Building portfolios with ETFs

Post on: 5 Май, 2015 No Comment

Whether you are building a portfolio on your own or with the assistance of a financial advisor, there are two critical steps to complete:

- Identify your objectives, time horizon, risk tolerance, level of financial knowledge, and personal preferences.

- Select a range of appropriate investments and decide how much to allocate to each asset class to maximize returns for a given level of risk.

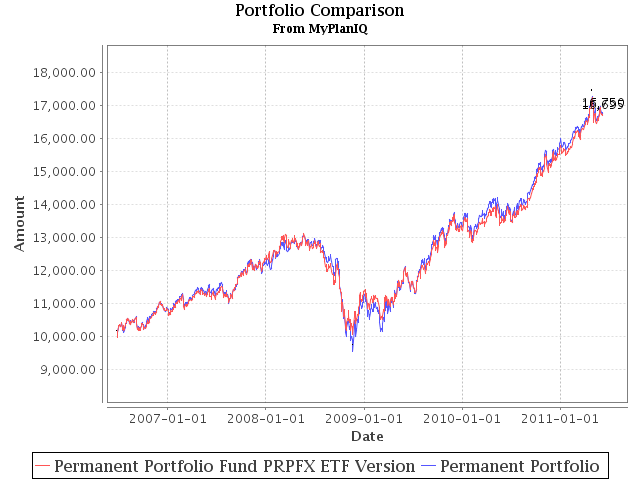

Ideally, you want an optimal portfolio — one that provides maximum potential returns for a given level of risk.

Portfolio building strategies using ETFs

The following strategies can be used on their own or in conjunction with one another.

- Blend index and actively managed funds.

Indexed funds offer market performance that matches the beta, or returns, of the overall market or a specific segment. Active management provides the potential for alpha (out-performance relative to the market) through individual security selection, sector rotation or other active strategies. Having both diversifies your exposure. Learn more .

Benefits of using ETFs:

- Diversified indexed exposure at a low cost.

- Added flexibility as they are traded throughout the day.

The core is comprised of major asset classes combined to achieve a particular risk/reward profile. (For example, the Canadian and U.S. equities, and domestic investment grade fixed income.) Satellites have the potential to add value when combined with your core, but may hold additional risk (e.g. U.S. high yield bonds). Learn more .

ETF benefits:

ETFs are an efficient means to adjust portfolio exposure through specific sector or segment investments. For example, if an investor wants tactical access to growth and dividend income provided by the Canadian banking industry, they could invest in a TSX-listed ETF that holds all of the big six banks in an appropriately diversified manner.

ETF benefits:

Certain ETFs can help investors build targeted fixed income portfolios, similar to their equity portfolios. With a variety of choices available (e.g. federal, provincial and corporate bonds with different credit ratings and maturities), they can select from specific fixed income sectors and maturities. Learn more .

ETF benefits: