Campbell BA350 Global Financial Management

Post on: 29 Июль, 2015 No Comment

Hypersyllabus

Course Description:

The objective of this course is to provide a rigorous introduction to the fundamental principles of asset valuation and financing in competitive global financial markets. The course is designed to provide the student with the tools that are necessary to analyze the financial issues presented in the elective courses. The course is organized around the three main ideas in Finance:

- The time value of money

- Diversification and risk

- Arbitrage and hedging.

Students completing this course will be fully conversant with the time value of money and will be able to value income streams of all forms. The time value of money is a basic determinant in the valuation of assets such as bonds, stocks, futures, and options. The classes on diversification and risk provide a thorough grounding in the trade off between risk and return given by modern portfolio theory. In discussing arbitrage and hedging. we demonstrate how to hedge market risk, interest rate risk, and foreign exchange risk. This involves using futures and options. The uses and valuation of futures and options by arbitrage are considered in some detail.

The Learning Experience:

The learning experience takes a number of different forms. Each method of learning is meant to complement the other methods.

- WWW-based lecture notes

- Proprietary Java-based interactive learning experiences

- Proprietary Java-based animations

- Downloadable Powerpoint slides

- MPEG video clips and streaming vidio

- Textbooks

- Class bulletin board

- On-line lecture experience

- Lotus screen-cam off-line lecture experience

- On-line review sessions

The course materials are designed to be long-lasting.The goal is to develop a learning experience which can be revisited through the years. Students and graduates will have access to these experiences.

Learning Modules

There are six learning modules (problem sets) that accompany the classes. All of the assignments will require computations. Knowledge of a spreadsheet package such as or EXCEL is very important. Problem sets are to be completed individually. All students must adhere to the Fuqua honor code

Note that Learning Module 1 runs the entire six weeks. In this assignment, you must track a portfolio of stocks, futures and options. It is critical that you spend time early in the term to set up this assignment so that at the end of the term you need only to enter a few prices to your spreadsheet and it prints the final assignnment submission.

Grade Calculation

The grade for the course will be based on performance on the assignments and two exams. The course grade is determined by the following formula:

I realize that it is difficult to have a midterm after only five lectures. This grading algorithm makes the midterm optional. However, to pass BA350, students must score at least 50% on the exam portion of the assessment. That is, the percentage score on the exam portion, Max[F. 4M + .6F], must exceed 50% in order to pass the course. The grading scheme for the GEMBA is slightly different. Due to the extended distance learning module, there are two additional assignments, one of which involves group work. These additional assignments replace the midterm exam.

Questions and Office Hours

The following is the procedure for extra help. First, most questions can be answered with the bulletin boards. I monitor the board every day. It ishighly likely that «your question is the same question that a number of students have. The bulletin boards make it possible to share your question and solution to a number of students to enhance everyone’s learning experience.

Second, there is an extensive list of tutors for the course. Feel free to contact them if you do not get a satisfactory answer on the board (they also monitor the board). There will also be weekly problem sessions.

Third, send me an email. If you choose to send me email, I reserve the right to post your question and my response on the bulletin board. My user name is cam.harvey@duke.edu.

Chat groups. There will be a weekly chat group. Details will be posted on the bulletin board.

If you are on-site, the best time to talk to me is directly after class. If you need to schedule an office visit, call my secretary Carol Bass at 660-7775 to arrange an appointment.I will be arranging a time to meet with students and it will be posted here.

Sharpe, William F. Gordon J. Alexander and Jeffery V. Bailey, Investments. Most recent edition, Prentice-Hall. [Recommended, not required.]

Brealey, Richard and Stewart Myers, Principles of Corporate Finance. Most recent edition, McGraw-Hill. [Required, you will need it anways for BA351.]

Grabbe, Orlin J. International Financial Markets. Most recent edition, Prentice-Hall. [Recommended, not required.]

Ross, Stephen, Randolph Westerfield and Jeffery Jaffe, Corporate Finance. Most recent edition, Richard D. Irwin, [Supplemental, substitute for Brealey and Myers.].

Grading Policy

- Although the exams are closed book, students may bring into the exams one 8 1/2 x 11 sheet of paper with notes on both sides.

- Students are allowed to bring in silent battery operated calculators to exams. Laptops, while useful for assignments, are not needed in my Daytime MBA exams. For off-site exams, you will need a Laptop to complete the exam.

- There are no verbal appeals of grades. I am glad to regrade any assignment or exam. However, you must provide a statement as to where and why there is a problem. Importantly, the entire exam or assignment will be regraded. As a result, the regraded score may increase, remain the same or decrease.

Outline and Reading Assignments

The course is self contained on the Web. However, much of the material is reinforced by reading the relevant sections of Sharpe, Alexander and Bailey (SAB) and either Brealey and Myers (BM) or Ross, Westerfield and Jaffe (RWJ).

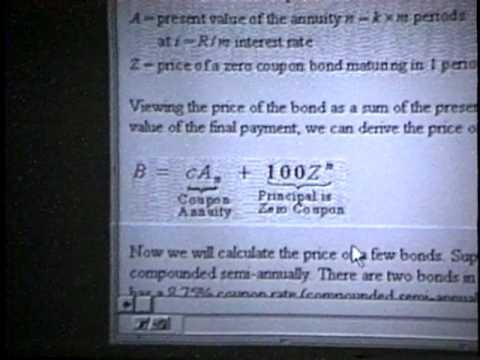

This class provides an overview of financial mathematics. The tools developed in this module perform the basis for valuing all assets including stocks, bonds, and investment proposals. The main theme is the time value of money — the idea that a dollar received today is worth more than a dollar to be received in the future. Given an interest rate or discount rate, the tools developed in this module allow us to quantify this idea. In particular, we can determine what lump sum received today is equivalent to a specific series of cash flows to be received in the future. This module also has many practical applications for personal finance relating to comparing mortgages and other loans and to valuing fixed interest investments.