Buy Emerging Market Bond ETFs Now For Five Reasons EMB PCY EMLC

Post on: 2 Август, 2015 No Comment

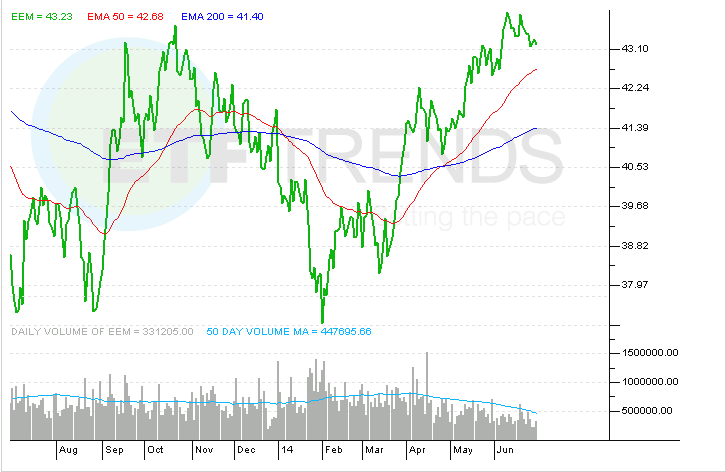

The Federal Reserve’s near-zero interest rate policy has forced bond investors to travel to emerging markets this year for interest income.

PowerShares Emerging Markets Sovereign Debt (ARCA:PCY ) the No. 1 performing fund in its class was up 18.92% this year going into Wednesday and 21.92% in the trailing year. By contrast, the benchmark Barclays U.S. Aggregate Bond Index returned 3.93% and 5.62% in those periods. Morningstar’s emerging markets bond ETF category gained 9.6% and 9.72%. PCY yields 4.75% and charges 0.5% of assets a year as a management fee.

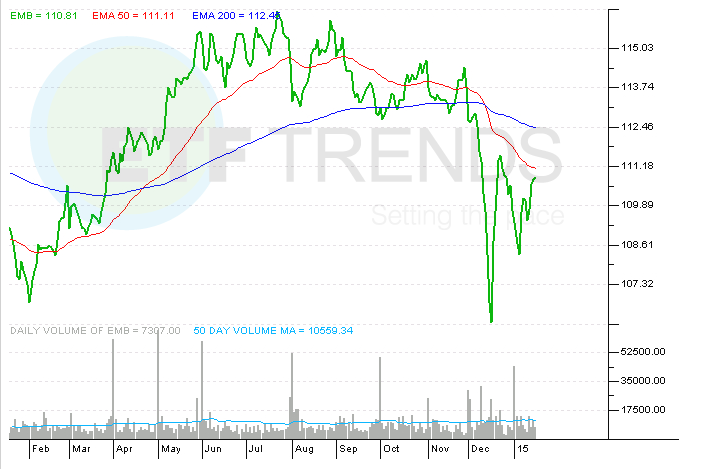

IShares JPMorgan USD Emerging Markets Bond (ARCA:EMB ), the largest of its class, yields 4.38% annually while charging a 0.6% annual expense ratio. It’s rallied 15.37% year to date and 18.53% in the past year.

Market Vectors EM Local Currency Bond ETF (ARCA:EMLC ) returned 12.43% year to date and 9.97% in the past year. It yields 4.38% and carries an expense ratio of 0.47%.

Coincidentally, both Ned Davis Research and TCW released reports Tuesday recommending emerging market bonds. Here are five bullish reasons to invest in these ETFs:

1. If global growth picks up next year, then emerging market currencies will rally against the dollar, benefiting dollar-denominated bonds, wrote Neil Leeson, ETF Strategist at Ned Davis.

2. Emerging market bonds offer yields that are 475 basis points (4.75%) on average over U.S. Treasuries yields and diversify risk and sources of yield. Based on returns and volatility over the last decade, allocating 19% of a global fixed-income portfolio to emerging market local currency bonds would have improved annual average returns by 200 basis points (2%), while reducing portfolio volatility by 100 basis points (1%), TCW wrote.

3. Most of the underlying bonds are investment-grade quality.

4. Emerging market countries have greater prospects for economic growth, smaller deficits and lower government debt burden than many developed market countries. Heavy debt loads will stunt growth as indebted countries pay back loans and cut spending.

EM local markets offer positive real interest rates reflecting market-driven supply and demand for funding, TCW wrote. In contrast, financial repression through aggressive quantitative easing has resulted in negative real rates of return in the developed world.

5. Quantitative easing programs in developed markets will likely devalue their currencies.

Expansionary monetary policy in developed markets tends to boost commodity prices and hence has a positive spillover to emerging market trade balances, TCW wrote. There are already incipient signs of stabilization in global manufacturing activity, which historically has triggered outperformance of emerging markets as an asset class, in particular local currency bonds.