Bonds Learn About Types of Bonds

Post on: 18 Июль, 2015 No Comment

Bonds and individual fixed income securities

- Bonds and fixed income securities can provide a predictable income stream

- Most pay interest semiannually

- When working with an Ameriprise financial advisor, you gain access to a wide variety of bonds and fixed income securities

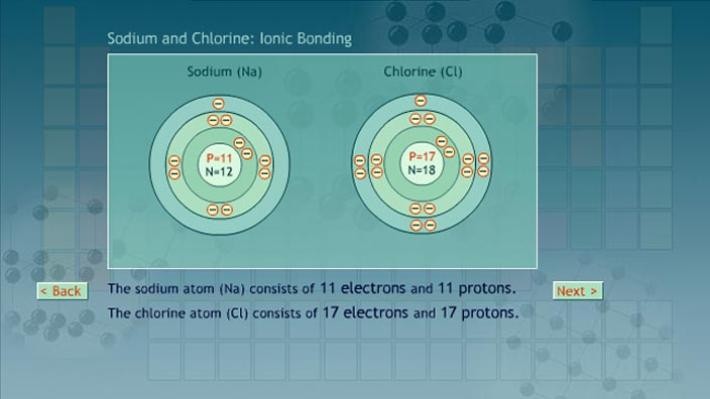

Bonds are a debt security. In general, the issuer promises to pay a specified rate of interest during the life of the bond and to repay the face value of the bond (the principal) when it matures.

Bonds and fixed income securities typically pay interest semiannually. Interest payments can provide investors a predictable income stream. Many people invest in bonds for the expected interest payments and to preserve their capital investment. (Interest payments and return of principal are subject to the creditworthiness of the issuer and are not otherwise guaranteed).

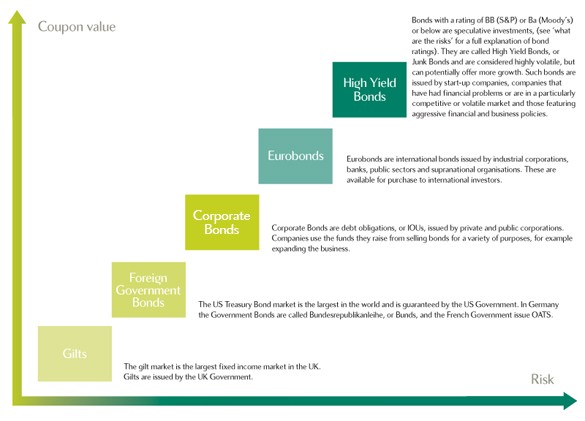

By working with an Ameriprise financial advisor, you have access to a wide variety of bonds and fixed income securities including:

- Corporate bonds

- Municipal bonds

- U.S. Treasury bills, notes, bonds and zeros

- U.S. Agency bonds

- Mortgage-backed securities

- Asset-backed securities (ABS)

- FDIC-insured brokered CDs

Take the next step

To find out more about trading bonds and fixed income securities at Ameriprise Financial, contact your Ameriprise financial advisor or locate an advisor near you .

There are risks associated with fixed income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities.

Although CDs are generally FDIC insured up to the applicable limits, the FDIC insurance applies only to the principal investment and will not cover any potential performance. FDIC thresholds are limited to all deposits held in the same insurable capacity at any one issuer.

Ameriprise Financial, Inc. and its affiliates do not offer tax or legal advice. Consumers should consult with their tax advisor or attorney regarding their specific situation.

Non-investment grade securities, commonly called high-yield or junk bonds, generally have more volatile prices and carry more risk to principal and income than investment grade securities. Investment decisions should always be made based on an investors specific financial needs, objectives, goals, time horizon and risk tolerance.

Investment products are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by, any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.

Ameriprise Financial Services, Inc. Member FINRA and SIPC.