Calculate Capital Gains Tax Active Traders Investors

Post on: 2 Июнь, 2015 No Comment

It is a fact of life that active traders and investors generate capital gains and losses — lots of them! The very nature of trading calls for buying and selling the same stocks and / or options over and over again.

When you trade or invest in equities such as stocks, options, bonds, mutual funds, and other capital assets, you may owe a capital gains tax on the profits from the sale of those investments.

Calculating Capital Gains

In a nutshell, the capital gain from the sale of an investment is calculated by subtracting your basis in the asset you sold, from the amount you realized in the sale. Your basis is your cost or the purchase price plus brokerage commissions and SEC fees. The amount realized is what you received from the sale, less brokerage commissions. Of course, when the cost basis is higher than the amount realized from the sale, the result is a capital loss.

Traders and investors also receive ordinary income, which includes dividends and interest. Ordinary income is not considered a capital gain, therefore dividends and interest are not part of your capital gain calculation .

It is also important to note that capital gains are taxed as net, meaning any losses in the tax year can offset the gains for the same period resulting in a net gain or loss. Capital gains and losses are typically reported on an IRS Form 1040, Schedule D for tax filing. However, not all investments are reported on a Schedule D. We discuss this more in the topic Filing Taxes — Which Form Should I Use? .

Holding Period For Capital Gains

Capital gains tax rates are determined by holding period for the investment. There are two types of capital gains holding periods, short-term and long-term:

- Short-term: capital gains (or losses) from investments held for one year or less. Most short sales are considered short-term by the IRS even if held more than a year — see the heading below on Short Sales.

- Long-term: capital gains (or losses) from investments held for more than one year.

Short-Term Capital Gains

If the date of the sale is one year or less after the date of the purchase, you have a short-term capital gain.

Example:

You bought 100 shares of ABC on May 12, 2009.

You sold the same 100 shares of ABC on May 18, 2009.

This sale results in a Short-Term gain as the holding period was less than 366 days.

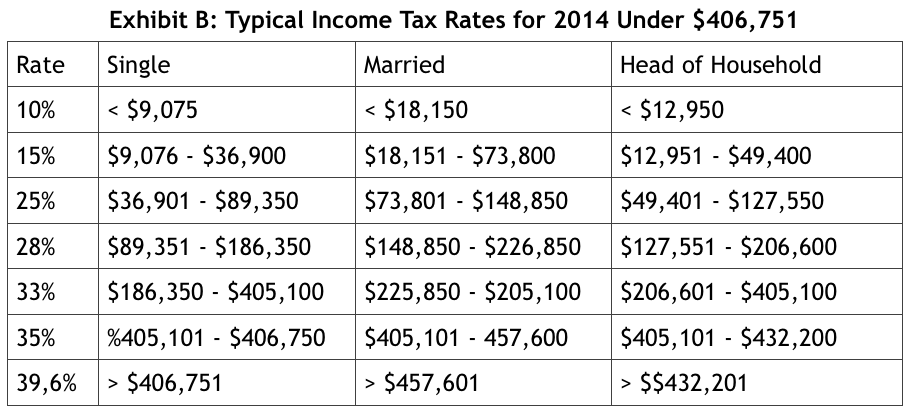

Short-term capital gains are taxed at the same rate as ordinary income (like wages and interest income). Remember, it is net gains that are taxed, therefore any losses will offset the gains for the same period. If you are in the highest federal tax bracket and you pay state capital gains tax, it’s possible to owe more than 40% of your investment gain in short-term capital gains taxes.

Long-term capital gains on the other hand, are taxed at much lower rates, thus it is important to accurately calculate the holding period for your investments.

Long-Term Capital Gains

If the date of the sale is more than one year (366 days or more) after the date of the purchase, you have a long-term capital gain.

Example:

You bought 100 shares of ABC on May 12, 2008.

You sold the same 100 shares of ABC on May 18, 2009.

This sale results in a Long-Term gain as the holding period was more than 365 days.

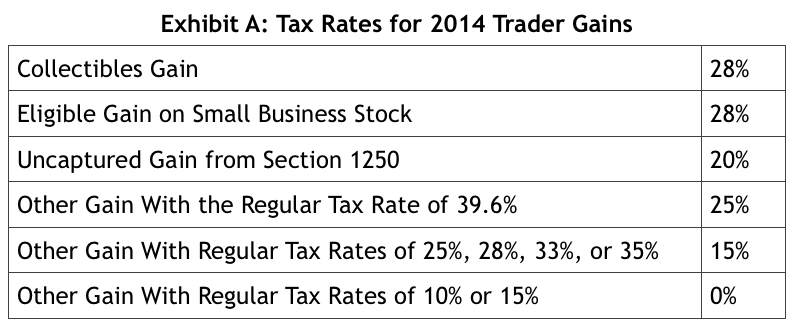

The gain realized from selling a long-term holding is taxed at a lower rate than short-term gains. Long-term capital gains are taxed at 15% for all tax brackets other than 10% and 15% which pay an even lower long-term rate of 5%.

Short Sales

In a short sale, the holding period is the time in which you actually hold the property eventually delivered to close the short sale.

IRS Publication 550 states:

As a general rule, you determine whether you have short-term or long-term capital gain or loss on a short sale by the amount of time you actually hold the property eventually delivered to the lender to close the short sale.

Example. Even though you do not own any stock of the Ace Corporation, you contract to sell 100 shares of it, which you borrow from your broker. After 13 months, when the price of the stock has risen, you buy 100 shares of Ace Corporation stock and immediately deliver them to your broker to close out the short sale. Your loss is a short-term capital loss because your holding period for the delivered property is less than 1 day.

The date you close the short sale is considered the acquisition date for the property, and the date the close position is settled is considered the date of sale, because that is when the property was delivered to the broker/lender to fulfill the short sale. Since the number of days between those dates is typically no more than five, a short sale is almost always a short-term holding.

When reporting short sales on Form 8949 the date acquired is the trade date in which you closed the short sale. The date sold is the settlement date for the closing trade (typically three business days later). However, if the closing trade results in a gain, the constructive sale rule applies and the sale is to then be reported on the trade date of the closing position. This was clarified in IRS Ruling 2002-44 .

Note: Brokers are not required to adjust for the constructive sale rule when reporting short sales on 1099-B. This may result in discrepancies as your broker may report some short sales as closed in the following tax year, where you are required to report them in the current tax year.

Benefits for Active Traders

Active traders benefit from generating capital gains instead of ordinary income for two reasons:

- IRS capital gains taxes are not paid until the security is sold and a profit is realized, so an active trader can time the sale of the security based on whether they want to claim a capital gain or loss. However, an investor has no control when interest and dividends are distributed

- Certain types of capital gains are taxed at much lower rates than ordinary income. For example, long-term capital gains are typically taxed at a lower rate to encourage investment in the economy and entrepreneurship.

As each type of capital gain has a different tax treatment, successful traders often select their investments and time their trades to produce specific tax results. TradeLog offers the active trader an automated way to log all their executed trades and run quick, concise reports that allow them to keep a handle on their capital gains and losses throughout the year.

Please note: This information is provided only as a general guide and is not to be taken as official IRS instructions. Armen Computing Ltd. does not make investment recommendations nor provide financial, tax or legal advice. You are solely responsible for your investment and tax reporting decisions. Please consult your tax advisor or accountant to discuss your specific situation.