Choosing Your Portfolio Risk Tolerance

Post on: 29 Май, 2015 No Comment

In a recent article [PDF file ], I laid out a series of steps for portfolio planning that emphasized how to get the most return for a given level of risk via asset allocation and minimizing fund expenses.

Everyone has an interest in getting more return for the risk that they bear, but there is an additional question that must be answered as this process is undertaken: how do investors determine how much risk they should take on? This issue is most often tackled in one of two ways.

In one approach, investors take a ‘risk survey’ that is supposed to determine how risk averse they are. This risk profile or survey can be useful in making sure that a broker or advisor does not suggest investments that are fundamentally unsuitable.

The second approach to determining the appropriate risk level for an investor’s portfolio is to analyze the level of portfolio risk and return that is most likely to allow an investor to meet his or her financial goals. Personally, I feel that it is crucial to determine appropriate risk levels for an investor’s portfolio using an analysis of the goals that he or she wishes to meet. The risk tolerance survey is useful, but needs to be combined with the goals-based analysis. If an investor has a self-described risk tolerance that is inconsistent with his or her goals, there is a fundamental problem.

Primary Sources of Risk

There are two broad sources of risk that investors face when they are saving and investing for a future goal:

- Risk Class 1: Risk of a Decline in Portfolio Value

- Risk Class 2: Risk of Not Meeting Financial Goal

These risks are related, but they are not the same. An investor saving for retirement who puts all of his/her money into bonds is reducing Risk Class 1 (by reducing the risk of a substantial loss over time). If that investor needs more growth than the bonds are likely to provide to meet his/her financial goals, however, this portfolio may actually be very high in Risk Class 2. AllianceBernstein characterizes these two risks in terms of retirement investing by giving Risk Class 1 the name Market Risk, and Risk Class 2 the name Longevity Risk.

Market Risk is the risk that adverse conditions in the market will cause losses in a portfolio. Longevity Risk is the risk that you will outlive your money in retirement and end up poor.

Investors may have a feeling for how risk averse or aggressive they are with respect to Market Risk but most investors have no objective way to characterize their Longevity Risk, much less to determine their comfort level with a given amount of Longevity Risk. While investors may have different opinions about their comfort with various levels of market risk, it is quite clear that running out of money in retirement is an outcome that everyone wants to avoid.

Determining Longevity Risk

How do we define and calculate Longevity Risk? The standard of practice in estimating Longevity Risk is to calculate the probability that an investor will run out of money by some age in retirement. To calculate this, we need several pieces of information (at a minimum):

- Portfolio value at current age

- Planned savings rate

- Planned retirement age

- Planned income in retirement

- Makeup of investment portfolio

These pieces of information are combined in a computer model that simulates many possible future outcomes, based on the simulated range of future returns for the portfolio. The computer model then calculates the probability than the investor will successfully fund retirement through a certain age. The computer models that provide these results are called Monte Carlo Simulations [MCS]. Quantext, my company, developed a Monte Carlo planning tool called Quantext Portfolio Planner [QPP].

If you have not encountered the concept of MCS before, a number of questions probably spring to mind. The first question that many people ask is how MCS simulates the range of future returns that the portfolio is likely to generate. The statistical processes that drive MCS are complex, but here are the main steps:

- Estimate future risk and return for each asset in the portfolio

- Estimate future risk and return for total portfolio

- Simulate range of possible futures (year by year) using output from (2)

- Simulate annual savings and income draw by year

- Calculate likelihood of running out of money at each age

Clearly, (1) and (2) are crucial. In the first step, we estimate the future returns and risks for each asset. In the second step, we have to do this for the whole portfolio, accounting for the correlations in returns between assets. Once (1) and (2) are done, the rest is very simple. Testing and benchmarking a MCS to see how well it performs (1) and (2) is a long and arduous process, and I have written a large number of articles on how we tested Quantext Portfolio Planner. For an overview, please see the following article.

In the rest of this discussion, I will be applying Quantext Portfolio Planner [QPP] to calculate Longevity Risk and to allow these calculations to suggest appropriate risk levels for a generic ‘model’ investor. In real life, an investor or his/her advisor will need to make choices of inputs for his/her specific situation. QPP allows far more detailed specifications of an investor’s situation and plans than are reflected in (1)-(5) above, but these will at least set the stage for a basic discussion.

Generating a Set of Possible Portfolios

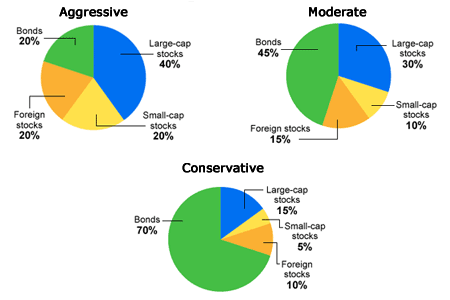

Every investor wants to get the most return for the risk that he/she takes on. The theory of asset allocation suggests that investors will want to include allocations to domestic equities, foreign equities, bonds, commodities, and real estate (at a minimum) to get a well diversified portfolio that delivers the most return for a given level of risk.

