ClosedEnd Funds Financial Web

Post on: 24 Апрель, 2015 No Comment

Closed-end funds – like open-end or mutual funds – establish a portfolio of securities and issue shares of the portfolio to the investing public. And as with mutual funds, each share represents an undivided interest in the portfolio of securities. Unlike mutual funds, however, closed-end funds typically issue shares to the public only once. They do not continually sell new shares or redeem already-outstanding ones. Therefore, the number of closed-end fund shares outstanding (the company’s capitalization ) tends to remain, for the most part, fixed.

A closed-end fund’s shares can be bought and sold in stock exchanges or the over-the-counter market (hence the commonly-known name publicly traded fund ). These shares are often described as being tradable securities. Conversely, mutual fund shares are redeemable securities and cannot be traded in the secondary markets.

The majority of closed-end funds have historically invested in the stocks or bonds of foreign countries or of specialized business sectors; for example, municipal securities or utilities. The closed-end fund structure was chosen because the securities in the portfolio tended to have less liquidity than others being traded on major stock exchanges. If investors bought the securities directly, they might find it difficult to liquidate their holdings during times of market downturns. But because closed-end fund shares trade on an exchange — a market which itself is highly liquid — it’s easier for U.S. investors to buy and sell them.

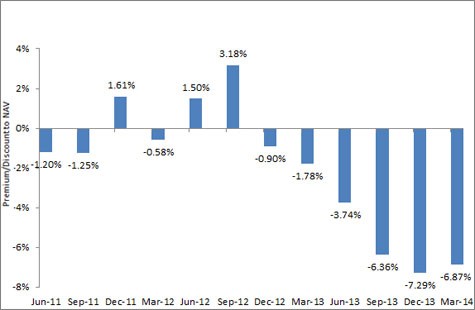

As with any publicly traded company, closed-end fund shares are issued at an initial public offering (IPO) price. This beginning price is based on the value of the equity or debt securities in the portfolio, plus any fees that are added into it. At the end of each trading day the creator of the fund must compute the actual value of all the shares in the portfolio based on their closing prices in the local markets. This value is then divided by the number of outstanding fund shares to compute the fund’s net asset value (NAV) per share.

Closed-end funds allow the investment manager to maintain the portfolio, while at the same time affording investors a way to buy or sell their shares in the secondary markets. If there were a huge downturn in a particular market or sector, the manager would not be forced to liquidate the portfolio due to the unfavorable conditions. As investors sell their shares of the fund, the market value would be driven down, perhaps trading at a deep discount to the NAV of the securities in the portfolio. In contrast, the manager of a mutual fund might be forced to liquidate positions in the portfolio if the number of redemptions resulting from a market downturn was high.

The prevailing wisdom among experienced investors is that it’s best to buy a closed-end fund when it’s trading at a substantial discount to the fund’s net asset value. The reasoning is that if the shares are held over a long-enough period of time, the price should eventually rise back to the level of the fund’s NAV. This price appreciation, combined with any dividends or interest, would provide the investor with a higher-than-market rate of return. Although this strategy may seem quite simple, investing in closed-end funds requires considerable knowledge of the securities contained in the portfolio, as well as the economic factors which affect them.

$7 Online Trading. Fast executions. Only at Scottrade