Closedend funds vs Openend funds Sell Shares

Post on: 8 Июль, 2015 No Comment

If you own mutual funds, you probably own shares of an open-end fund. Funds also come in the closed-end variety.

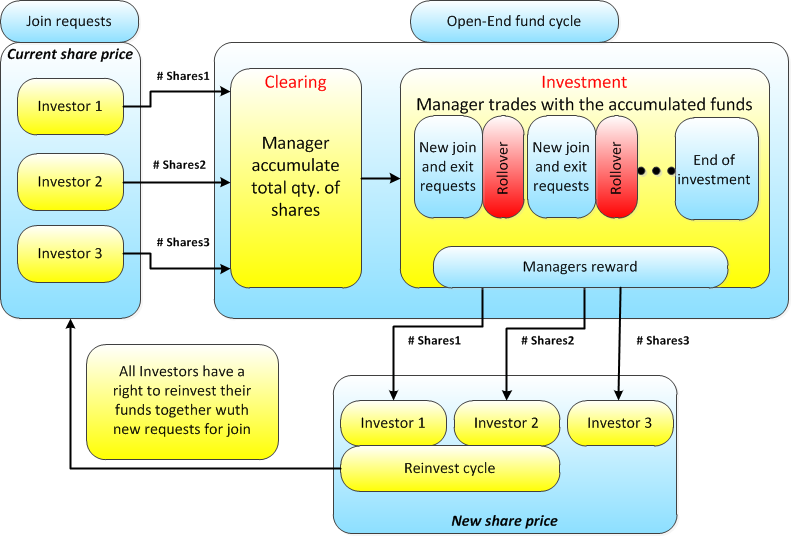

Open-end funds

Open-end funds are those that you may think of as a regular mutual fund. When you put money into an open-end fund, youre buying shares from the fund company. As fund companies take in money from investors, they buy additional holdings to create new shares.

The share price, or net asset value (NAV), is established at the end of each trading day. Its a daily reflection of the combined value of the funds holdings calculated by taking the market value of the funds holdingsstocks or bonds owned by the fundand dividing it by the total number of outstanding shares.

When you sell shares of an open-end fund, youre selling them back to the fund company. The price you get is the NAV, the underlying value of the investments inside the fund.

Open-end funds typically offer more liquidity and flexibility than their closed-end counterparts. Heres why:

- You can buy or sell shares of any open-end fund any day the market is open.

- Fund companies arent limited to how many shares they can create to accommodate more investors.

- Theyre open to new investors unless the fund company decides a fund is too large and stops selling shares.

Closed-end funds

Closed-end funds offer only a fixed number of shares through an initial public offering, or IPO. Afterwards, shares are available through a stock exchange, trading like shares of stock.

That means that when you buy and sell shares of a closed-end fund, youre not going through the fund company. Youre dealing with other investors. It also means you may not pay or receive the funds actual NAV at the time you make a trade. For example, if you need to sell shares of a closed-end fund, you may get only $9.50 even though they may be worth $10 based on the value of its holdings. Because they trade like shares of stock, each trade price is determined by bid and ask prices. If you need to sell shares and the best bid for your shares from other investors is $9.50, thats your selling price.

Perhaps experienced investors know how to buy closed-end shares at a discount and sell them later at a premium. While thats everyones investing goalbuying low and selling highit can be a riskier proposition in the world of closed-end funds, one better left to the professionals.

Heres a list of other things you should know about closed-end funds:

- New shares are rarely available in closed-end funds. After the IPO, its uncommon for a fund company to make more shares available.

- You may pay a commission when buying or selling shares. Of course, if youre buying an open-end fund with a load, youre paying extra in the form of a sales charge that reduces your actual investment amount.

- Just as shares of stock can be traded any time the market is open, so can shares of closed-end funds. This is in contrast to open-end funds, which arent traded during the day. Instead, trades are done after the market closes and share values have been established as discussed above.