Buy this ETF and look like a genius

Post on: 5 Май, 2015 No Comment

Article utilities

Photo: Bloomberg The performance of the Dow Jones index clearly demonstrates the positive sharemarket impact of quantitative easing.

Nothing has economists and investors more polarised than the mixed perceptions regarding the merits and flaws of quantitative easing (QE), but one thing is for sure: it is a positive catalyst for stock markets. Investors who ignore this fact are in danger of leaving money on the table.

Investors will get a second bite at the cherry following the European Central Banks decision earlier this month to embark on a 1.1 trillion ($1.6 trillion) QE programme, and financial markets are already responding in kind.

For those who have seen the terminology bandied around but arent sure exactly what it means, the Bank of England defines QE as: An unconventional form of monetary policy where a central bank creates new money electronically to buy financial assets like government bonds with the aim of directly increasing private sector spending.

It has come to prominence since the global financial crisis, particularly as the US Central Bank attempted to stimulate the economy and achieve what is commonly viewed as an ideal inflation number of 2 per cent.

The US has backed up its initial QE efforts enough times to resemble a fleet of cruise ships QE1 (2008), QE2 (2010), and QE3 (2012) which extended to October 2014. Some have begun to float the possibility of QE4 occurring in 2016.

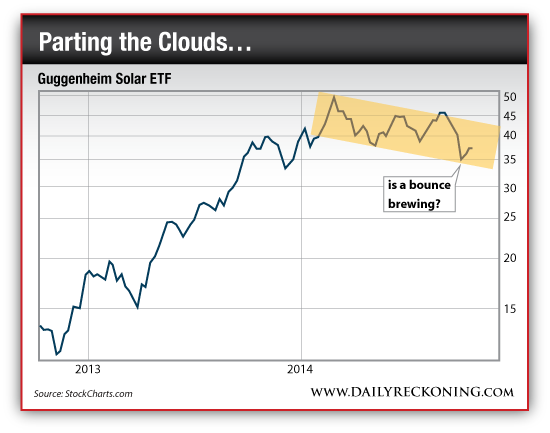

The performance of the Dow Jones index clearly demonstrates the positive sharemarket impact of quantitative easing over that period. Between the introduction of QE1 and last years termination of the program, the index increased from approximately 8000 points to 17,000 points, regathering all of the GFC lost ground plus another 30 per cent.

Experienced stockbroker and managing director of Bell Potter wholesale, Charlie Aitken summed up the situation well, saying in late January, Over the last five years all you really had to do at the macroeconomic and investment strategy level was front run central banks, most notably the US Federal Reserve.

How to cash in on Europe QE1

Markets began to react after rumours emerged early in January that the European Central Bank was about to launch a quantitative easing programme, but following the announcement at the end of January the gains were more pronounced.

The FTSE 100 stacked on about 9 per cent, increasing from 6300 points to more than 6800 points. Germany is arguably the powerhouse of mainland Europe and not surprisingly the Dax rallied 15 per cent, increasing from 9400 points to a high of more than 10,800 points last Tuesday.

The Euro Stoxx 50 Index (ESTX50) is the leading blue-chip index for the eurozone, encompassing a blue-chip representation of what are termed super sector leaders. The index covers 50 stocks across all sectors from 12 eurozone countries.

Prominent companies in the index are Allianz, BMW, Bayer, Nokia and Siemens. It has also gained nearly 15 per cent, and it could be argued the stocks that make up the index are ones Australian investors should be targeting.

Gaining leverage to global giants

One way that Australian investors can gain leverage to the European companies benefiting from European QE is through BlackRocks iShares Europe Exchange Traded Fund (IEU). While this has already had a solid run in the last few weeks, increasing by about 10 per cent from just over $50 to close in on $56, there appears scope for further gains.

The ETF is based on a broader index than the ESTX50, namely the S&P Europe 350 Index. It fell sharply in 2008 as the global financial crisis unfolded. As was the case with the ESTX50, it was not until mid-2012 that a sustained recovery occurred. Since then both the ESTX50 and IEU have gained 70 per cent.

However, the ESTX50 is still some 1200 points, or 35 per cent, shy of pre-GFC levels. If it were to mirror the Dows performance and regather all of the lost ground plus 30 per cent this would see it tracking in the region of 5850 points, equating to upside of more than 70 per cent from current levels.

Given this backdrop, if the IEU continues to perform in line with the ESTX50 it could hit $95, representing an increase of approximately $40 per share or a percentage increase of 61 per cent. While this provides an idea of how the numbers could pan out, it is worthwhile gaining an appreciation of both sector and stock exposure provided by IEU.

Firstly, there is a strong element of conservatism in terms of sector exposure with financials, health care and consumer staples accounting for about 50 per cent of invested funds. However, it should be noted healthcare stocks tap into non-discretionary spending as well as providing exposure to high growth areas.

Like the ESTX50, healthcare and chemicals companies such as Bayer, Sanofi and Essilor International are part of IEUs key holdings. With its broader reach though, it also incorporates big names such as Novartis. AstraZeneca and Glaxo SmithKline .

The manufacturing industry in Europe and particularly Germany represents a significant part of the economy, with the automobile sector a major driver. This received a boost last week with news British car production rose to its highest level since 2007 last year, up 1.2 per cent to 1.5 million motor vehicles.

This resulted in shares in BMW (+4.8%), Volkswagen (+2.9%) and Daimler (+3%) surging each of these stocks are part of the ESTX50. Once again, IEU has exposure to all three stocks with Daimler its largest holding in the consumer discretionary sector.

In the banking sector, both have exposure to BNP Paribas, Deutsche Bank and ING. while IEUs largest holding is HSBC .

Among industrial stocks Siemens, Schneider Electric and ABB Ltd are IEUs largest holdings, with the former two represented in the ESTX50.

It is difficult to invest in huge overseas-based enterprises such as the ones mentioned, and gaining exposure to this market segment through a diversified ETF for as little as 60 basis points a year is a significant win.

While not directly providing geographic diversification being a focused European play, the multi-sector coverage of IEU along with the fact many companies in the portfolio generate a significant proportion of earnings from other global regions work in its favour.

As for quantitative easing, ditch the ETF at the first sign of it ceasing. However, that isnt likely to happen in Europe for some time yet.