Build your investment ladder with corporate bonds

Post on: 13 Май, 2015 No Comment

If you’re looking for a way to improve on certificate of deposit returns without taking on significant risk, a laddered portfolio of high-quality corporate bonds may provide an advantage.

The world of corporate bonds can be a bit intimidating to smaller do-it-yourself investors. If you’re not well-versed in areas such as primary issues, the secondary market, credit quality risk, and buying at par, discount or premium, you may be tempted to stick with the more plain vanilla investment options.

But there is a way to buy corporate bonds that makes bond selection and purchase much easier. It also enables you to simply create a diversified ladder that employs a variety of criteria.

Do-it-yourself corporate bonds

InterNotes are primary issue, investment-grade corporate and government agency bonds made available only to individual investors. Each bond sells at par, $1,000, the minimum investment, and they can be purchased in increments of $1,000. The bonds are issued weekly and are typically available for purchase for five business days. You can buy them through most brokerages.

Unlike bonds on the open market, which often have far higher purchase minimums and yields that fluctuate constantly, you don’t have to make a quick decision about whether to buy.

Prior to InterNotes, it was very difficult for individual investors to buy individual corporate bonds, says Tom Ricketts, CEO at Chicago-based Incapital, the co-agent for InterNotes.

This simplifies and slows down the whole process for individual investors. They can understand what they’re buying and have time to make an informed decision because the issuers accommodate the individual investor by holding the rate firm from Monday through the following Monday.

A recent offering of InterNotes included a GE Capital bond with a yield of 5.25 percent, and a Bank of America bond yielding 5.25 percent. Some bonds are callable, meaning the issuer could decide to take back the bond and pay you off before the maturity date.

Other companies offering securities through InterNotes include HSBC Finance Corp. Prudential and Dow.

Spreading the risk

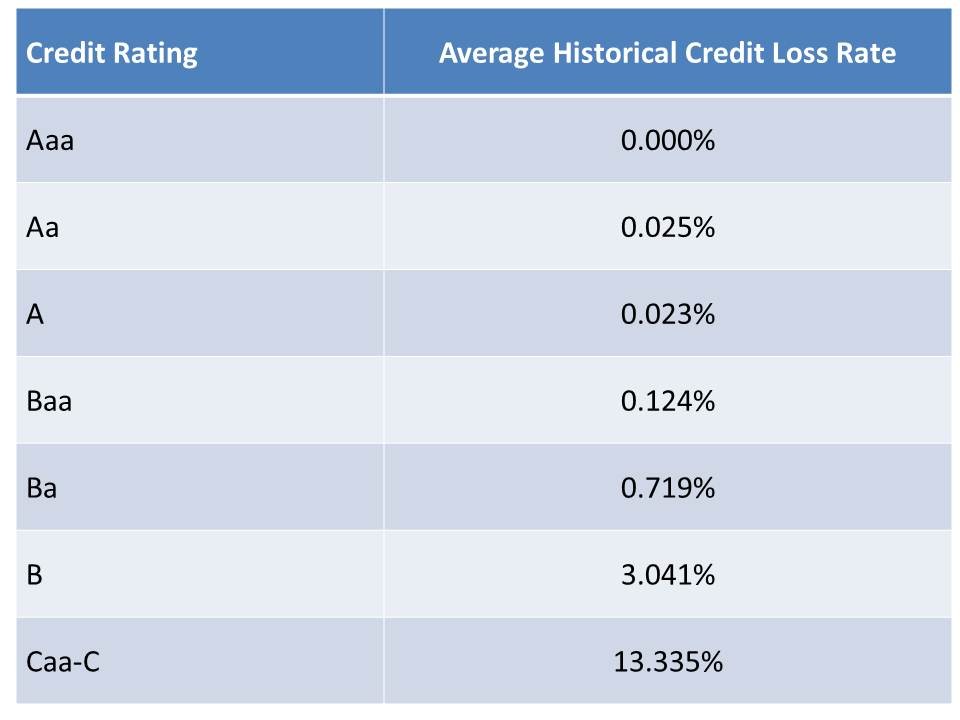

When laddering these bonds, you can diversify and spread your risk by buying bonds in different industries with differing maturities, yields and credit ratings, although all are investment grade. But there is a caution.

As a general rule, we don’t like laddering callable bonds, says a Fidelity spokesman.

You need to be very careful when interest rates are low because that’s when the typical call will be made and that’s when you most need to keep the bond you have because you can’t replace it with a similar rate.