Bonds Understanding Yield to Maturity

Post on: 15 Июнь, 2015 No Comment

Key Points

- When you invest in a bond, one of the most basic things you need to know is the expected return. Yield to maturity, yield to call, and yield to worst all tell you something about the return you may get, but they’re calculated differently. If you focus on yield to worst, your comparison will center on the lowest yield an investor can receive. whether you’re looking at callable or non-callable bonds.

When you invest in a bond, one of the most basic things you need to know is the expected return. That’s where yield to maturity comes in.

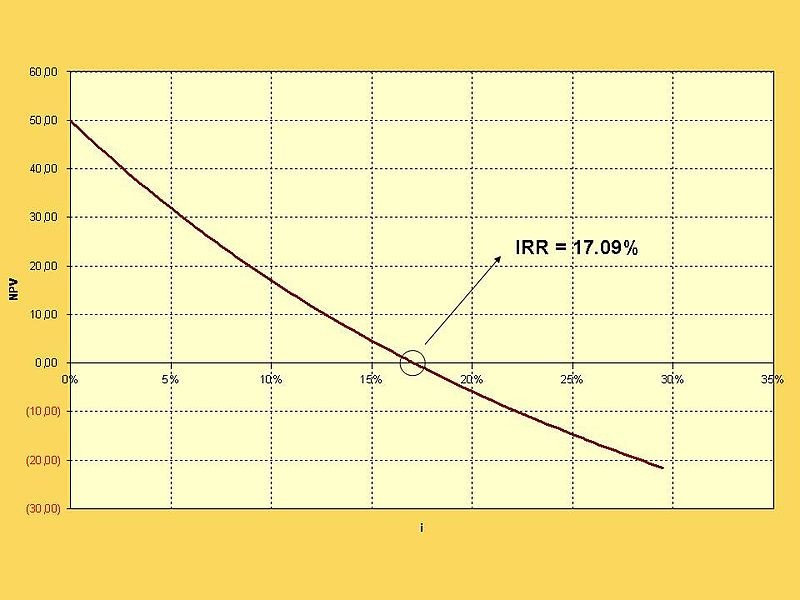

Also known as the internal rate of return for a bond, yield to maturity is the annual rate of return assuming a bond is held to maturity and all of the interest payments are reinvested at the original rate. It’s the most commonly used way to look at a bond’s expected return.

But there are other types of yields you may come across when looking at bonds. All of these yields tell you something about the return you may get, but they’re calculated differently. It’s important to understand the subtle differences between them.

- Yield to call is the annual rate of return assuming a bond is redeemed on the first (or next, if you’re buying after the first call date has passed) call date. This comes into play with bonds that are callable, meaning the issuer has the option to retire them—or call them in—before the stated maturity date. The price at which a bond can be called may vary. While many bonds are callable at their par value (usually $1,000), some bonds are callable at a premium price. Some bonds may even have a scaled call schedule, meaning they start at a premium, which then decreases with each successive call date, usually ending with a call price of $1,000.

- Yield to worst is the lower of the yield to maturity or the yield to call. It’s essentially the lowest potential rate of return for a bond.

- Current yield is calculated by dividing the annual income of a bond by its price. A bond’s current yield does not take into consideration any potential price changes in the secondary market, like the fact that a bond’s price will eventually converge to its par value as it approaches its maturity date. It doesn’t consider the reinvestment of interest payments either. As a result, current yield is not meant to represent a bond’s potential rate of return, and should not serve as a substitute for yield to maturity, yield to call, or yield to worst.

Which one is best?

So what yield should you look at? It depends if the bond can be retired prior to maturity or not.

Bonds that can only be retired at maturity—meaning they can’t be called by the issuer, using one example—are called “bullet” bonds. For a bullet bond, the yield to maturity and yield to worst are always equal.

If the bond is callable, look at both the yield to call and yield to maturity to understand what type of returns you can expect if the bond is or isn’t called. A callable bond trading at a premium price (a price above its par value) will likely have a yield to maturity that is higher than its yield to call. That’s because the premium you paid subtracts from your yearly returns. If you hold the bond for a shorter amount of time, the premium amount that will be subtracted each year is larger, further depressing your yield.

The opposite is true for discount bonds. The discount essentially gets added to your yearly returns, so spreading the discount over a shorter period of time adds more to your returns, increasing your yield to call. In this case, the yield to worst will be the same as the yield to maturity.

But always make sure to look at the yield to worst so you are aware of the lowest possible yield you’ll receive. It’s the most conservative way of looking at a bond since it’s the lowest yield you’ll earn, short of default. If you focus on yield to worst, you’ll be as close as you can get to an apples to apples comparison when looking at callable and bullet bonds.

I hope this enhanced your understanding of fixed income. I welcome your feedback—clicking on the thumbs up or thumbs down icons at the bottom of the page will allow you to contribute your thoughts.