Build up your stock portfolio with REITs

Post on: 2 Июнь, 2015 No Comment

JohnPrestbo

Reuters

Real estate investment trusts, which corrected with a loud crash this summer, may be ready for their close-up again from investors hunting for “next steps.”

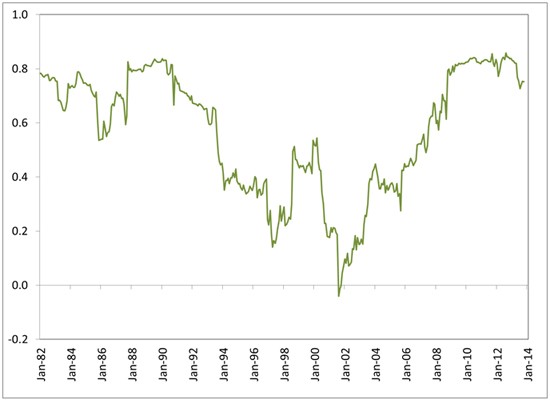

First, the back story: When the market began recovering from the financial crisis, REITs were among the sprightlier rebounders. By the end of April 2013, the SPDR Dow Jones REIT ETF RWR, -0.07% had jumped 255% since the bear market ended, versus 162% for the S&P 500 SPX, -0.61% .

Market climate and Its influence on the Fed

How will the market and economic climate impact the Feds decision-making as it contemplates paring back its bond-buying program? Charles Schwab chief investment officer Liz Ann Sonders joins MoneyBeat.

The revival of commercial real estate was one reason. In addition, many investors who couldn’t care less about office parks or shopping malls piled in because they were attracted by REITs’ plump dividend payouts.

Then came May 22, 2013, when Federal Reserve Chairman Ben Bernanke told Congress that the Fed’s bond-buying program could slow. The whole U.S. market tumbled, REITs included. But when the market recovered, REITs didn’t. They lost around 18% within the next three months.

As of last Friday, the score was still severely lopsided. The S&P 500 was up 24.5% for this year while the SPDR Dow Jones REIT was basically flat.

The conventional explanation is that REITs don’t do well when interest rates are rising — what investors anticipated when Bernanke started talking about tapering the Fed’s “quantitative easing.” That’s because REITs have to pass along almost all their profits to holders, which means they borrow a lot to expand.

True enough, but the less-discussed factor was that REITs had become unsustainably expensive. Fortified by the yield-seekers, many REIT prices had outstripped the real-world valuations of the properties they owned. Moreover, they had raced so far ahead of the stock market in which they trade that reversion to the mean set in.

New foundation

As it now stands, REITs have heaved off the bottom they hit in August, but basically are treading water. Many yield-hungry investors have gone elsewhere, including back to the familiar comfort of the bond market. Property valuations seem to be catching up with reduced REIT market prices — in line with a gradually expanding economy — though that data is slow to come in.

So, the sector looks much less negative than it did a few months ago. But what about interest rates rising when Fed tapering begins? The latest thinking is that the two aren’t the cause-and-effect that was first assumed. Many argue that the Fed will keep interest rates low to fight unemployment even as it buys fewer bonds.

None of this is to tell you to run out and buy REITs right now. Indexed investors don’t market-time. However, that doesn’t mean indexed investors shouldn’t be aware of situations and conditions, particularly if they are thinking about initiating or expanding a position in their portfolios.

Will REITs rally tomorrow? Nobody knows. Mr. Market could let them drift in a trading range for a prolonged while. If real estate is already on your radar, though, there have been worse times than now to make plans.

Here is a table of REIT ETFs that have attracted the most assets from investors: