BondsOnline Chart Center Yield Curves for US Municipal Bonds Corporate Bonds and Treasury Bonds

Post on: 29 Май, 2015 No Comment

US Treasury Bonds

Create your own charts of US Treasury Bond yields to compare yields at different points in time, or to compare performance and spread between different maturities. Data from January 2006 through end-of-day, yesterday.

Maturity vs Maturity Spreads

From To

Municipal Bonds

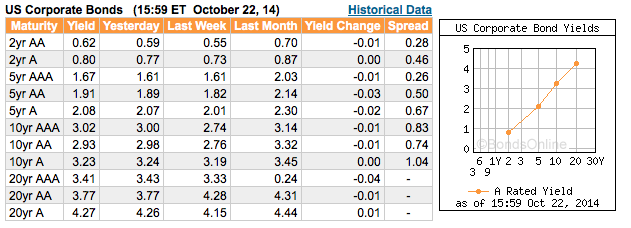

US Corporate Bonds

Certificates of Deposit

Maturity vs Maturity Spreads

Premium Charts

Premium data are available to create time series charts. Costs vary with the type of data.

US Corporate Bond Daily Spread Tables ($35 each) BondsOnlineQuotes

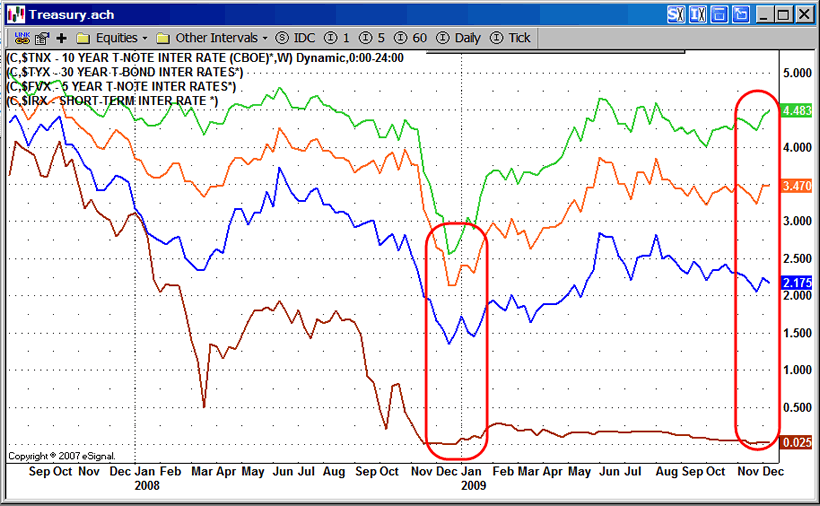

The yield curve is a graph illustrating the relationship between bond yields and years to maturity, generally ranging from one month to 30 years. Though the yield curve can graphically depict the yield and maturity relationship for any type of bond, the term generally refers to Treasury securities.

Why Do I Care?

The shape of the yield curve is closely followed by bond investors. It provides information about the yields of short term compared to long term fixed-income investments. Investors analyze and interpret the yield curve shape to give some insights on the future direction of rates and the economy.

A yield curve normally has an upward sloping shape. That is, in a normal yield curve, shorter-term yields are lower than longer-term yields, with yields generally increasing as years to maturity increase. The yields are higher on securities with longer maturities because these securities are more vulnerable to price changes caused by changes in interest rates over time. Investors in longer-term securities are typically rewarded with a higher yield for taking the risk that interest rates could rise and cause the prices of their securities to fall.

Investors pay attention to both the current shape of the yield curve, whether it is steep or flat, and yield curve movements. That is, investors will look at whether the entire curve is shifting up or down in a parallel fashion which suggests that rates across the maturity spectrum are changing by the same magnitude or, alternatively, the shape or slope of the curve is becoming flatter or steeper. For example, when Federal Reserve monetary policy is more accommodative and reduces short term rates, the yield curve generally steepens, and flattens when monetary policy tightens the Fed raises short term rates.

When the yield curve is steep, that is when the difference between short-term and long-term yields is large, the market often expects interest rates to rise, though there are a number of variables, including the rate of economic growth and inflationary expectations, that go into interest rate analysis and forecasting; the risk at the long end of the maturity range is therefore greater, and so is the return or yield. When the yield curve is relatively flat, the difference between short-term yields and long-term yields is not that great. When this happens, the market is not rewarding investors for taking the risk of a longer maturity, possibly because the market believes interest rates will decline, causing bond prices to rise and yields to fall. Investors holding securities with longer maturities tend to benefit more from a declining interest rate trend.

There have been brief and unusual periods of time when the there has been what is known as an inverted yield curve shape, where, at certain points along the maturity spectrum, short-term yields have been higher than long-term yields. Inversely sloped yield curves are not sustainable either short term yields will eventually fall or long term yields rise. An inverted yield curve is considered an omen of recession as well as lower interest rates.

BondsOnline Group, Inc.