Buy and sell v and hold

Post on: 19 Апрель, 2015 No Comment

ThomasH. Kee Jr.

Thomas’s Latest Posts

Approximately one month ago we traded the long-term double-short Treasury ETF short, which essentially meant that we were long the Treasury market, and we closed that trade with a gain of about 15% after a few short weeks.

Also, about a month ago, we bought Apple AAPL, -0.69% near $392 which we also sold for a gain of about 10%. Now, each of these equities is again on our radar. Both of these trades are examples of our buy-and-sell vs. buy-and-hold mentality in this market.

Although recommendations on these two positions have not been made official, we are monitoring these for opportunity again now. After closing our positions, we have backed away from being interested in establishing new positions in these, but recent action in these equities — Apple and the TBT, +0.61% — has made them more attractive than they were when we sold them (these move fast).

Stock Traders Daily is monitoring these positions for new opportunities with the anticipation that entry levels will become attractive again soon. The price of Treasury bonds has been declining recently, and the price of Apple has been declining as well, and that is what is putting these equities back on our radar. They have not come down quite enough yet, but they are getting much closer.

Because these positions have been exceptional for us in the past, we believe our that advanced warning of these probable upcoming trades is warranted. Like last time, we will be using the real-time trading reports offered by Stock Traders Daily to determine our entry levels for these positions, but our profit targets will remain in that 10% range because we do not trust this market.

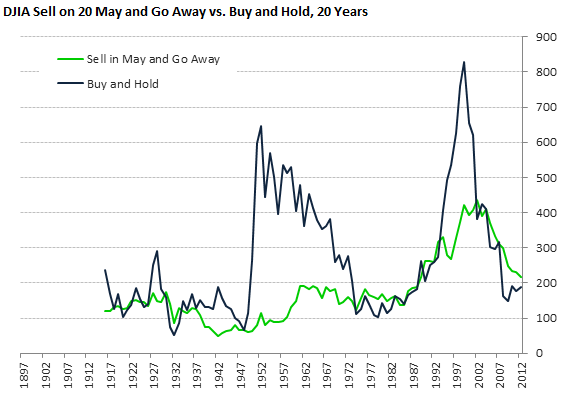

The stock market is in a Federal Reserve-induced equity-asset bubble, and we do not trust it. However, there are exceptional opportunities within this bubble, as there are in every bubble-like environment. This was true during the Internet bubble, during the credit bubble, and it is true again now, but another thing is true and that is buy-and-hold investments at these lofty market levels are probably the worst choice for any new investment.

In fact, traditional buy-and-hold investors should also consider reversing to a more proactive approach that will both shelter their money from potential market decline (something we think is just a matter of time) and give them the opportunity to make money no matter what happens to the market, the economy, or this asset bubble we are in today as well.

The approach that we are using with Treasury bonds, and Apple is a proactive approach, an excellent example, and we believe this ‘buy and sell’ approach is the best approach given current conditions.