To demonstrate how the makeup of a portfolio impacts your probability of reaching a goal, the first step is to create a series of possible portfolios which provide the most return available for a given level of risk. I have created a series of model portfolios using a small number of ETFs. These portfolios are shown in the table below:

click to enlarge

Model portfolios for this study (P90 is the portfolio with 90% bonds, P20 has 20% bonds)

These portfolios vary from one with 90% in bonds (P90) to a portfolio with 20% in bonds (P20), and a range of allocations in between. There are two portfolios with 40% in bonds (P40-1 and P40-2) that have different allocations to the various equity classes. When these portfolios are run through QPP, the projected average annual return and risk define the range of risk and return that are available from well-diversified portfolios of these asset classes:

Projected risk and return for model portfolios

The risk/return estimates for each portfolio are estimated using forward-looking Monte Carlo in QPP, rather than historical data. These results used all default settings in QPP and the model was initialized with three years of data through April 2008. The QPP-generated outlooks combine the historical data with long-term risk/return relationships from the capital markets. The model portfolios represent the most return that can be expected for a given level of risk.

When these risk/return pairs are plotted on a chart, we get the curved shape that is characteristic of what is called the efficient frontier (see chart below). Each point on the chart represents one of the model portfolios.

Forward-looking efficient frontier defined by model portfolios (from QPP)

This type of chart is a standard in textbooks on portfolio theory. The reader who has not encountered this type of chart before will benefit from taking some time to really understand what this chart shows. Portfolio P70 generates more return with less risk than P90. This shows the basic power of diversification: you get more return for a given level of risk by mixing asset classes with low correlation to one another. P70 is expected to generate 1.3% per year in additional return, with less risk, than P90. The impacts of this incremental return on Longevity Risk are substantial, as we discuss in the next sections.

Calculating Portfolio Survival Rates

We can now use these portfolios to see how the choice of one of these portfolios impacts the probability of a model investor being able to generate sufficient income to fund his retirement. Consider an investor (let’s call him Fred) who is retiring this year, at age 65. Fred has $1 Million dollars in his retirement account and wishes to draw $50,000 next year (his first non-working year) and escalate this draw with inflation each year thereafter. This is a very simplified case, but it will serve our purpose here.

How does Fred choose between all of these portfolios? We can use QPP to estimate the probability that Fred will run out of Money by a certain age, as well as the types of swings in value that each portfolio will generate—these are standard outputs in QPP. When I run Fred’s case against all of these portfolios, I get the following outcomes:

Monte Carlo outcomes for Fred

The table above lists two statistics. The first is the age by which Fred has a 20% chance of running out of money in retirement (20th Percentile Failure Age). The second is an estimate of the potential loss in a single year in the portfolios (2-Standard Deviation Annual Return). A ‘2 Standard Deviation’ event occurs roughly in the worst 1-in-40 12-month periods. This is a reasonable ‘rule of thumb’ for the worst downside that you will probably see with a portfolio in any 12-month period.

Note that this does not mean that this kind of loss will happen only once in a forty year period. At any point in time, an investor should expect this level of loss (or more) with a 1-in-40 probability over the next twelve months. Bear in mind that this sort of loss estimation is very approximate. For purposes of comparison, QPP estimates that the 2-Standard Deviation 12-month loss for the S&P 500 is -21%.

How would Fred look at these results and choose between these portfolios? There are a number of features of this table that are notable. First, the portfolio with 90% in bonds (P90) is the least attractive. Many investors think of bonds as the ultimate safe haven but these statistics suggest that this is not the case. P90 gives Fred a 20% chance of running out of money by age 83 as well as a one-year loss potential of -4.7%, worse than the next three portfolios (P80, P70, and P60), each of which have more allocation to equities than P90.

This is a very clear demonstration of a case in which taking on a low market risk portfolio is actually a fairly high risk strategy. There is a lot of longevity risk here, compared to the other portfolios.

P90 has both more market risk and more longevity risk than P60. Can it be that a portfolio with 60% in bonds is actually less risky than a portfolio with 90% bonds? Yes—this result is at the core of portfolio theory. This result will not hold true for all portfolios—they need to be well designed. P60 is less risky than P90 largely because of diversification. By combining bonds with carefully selected allocations to a range of other asset classes, P60 generates more return with only slightly more volatility than P90—and the higher expected return more than compensates the portfolio for its slightly higher level of volatility.

