Bonds v Only one can be right

Post on: 2 Июль, 2015 No Comment

JohnNyaradi

John’s Latest Posts

Current stock market action and the global financial system’s reliance on central bank support reminds me of rock legend Bachman Turner Overdrive’s 1974 hit You Ain’t Seen Nothin’ Yet.

I met a devil woman

She took my heart away

She said, I’ve had it comin’ to me

But I wanted it that way

I say that any love is good lovin’

So I took what I could get mmh, mmh, mmh

She looked at me with them brown eyes

And said, You ain’t seen nothin’ yet

B-B-B-Baby, you just ain’t seen n-n-n-nothin’ yet

But here’s what we have seen in the last few days in spite of the massive ongoing global central bank intervention:

ISM manufacturing. 51.3, down 2.9 from February and missing expectations, now approaching the 50 mark that separates expansion from contraction.

ISM services index. 54.4, down from February’s 56 and missing expectations of 55.8

Markit U.S. PMI. 54.6 in March, up from February’s 54.3 but missing estimate of 54.9

ADP employment. 158,000 jobs, down from 190,000/month average and February’s 237,000

Initial jobless claims. 385,000, week ending March 30, up from previous week’s 357,000 and higher than expectations

NFIB small-business report. Optimism index declines as NFIB Chief Economist Bill Dunkelberg reports, For the sector that produces half the private GDP and employs half the private-sector workforce — the fact that they are not growing, not hiring, not borrowing and not expanding like they should be, is evidence enough that uncertainty is slowing the economy.

March non-farm payroll. 88,000 new jobs, missing expectations of 175-195,000 and far below February’s 238,000. Labor-force participation declines to 63%, well below the 66% average of the last two decades. There are 11.7 million people are unemployed, not including the 496,000 who dropped out of the civilian labor force in March.

Sequestration. The sequestration is beginning to reduce federal employment, and since these are people who buy things, even slower economic growth seems inevitable. CBO estimates suggest that from the fourth quarter 2012 to the fourth quarter 2013, the economy will grow by only 1.4% as opposed to the 2.9% growth rate we would see without sequestration. We would also see the equivalent of approximately 750,000 more full-time jobs created or retained by the end of the third quarter of 2013 if there were no sequestration.

Declining earnings growth. Earnings forecasts turn bleak as more than 100 S&P 500 companies have offered negative revisions of their quarterly earnings forecasts, leading economists to expect first-quarter earnings growth to expand by just over 1.5% compared to 6.2% earnings growth during the fourth quarter of 2012.

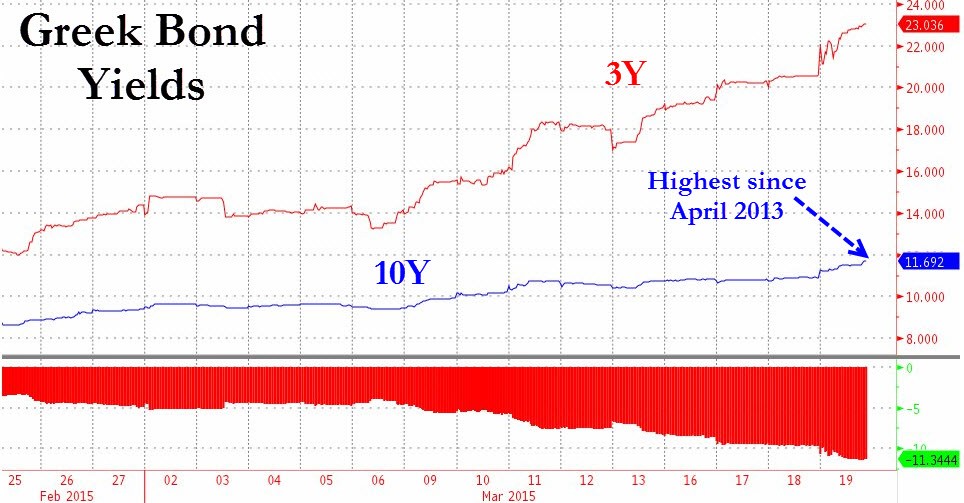

Bond-market warnings. In the chart below, we can see how the bond market flashes a bright red warning signal. The stock market continues hitting new record highs while bond yields tumble, which indicates that the bond market sees significant danger ahead.

As everyone knows, the bond market and the stock market tend to move inversely to each other. As stocks rise, bond prices fall and bond yields rise. As stock-market prices fall, bond-market prices rise and bond-market yields fall.

However, in today’s central-bank influenced, Wizard of Oz economy, interesting divergences are now taking place between the bond market and the stock market. The divergence between bonds and stocks is clearly visible in this chart, as the bond market screams that risk on assets are simply too risky.

A similar divergence occurred last May when bond yields started collapsing while the S&P 500 index held steady, but soon the S&P 500 followed with a decline of nearly 9% between early May and early June.

Most analysts believe that the bond market is smarter than the stock market, and since only one of these markets can be right, we’re going to find out soon enough which one is both smarter and correct.

Against this background of weak economic reports, stubbornly high unemployment, declining earnings growth and sequestration, I am quite certain that today’s economic climate is going to look positive in comparison to what we’ll be facing in coming months. The divergence between the bond market and stock market will, by necessity, be repaired in one direction or other, and the current situation favors a stock-market correction rather than a bond-market slump.

In other words, Bachman Turner Overdrive was right to sing, you ain’t seen nothin’ yet, and so Wall Street Sector Selector remains in Red Flag status for the week ahead.