CD Rates

Post on: 20 Апрель, 2015 No Comment

Which is better: CDs vs. Bonds

Posted in Best Deals by DailyDeals on 2015-01-14 16:36:38

Certificates of Deposits and having bonds are two most common investments that investors constantly lookout for, and at the same time, they need to be sure that their investments are safe and serve as reasonable income. Presently, CDs offer a much higher yield than bonds, and both share the same terms and conditions in terms of safety.

However, a closer look may help investors determine which would be the ideal one for their investment, depending on their needs. In order to decide which is better, some facts worth considering include the following:

Comparing Safety Issues

The surprising news for most investors in recent times is that, some bonds do yield more than 10%. However, the average interest on CCC-rated binds at present is as high as 11.3%. At the same time, it is almost impossible to find 5-year CD the US bank or certified credit union that may issue as much as or even high.

Read Full Deal >>

Investors Take Business Elsewhere Due to Poor CD Rates

Posted in Best Deals by DailyDeals on 2015-01-08 16:29:30

Recently the Capital Credit Union was seeking the right opportunity to increase its deposits. This was when it offered 1.11% APY return for an 11-month Certificate of deposit. Before the opportunity ran out, members snatched the available CDs and made the most of it last December.

The wise president of the member service, Capital Credit Union, Jim Schaefbauer said, “It seemed like people would break down doors when we put the rate out there.”

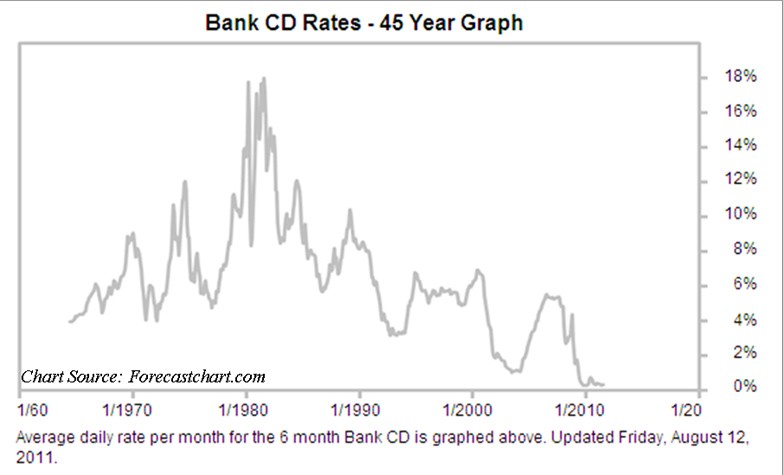

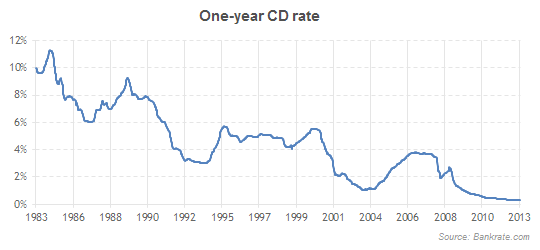

Thirty years ago, a 1-year CD earned about 10% and at that time, mortgage rates were much better. However, in recent years, to get even 1% on a CD on a 1-year term is something no one had heard of. Schaefbauer added that, today, people have to wait three years or more to get close to 1%.

According to the report on CD rates, as reported this week, the average national rate for a 1-yr CD is.

Read Full Deal >>

Employment Levels and Inflation Would Both Force CD rates to Rise in 2015

Posted in Best Deals by DailyDeals on 2014-12-15 06:15:40

Learn Bonds, a reputable research firm, forecasts that CD rates are expected to appreciate in 2015 in line with rising Fed rates. The research firm predicts that once the Fed ends its expansionary policies; the CD rates, which have hit rock bottom this year; will start to move higher. And since the Fed has started talking about raising the Fed funds rate, experts believe that CD rates will also follow soon.

Next year, employment levels in the technology sector are expected to increase significantly, but only for highly skilled.

Read Full Deal >>

Posted in Best Deals by DailyDeals on 2014-11-30 06:13:18

The fed rates are expected to continue their uphill climb during 2015. This is good news for investors who have put their savings in financial instruments connected with federal rates like certificate of deposits. Given the possible rise in rates, most investors are considering investing in different CD products to ride the wave of rising CD rates.

The problem is that most large banks and financial instruments do not offer such non-traditional CDs. Investors have to look at regional banks, credit unions, and community bank to invest in the instruments. Some of the non-traditional CDs that offer the best return potential for investors include index-linked CD, Set-up CD, Liquid CD, Add-on CD, a.

Read Full Deal >>

CD Rates Are Rising! It’s Time to Invest in Non-Traditional CDs, Recommend Experts

Posted in Best Deals by DailyDeals on 2014-11-15 01:45:33

The fed rates are expected to continue their uphill climb during 2015. This is good news for investors who have put their savings in financial instruments connected with federal rates like certificate of deposits. Given the possible rise in rates, most investors are considering investing in different CD products to ride the wave of rising CD rates.

The problem is that most large banks and financial instruments do not offer such non-traditional CDs. Investors have to look at regional banks, credit unions, and community bank to invest in the.

Read Full Deal >>

Walmart launching Bluebird checking accounts

Posted in Best Deals by DailyDeals on 2014-10-30 03:10:19

Walmart has announced their new service called GoBank which should be starting next month in all of their nationwide stores. Bluebird is a type of checking account which targets those who don’t have or don’t use traditional banking system or don’t have checking accounts. The main goal of this service is to cover for those Americans who are considered to be “underbanked” or “unbanked” giving them at least some benefits of regular checking accounts.