Center for Retirement Research

Post on: 16 Март, 2015 No Comment

More Boomers Crack 401(k), IRA Nest Eggs to Start Own Businesses

Once viewed by the IRS as a “scheme,” rollover business startups are now a sanctioned arrangement. Experts say retirement savings now fund 10% of the more than 600,000 new businesses started each year.

Even as a barrage of sobering news hits Americans about retirement savings, many are using their nest eggs not to stop working but to finance their next career transition.

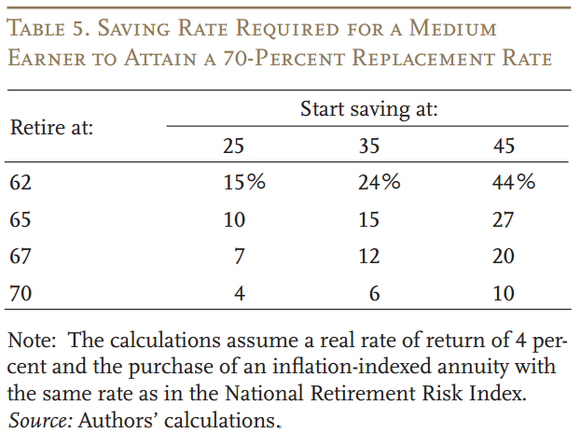

A widely reported study from the Center for Retirement Research at Boston College reveals that on average, people aged 60 to 62 currently have less than one-quarter of what they’ll need in their 401(k) to maintain their standard of living in retirement.

With Social Security projected to provide about 40% of pre-retirement income, these people need to come up with quite a bit to fill the gap.

A little while back, Merrill Lynch released a survey that finds that the vast majority (84%) of affluent Baby Boomers believe their retirement will differ from that of their parents.

While 72% think they will enjoy a higher standard of living in old age than their parents, a full 70% also expect to keep working as a way to stay active and engaged. That may be good news if they need to stretch their retirement savings.

Investing in your own “private equity”

With business loans and second mortgages hard to get these days, pre-retirement Boomers are buying franchises and other businesses with their 401(k) and IRA retirement savings.

One of them, John Mickey of Chicago, tells us this strategy saved him from the stock market crash.

In May 2008, after 20 years working for other people, he bought a franchise from Adventures in Advertising, a Wisconsin company that makes promotional items like pens, coffee mugs and golf balls imprinted with company logos.

With no track record as a business owner, he knew he couldn’t get a small business loan from a bank to buy the franchise rights, so he invested $30,000 from his nest egg instead.

Now his company Burly Bear Promotions has landed over a dozen clients and pays him a salary of about $100,000 a year.

“It’s the best thing I could have ever done with my retirement money,” he says.

Mickey is not unlike many Americans who would rather bet on themselves than the stock market through a transaction called a rollover business startup (ROBS).

For tax purposes, the trickiest part is making sure the start-up company’s new retirement plan complies with the federal rules.

For such a plan to qualify for tax-deferred contributions and earn the owner a corporate tax deduction, it must be used for the “exclusive benefit” of employees and not primarily to benefit the company.

Thinking about starting your own business?

In general, as the new reality of retirement sets in, the conventional thinking that a conservative investment approach will somehow lead abundant golden years has gone out the window.

Unless someone thinks out of the box when it comes to retirement, many people will end up living well beyond their savings.

To be safe, a ROBS entrepreneur should hire an expert to prepare the new retirement plan document and an objective valuation of the new corporation’s stock.

An obvious red flag to the IRS would be if the value of the corporate stock is assessed at exactly the amount of funds rolled over into the retirement plan in the first place. This raises the question of whether the enter exchange would be a prohibited transaction.

Instead, the stock should be appraised as the true enterprise value of the company’s available assets.

Before purchasing a franchise through promoters who charge fees out of the proceeds of the stock purchase, consider whether these third parties can be construed by ERISA or the IRS as fiduciaries rendering investment advice this may constitute a violation of the tax code.

Enable future employees to acquire employer stock. ROBS transactions are often designed to take advantage of a one-time-only stock offering, which fails to satisfy the available benefit requirement of retirement plans.

Along with this, communicate in writing the existence and availability of the plan to all new employees. Otherwise, your plan will be in violation of Treasury regulations and may result in the failure of the initial ROBS arrangement.

In order for the plan to not discriminate in favor of highly compensated employees, an extension of the stock investment option must be given to non-highly compensated employees who may be hired in the future.

Establish the plan as permanent. Do not discontinue it within a few years after its adoption.

Finally, never pay purely non-business expenses from the plan and avoid taking a sizable salary out of the company.

Scott Martin. senior editor, The Trust Advisor Blog. Steve Maimes contributed to the editing and research.