Brazil s Election Peril or Profit for EM Bond ETFs

Post on: 11 Июль, 2015 No Comment

Global ETFs News:

As the presidential elections heat up in Brazil, the push toward economic reforms could help bolster Brazilian currency and fixed-income related exchange traded funds.

A new administration could mean embracing reform and macro-economic adjustments, reports Dimitra DeFotis for Barrons .

We favour longs in BRL [Brazilian Real], given its balanced risk/reward and short investor positioning, Morgan Stanley economists said. In local bonds, the 10-year NTN-Fs sector still offers some upside, particularly in a positive macro scenario, while short-dated NTN-Bs offer interesting defensive strategies.

ETF investors can use the WisdomTree Brazilian Real ETF (NYSEArca: BZF ) to monitor shifts in the Brazilian real against the U.S. dollar. Year-to-date, BZF has gained 10.8%.

An improved outlook on the Brazilian real and local bonds would also help benefit local-currency-denominated debt ETFs like the WisdomTree Emerging Markets Local Debt Fund (NYSEArca: ELD ) and Market Vectors Emerging Markets Local Currency Bond ETF (NYSEArca: EMLC ). Brazil makes up 11.0% of ELD and 9.8% of EMLC.

However, the U.S. dollar has been strengthening against a basket of foreign currencies, and investors who still want exposure to emerging market bonds, including Brazilian debt, can consider U.S.-dollar-denominated EM bond funds, such as the iShares J.P. Morgan USD Emerging Markets Bond ETF (NYSEArca: EMB ). which has a 5.5% position in Brazil, and PowerShares Emerging Markets Sovereign Debt Portfolio (NYSEArca: PCY ). which has a 4.6% weight toward Brazil. [Considering Your Emerging Market Bond ETF Options ]

If economic reforms pull through, the economists believe the equities market offer some potential.

The equity market still offers reasonable upside, favoring domestic-oriented companies leveraged to stronger economic activity and lower cost of capital and those benefiting from less government interference, Morgan Stanley economists said.

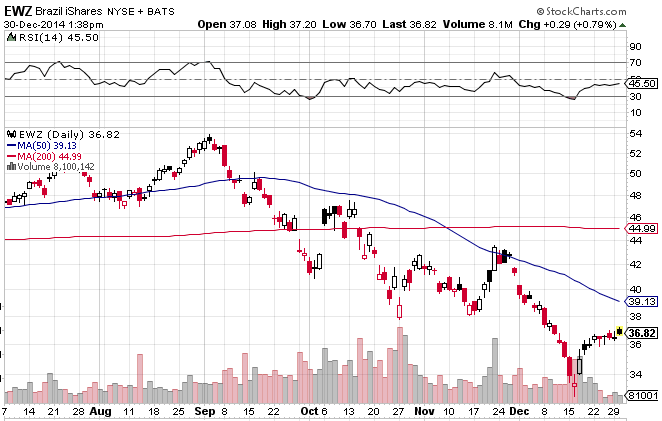

For instance, the iShares MSCI Brazil Capped ETF (NYSEArca: EWZ ). a market cap-weighted index fund, could benefit from the less heavy-handed government intervention in the private sector. [Election Bounce for Brazil ETFs ]

For more information on developing economies, visit our emerging markets category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.