Buying Zero Coupon Bonds 10 Tips

Post on: 7 Апрель, 2015 No Comment

When buying Zero Coupon bonds, remember these 10 tips to ensure that you receive all the information you need to make a sound investment. Zero Coupon bonds get its name from the fact that there is no interest paid until maturity. These bonds offer a huge discount by providing the investor with a full face value upon maturity. Below are 10 tips to remember when purchasing zero coupon bonds.

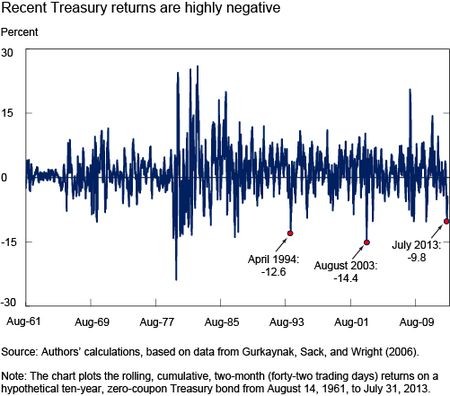

- Manage Risk. Zero coupon bonds vary in price. The yield and price have an inverse relationship. The lower the price of the zero coupon bond, the higher the yield. While this sounds great, keep in mind that zero coupon bond yields change dramatically based on the interest rates, so a 30 year zero coupon bond will offer a higher discount, but much more volatility than a shorter term bond.

- Buy when rates rise. Interest rates have an inverse relationship with zero coupon bond prices. When the interest rates rise, the zero coupon bond is heavily discounted and offers a better deal than when interest rates are low.

- Avoid buying when rates are low. The purpose of buying zero coupon bonds is the opportunity of a significant discount off the face value of the bond. When interest rates are low, the discount is minimal and not worth the investment.

- Remember Uncle Sam. Although there is no interest payment offered to the investor, zero coupon bonds have an implied interest rate in the yearly gains that is taxable. So budget accordingly.

- Consider tax sheltered retirement accounts. Because of the taxable nature of zero coupon bonds, a strategy of placing them into a traditional IRA or 401k is a good one. These accounts defer taxes until maturity which will save you money on taxes.

- Buy from a reputable company. Because of the deferred payoff of the zero coupons, there are many con artists that will try to sell you fake zero coupon bonds. Dont let this happen to you. Always buy from a well known firm.

- Buy non callable bonds. Focus on zero coupon bonds that are not callable. Callable bonds may lessen the timeframe involved for accruing interest. Avoid these if possible.

- Wait until maturity. Bonds are a long term investment. If you sell before maturity, the bond will be worth less. So dont sell.

- Consider laddering. Laddering involves buying multiple bonds with various maturity dates. Laddering helps to offset the volatility of long term interest rates making the investment more sound.

- Research different firms before buying. There is often a markup on zero coupon bonds, so shop around reputable firms before buying.

Zero coupon bonds offer a great way to invest in the future. Like with any investment, research is the key for any sound investment strategy.