A second point to note here is that the incremental benefit to Fred by decreasing his allocation to bonds decreases as the portfolio gets more aggressive. Going from 90% bonds to 80% bonds (P90 to P80) gives Fred a probable extra three years of retirement funding (20th percentile failure age goes from 84 to 87). Going from 60% bonds to 50% bonds (P60 to P50) gives Fred one additional year. Going from 60% bonds to 50% bonds also markedly increases Fred’s potential one-year loss level. This is where psychological risk tolerance comes in.

There is a deeper theme here that needs to be understood. An investor has one life to live and will experience one set of possible future markets, whereas the MCS is simulating many possible market conditions. There is a real possibility of losing almost 9% in a year in the first of the 40% bond portfolios (P40-1). That event, should it occur, will have a real and lasting impact on Fred’s wealth. This ‘event risk’ should not be discounted. I believe that Longevity Risk is the first variable to consider, but Market Risk is not to be ignored.

On the basis of these results, portfolio P50 seems like a reasonable choice for Fred (my ‘model’ investor) without going deeply into specifying his personal goals and attributes. For any real person considering an investment in any portfolio, the analysis should go deeper into their specific needs.

Do these results imply in any way that Fred should go with a portfolio of 50% bonds (via something like AGG and TIP) and 50% in the S&P500—i.e. a generic 50/50 portfolio? Not by a long shot! A portfolio that is 50% in IVV and 25% each in TIP and AGG has a projected 20th percentile failure age of 87 and a 2-standard-deviation loss for 12-months of -6.1%. In other words, the market risk is the same as our P50, but Fred will have lost five years of potential retirement income (20 percent chance of failure by age 87 vs. age 92 for the P50 portfolio). This increase in longevity risk is the result of being radically under-diversified.

Finally, I hasten to add that these portfolios are not the best than can be built—they are here for demonstration purposes only.

A Cautionary Tale on Fees and Expenses

The analysis performed here used ETFs, which typically have substantially lower fees than traditional mutual funds. Many mutual fund portfolios, covering the same asset classes, will incur annual expenses substantially higher than this one. All-in fees from owning mutual funds vary widely and investors need to understand that these fees can go considerably higher than the stated expense ratio. There are additional costs that the investor pays, such as the funds’ transaction costs (brokerage and bid-ask spread).

To get estimates for the all-in expenses of owning a specific mutual fund or ETF, personalfund.com is a useful resource. The user should be aware, however, that the estimates of total fund expenses have some approximations in them. These approximations are disclosed in documentation on the site.

Research from personalfund.com [PDF file ] (among others) suggests that there are many mutual funds that will have an additional 1% per year in ‘drag’ relative to an ETF in the same asset class.

If Fred chose the P50 portfolio allocation, but achieved it by investing in mutual funds and had to pay an additional 1% per year due to higher fees in mutual funds (higher expense ratio and other costs)—an increase that is very plausible, Fred would have a 20% probability of running out of funds by age 87. In other words, a 1% decrease in portfolio return due to higher expenses in Fred’s portfolio reduces his ability to confidently fund his retirement needs by five years!

Some Further Considerations

I have written a number of articles about the problems of trying to perform the types of analysis in this paper with just historical data. If you do that, you will end up with portfolios that are substantially overweight in whichever asset classes have performed well in your historical sample. When these asset classes revert to the mean, the future performance of such a portfolio will be dismal.

William Bernstein has shown this very clearly in his investment classic, The Intelligent Asset Allocator. Bernstein looked at allocating portfolios using a portfolio optimizer to construct portfolios on the efficient frontier using trailing five years of historical data and six major asset classes for the period from 1975-1998. He then looked at performance in each subsequent five year period. He found that the portfolio that is “optimized” to the trailing five years generated an annualized return of 8.4% per year while a simple allocation equally into all six asset classes generated 15.79% per year. In other words, the portfolios designed using historical performance data as the basis of the allocation generated roughly half the return of a simple portfolio that was equally weighted in each asset class.

The type of analysis performed here requires a forward-looking analysis in order to be meaningful.

Conclusions

When investors construct a portfolio to meet future goals, they need to use objective methods to determine whether there is a reasonable probability of meeting these goals. When investors planning for retirement decide how much to allocate to each of a range of asset classes, they often lack such information. In this article, I have outlined a modern standard-of-practice for solving this problem: Forward-looking Monte Carlo Simulation [MCS].

In practice (as opposed to our idealized investor, Fred), many investors have portfolios and specific needs that are more nuanced than Fred’s situation. Many Baby Boomers, for example, are re-thinking retirement and will not simply jump from their working lives (‘accumulation’) to non-working (‘consumption’). A good MCS can accommodate this and show how these personal decisions impact the development of a portfolio plan.

It is my fervent hope that more investors will use objective tools to look at their specific situations and personal goals to find the best solutions.

Finally, it is important for investors to realize that there are many types of Monte Carlo Simulation tools available. Potential users should be aware that there can be substantial differences between these tools and that careful due diligence is required in choosing between the available tools.