Chapter 25 ROI and Residual Income

Post on: 16 Март, 2015 No Comment

An investment center is a segment or area of responsibility in which a manager controls revenues, costs, and the assets invested in that segment. The manager’s performance is assessed based on how well the manager controls these components, typically using an evaluation that includes an assessment of profit and a return on the invested assets. A group of investment centers are typically housed under a corporate structure which top executives that provide strategic guidance.

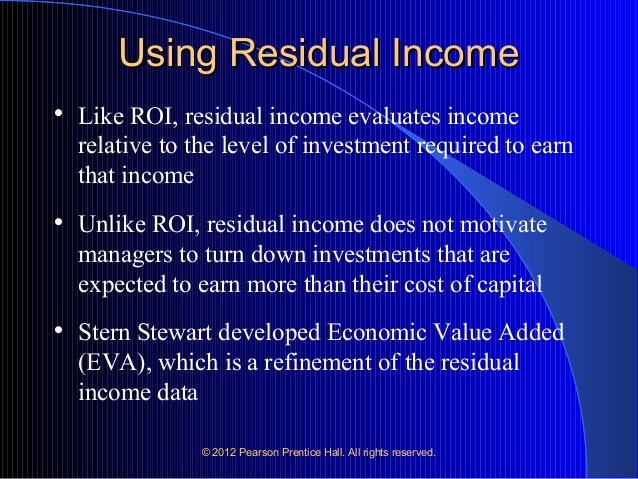

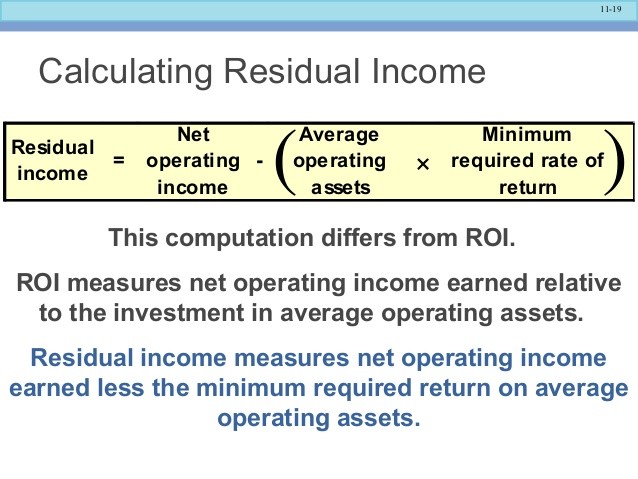

Managers of investment centers are given responsibility to fully operating their respective segments. Evaluation of these managers is based on the three components for which these managers are responsible—revenues, expenses, and the segment’s assets. Evaluation using return on investment is based on a percentage rate of return relative to a benchmark rate of return. The benchmark is the discount rate established by top management as the minimum acceptable rate it is willing to accept. You know this amount as the required rate of return, or the hurdle rate. When residual income is used for evaluation of investment centers, it focuses on the dollar amount that a segment contributes to the shareholder value of the parent company.

Return on Investment

Return on investment. known in the financial world as ROI, is an important gauge of the performance of investment centers and their managers. It focuses the attention of a manager on both income and the assets invested in the segment, making it a better measure of performance than simply income. The calculation parallels that of return on assets (ROA) from a financial accounting perspective. Return on assets is calculated for a company as a whole, and its components are taken straight from a company’s financial statements. Net income is divided by average total assets to arrive at a percentage return. ROA indicates the portion of each dollar of assets that a company generates as profit. The ROI is compared to the required rate of return to assess the viability of the investment. Only investments which generate at least the required rate of return should be accepted.

ROI is used to calculate the return of an investment center of a company using the profit of that segment and the assets invested in the segment. It enables top executives to compare multiple segments to determine the better candidate for expansion. In most cases, an investment with a higher ROI is deemed to be a better investment than those with lower ROIs. R eturn on investment is calculated as profit divided by the total assets of the investment center.