet investor demand. CDO’s value and payments are derived from a portfolio of fixed-income underlying assets. CDO securities are split into different risk classes, or tranches, whereby senior tranches are considered the safest securities. Interest and principal payments are made in order of seniority, so that junior tranches offer higher coupon payments (and interest rates) or lower prices to compensate for additional default risk

Structures

CDO is a broad term that can refer to several different types of products. They can be categorized in several ways. The primary classifications are as follows:

Source of fundscash flow vs. market value

- Cash flow CDOs pay interest and principal to tranche holders using the cash flows produced by the CDO’s assets. Cash flow CDOs focus primarily on managing the credit quality of the underlying portfolio.

- Market value CDOs attempt to enhance investor returns through the more frequent trading and profitable sale of collateral assets. The CDO asset manager seeks to realize capital gains on the assets in the CDO’s portfolio. There is greater focus on the changes in market value of the CDO’s assets. Market value CDOs are longer-established, but less common than cash flow CDOs. Motivationarbitrage vs. balance sheet

- Arbitrage transactions (cash flow and market value) attempt to capture for equity investors the spread between the relatively high yielding assets and the lower yielding liabilities represented by the rated bonds. The majority, 86%, of CDOs are arbitrage-motivated

- Balance sheet transactions, by contrast, are primarily motivated by the issuing institutions desire to remove loans and other assets from their balance sheets, to reduce their regulatory capital requirements and improve their return on risk capital. A bank may wish to offload the credit risk to reduce its balance sheet’s credit risk. Fundingcash vs. synthetic

- Cash CDOs involve a portfolio of cash assets, such as loans, corporate bonds, asset-backed securities or mortgage-backed securities. Ownership of the assets is transferred to the legal entity (known as a special purpose vehicle) issuing the CDO’s tranches. The risk of loss on the assets is divided among tranches in reverse order of seniority. Cash CDO issuance exceeded $400 billion in 2006.

- Synthetic CDOs do not own cash assets like bonds or loans. Instead, synthetic CDOs gain credit exposure to a portfolio of fixed income assets without owning those assets through the use of credit default swaps, a derivatives instrument. (Under such a swap, the credit protection seller, the CDO, receives periodic cash payments, called premiums, in exchange for agreeing to assume the risk of loss on a specific asset in the event that asset experiences a default or other credit event.) Like a cash CDO, the risk of loss on the CDO’s portfolio is divided into tranches. Losses will first affect the equity tranche, next the junior tranches, and finally the senior tranche. Each tranche receives a periodic payment (the swap premium), with the junior tranches offering higher premiums.

A synthetic CDO tranche may be either funded or unfunded. Under the swap agreements, the CDO could have to pay up to a certain amount of money in the event of a credit event on the reference obligations in the CDO’s reference portfolio. Some of this credit exposure is funded at the time of investment by the investors in funded tranches. Typically, the junior tranches that face the greatest risk of experiencing a loss have to fund at closing. Until a credit event occurs, the proceeds provided by the funded tranches are often invested in high-quality, liquid assets or placed in a GIC (Guaranteed Investment Contract) account that offers a return that is a few basis points below LIBOR. The return from these investments plus the premium from the swap counterparty provide the cash flow stream to pay interest to the funded tranches. When a credit event occurs and a payout to the swap counterparty is required, the required payment is made from the GIC or reserve account that holds the liquid investments. In contrast, senior tranches are usually unfunded as the risk of loss is much lower. Unlike a cash CDO, investors in a senior tranche receive periodic payments but do not place any capital in the CDO when entering into the investment. Instead, the investors retain continuing funding exposure and may have to make a payment to the CDO in the event the portfolio’s losses reach the senior tranche. Funded synthetic issuance exceeded $80 billion in 2006. From an issuance perspective, synthetic CDOs take less time to create. Cash assets do not have to be purchased and managed, and the CDO’s tranches can be precisely structured.

Single-tranche CDOs

The flexibility of credit default swaps is used to construct Single Tranche CDOs (bespoke CDOs) where the entire CDO is structured specifically for a single or small group of investors, and the remaining tranches are never sold but held by the dealer based on valuations from internal models. Residual risk is delta-hedged by the dealer.

Variants

Unlike CDOs, which are terminating structures that typically wind-down or refinance at the end of their financing term, Structured Operating Companies are permanently capitalized variants of CDOs, with an active management team and infrastructure. They often issue term notes,commercial paper, and/or auction rate securities, depending upon the structural and portfolio characteristics of the company. Credit Derivative Products Companies (CDPC) and Structured Investment Vehicles (SIV) are examples, with CDPC taking risk synthetically and SIV with predominantly ‘cash’ exposure.

Taxation of CDOs

CDOs are bonds issued by special purpose vehicles that are backed by pools of bonds, loans or other debt instruments. CDOs are typically issued in classes or tranches with some being senior to others in the event of a shortfall in the cash available to make payments on the bonds. The issuer of a CDO typically is a corporation established outside the United States to avoid being subject to U.S. federal income taxation on its global income. These corporations must restrict their activities to avoid U.S. tax; corporations that are deemed to engage in trade or business in the U.S. will be subject to federal taxation. However, the U.S. government will not tax foreign corporations that only invest in and hold portfolios of U.S. stock and debt securities because investing, unlike trading or dealing, is not considered to be a trade or business, regardless of its volume or frequency.

In addition, a safe harbor protects CDO issuers that do trade actively in securities, even though trading in securities technically is a business, provided the issuers activities do not cause it to be viewed as a dealer in securities or engaged in a banking, lending or similar businesses.

CDOs are generally taxable as debt instruments except for the most junior class of CDOs which are treated as equity and are subject to special rules (such as PFIC and CFC reporting). The PFIC and CFC reporting is very complex and requires a specialized accountant to perform these calculations and tax reporting.

Types of CDOs

A) Based on the underlying asset:

- Note: In 2007, 47% of CDOs were backed by structured products, such as mortgages; 45% of CDOs were backed by loans, and only less than 10% of CDOs were backed by fixed income securities.

- B) Other types of CDOs include:

- Commercial Real Estate CDOs (CRE CDOs) backed primarily by commercial real estate assets Collateralized bond obligations (CBOs) CDOs backed primarily by corporate bonds. Collateralized Insurance Obligations (CIOs) backed by insurance or, more usually, reinsurance contracts. CDO-Squared CDOs backed primarily by the tranches issued by other CDOs. CDO Generic term for CDO3 (CDO cubed) and higher, where the CDO is backed by other CDOs/CDO2/CDO3. These are particularly difficult vehicles to model because of the possible repetition of exposures in the underlying CDO.