Can barbell investing beef up your returns

Post on: 22 Июль, 2015 No Comment

This article appeared in the March 2014 ASX Investor Update email newsletter. To subscribe to this newsletter please register with the MyASX section or visit the About MyASX page for past editions and more details.

This very different style of asset allocation is gaining popularity — but it’s not for everyone.

By Robert da Silva, van Eyk Research

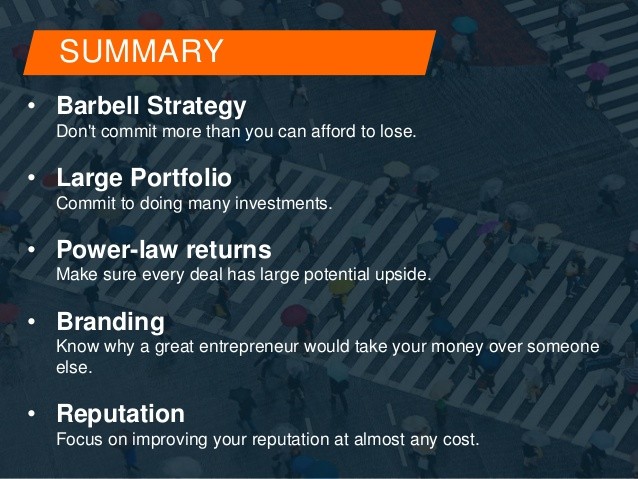

The strategy known as barbell investing has been used by bond traders and managers for decades to maximise returns. As the name suggests, it refers to a strategy where fixed-interest portfolios are split between long and short-dated bonds to achieve a better yield than medium-term bonds.

More recently, the strategy has extended beyond bonds to equities and other assets. With shares, for example, a portfolio may be split between defensive, low-beta sectors (to achieve the market return) and aggressive, high-alpha (a return above the market return) sectors and stocks.

(Editor’s note: for example, an investor might hold 90 per cent of their portfolio in safe assets, such as cash or government bonds, and 10 per cent in riskier small- or micro-cap stocks that may deliver big returns).

Former options trader, scholar, statistician and widely published author on risk and investing, Nassim Taleb, is a leading proponent of barbell investing. He first gained global attention with his 2007 book, ‘The Black Swan: The Impact of the Highly Improbable’. Nearly three million copies were sold. In 2012 Taleb published ‘Antifragile’. in which he explores the concept of barbell investing.

It was Taleb who popularised the notion of a black swan event — an extreme event that has a massive impact but which is so unlikely or improbable that conventional wisdom says it can’t happen.

Once it does happen, the illusion is shattered and there is a rush to analyse it. Popular wisdom then explains that such an event was obviously going to occur, outlining its causes and how it can be avoided in the future.

‘Black Swan’ events more frequent than statistical models suggest

A recent and obvious black swan event is the 2007 global financial crisis. Others include earthquakes, tsunamis, sharemarket crashes and currency crises. History shows that the frequency of black swan events is far greater than traditional statistical risk models suggest. In technical terms, the probability distribution has much fatter tails than the standard normal distribution assumption.

This is an ominous concept for investors, especially those nearing retirement. It is challenging enough managing investments without having to contend with the continuous threat of a catastrophic black swan event.

Taleb’s solution is barbell investing. In ‘Antifragile’ he argues that barbell strategies are designed to benefit from the chaos and volatility caused by these events.

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty, Taleb wrote. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.

The book gives many examples of situations which are antifragile, often drawing on nature. In Australia, large forests subject to periodic bushfires are often improved by such events. The fire burns away debris and weaker trees, and triggers germination in many plants.

Profiting from the unpredictable

As such, barbell investing is a way of profiting from the unpredictable and volatile, while protecting the downside and avoiding catastrophe.

This is done, Taleb says, by placing the vast bulk of your money in extremely safe investments that provide downside protection, then investing the rest in extremely risky investments that have the potential to deliver massive returns. That return will bring the overall performance of the portfolio up to a very satisfactory level, hence benefiting from the impact of a black swan event.

Taleb’s take on barbell investing is significantly different to traditional asset allocation, where investments are spread across a variety of more defensive asset classes with a small allocation to riskier assets. All the components are subject to varying degrees of (expected) investment risk, and diversification is meant to bring overall risk down.

Taleb believes the worst-case scenario with barbell investing is that an investor blows the risky part of their portfolio, leaving the rest intact. On the other hand, one or more of their risky investments could pay big and boost overall portfolio returns.

In theory, it sounds like a simple and effective way to make money, but problems can arise in practice.

Designing the safe component (90 per cent)

The obvious choice is defensive assets such as cash, term deposits, bank bills or short-term government bonds. However, bear in mind, this part of the portfolio is meant to be bullet-proof in the face of Armageddon.

The GFC proved that fixed interest is no longer the safe-haven investment it once was.

Bank deposits should be satisfactory for this component of the portfolio, although a purist would use short-term government bonds or bills issued by a government with a clean and sound balance sheet. Australia fits this bill. If using deposits, diversify across banks and other strong institutions.

Designing the risky component (10 per cent)

There are no rules here. Choose any legal, legitimate investment with a high potential to pay off. This may include micro-cap stocks, leveraged investments (as long as you are limited to a 100 per cent loss on your investment), out-of-the-money options on any financial asset, venture capital, angel investments, micro finance and crowd funding.

The key rule for this segment is to diversify widely (across different types of strategies) and deeply (high number of individual investments). If the entire pool is invested in a single risky investment, the chance of blowing the whole 10 per cent is extremely high.

The challenge is to access enough risky investments, across a variety of styles, while keeping fees and transaction costs down.

Tax is another major issue because riskier strategies tend to be very tax-ineffective, unlike the safe component, which will typically be income based, low yielding and taxed at your marginal rate.

Does barbell investing work?

There has been much comment and reflection on the new approach to barbell investing, but not much evidence that it is actually being implemented widely. It is very doubtful that fund managers would embrace barbell strategies. Furthermore, there do not seem to be any studies comparing the returns from barbell investing to traditional approaches.

Moreover, barbell investing is probably better suited to a younger demographic. Their longer investment horizon provides scope to test the process and iron out any kinks. Those nearing retirement may find a use for this approach, but the risky component, even though limited to 10 per cent, may be psychologically challenging if multiple losses arrive before the hoped-for big pay-offs.

About the author

Robert da Silva is head of manager research and deputy chief investment officer at van Eyk Research, a leading Australian managed fund and investment research house.

Learn about the features, benefits and risks of Exchange-traded Australian Government Bonds with this free online ASX course .

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (ASX). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.