Bonds Is Now the Time to Buy LongTerm Munis

Post on: 18 Апрель, 2015 No Comment

Yields on tax-exempt bonds maturing in less than 10 years fell to a six-year low during the week of Aug. 16. With 30-year municipal bonds offering yields near 5%—an astonishing four percentage points higher than two-year muni bonds—yield-hungry municipal bond investors are shifting money into riskier, longer-term municipal bonds, according to Municipal Market Advisors, which publishes a newsletter for municipal bond investors.

Is it smart to buy long-term munis right now? The bulls argue that there are good opportunities for investors in high tax brackets who aren’t worried about inflation. That’s because absolute yields on short-term municipal debt are extremely low right now. And long-term municipal debt is scarce, thanks in part to the success of the Build America bond program that lets municipalities issue long-term debt in the taxable bond market.

The end result is strong demand combined with diminished supply for 20- and 30-year municipal bonds. The steepness of the municipal yield curve offers investors a significant yield pickup over short-term securities and a compelling reason to extend out on the yield curve, says Peter Hayes, who heads the municipal bond team at BlackRock (BLK) in New York. His group favors higher-quality hospitals and some corporate-backed municipals, such as investor-owned utilities, with single-A credit ratings.

Attractive vs. Treasuries But the bears, such as Dan Genter, president and chief investment officer at RNC Genter Capital Management in Los Angeles, argue that investors aren’t getting paid for the incremental interest rate risk. His argument is simple: The yield curve starts to flatten out after 15 years, so it doesn’t make sense to own municipal bonds with longer maturities. He adds: Investors in 15-year municipal bond credits already get 80% of the yield that is available from a 30-year bond.

That may be the case, but relative to U.S. Treasuries, long-term municipal bonds are offering enticing yields. Robert MacIntosh, co-head of the municipal bond group and chief economist at Eaton Vance, compares the yield of a typical high-quality municipal bond to the yield of the 30-year U.S. Treasury bond. Today this relative yield is 107%—well above the historical norm of 85% to 90%, he says. His conclusion? Tax-exempt yields are too high relative to the U.S. Treasury bonds and, therefore, should outperform long-maturity U.S. Treasuries over time, he says.

Vanguard Group’s John Carbone is another fan of longer-maturity muni bonds. There’s still some rocky terrain out there, but the yields are definitely intriguing if you are in a high tax bracket, says Carbone, who manages several state municipal bond funds at Vanguard. His credit research team is focusing on single-A credits as well as triple-B issues.

Watch Interest Rates After concentrating on short and intermediate muni bond funds, Thornburg Investment Management opened the Thornburg Strategic Municipal Income Fund (TSSAX) in April to capitalize on opportunities for long-term muni investors. George Strickland, the fund’s co-manager, says he is sticking with issuers rated single-A or higher. In addition to hospital bonds, he likes longer-maturity general obligation bonds. Strickland says he is finding good deals in states with shaky finances that other investors tend to avoid, such as Florida, Nevada, and California. In addition, he likes higher education bonds from colleges, universities, and even secondary schools.

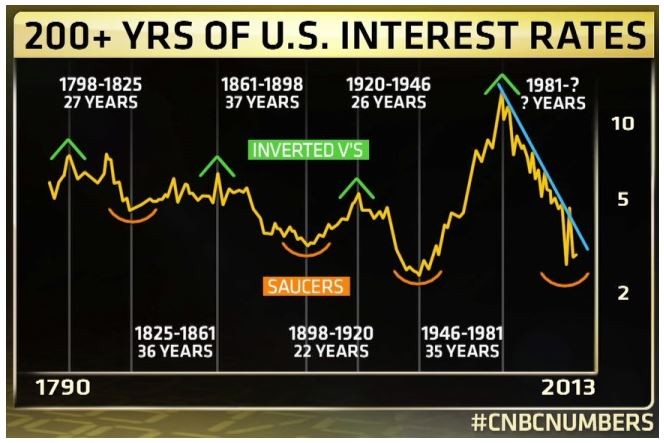

To invest in long-term munis, investors need to get over a few hurdles. The biggest one is figuring out where interest rates are headed. Like Genter, Sam Ramirez Jr. of Samuel A. Ramirez & Co. a New York investment firm with expertise in munis, sees rates spiking. Inflation or rising interest rates will occur at some point within the next 12 months, Ramirez says. We want to be shorter on the yield curve to protect principal.

It’s also unclear what will happen to the Build America bond program after it expires at the end of 2010. Some analysts expect more municipalities will come to market with longer-term bond issues. As a result, they see rates rising due to increased supply and inflation fears. BlackRock’s Hayes, however, expects supply to remain low.

Credit Research Is Essential With more than 50,000 municipal bond issues in existence, credit research is even more crucial in munis than other kinds of fixed-income, experts say. For example, in the corporate bond world, there is more consistency among companies that are rated triple-B. But that’s not the case in muni land. In munis, triple-Bs have to be analyzed individually to be understood, says Ben Thompson of Samson Capital Advisors, a New York firm that specializes in fixed-income investing for wealthy families and institutions. Since municipal finances are far less transparent than corporate reporting, investors should only commit to longer-term holdings if they have a great deal of confidence in the issuer, says John Boland, chief investment officer of Maple Capital Management, a wealth management firm based in Montpelier, Vt.

That’s why the safest way to play muni bonds is via a municipal bond mutual fund led by a seasoned investment team. Because the category is so vast, fund tracker Morningstar (MORN) doesn’t have picks for muni single-state long funds. But it does recommend focusing on funds with low costs, a proven management team, and ample resources. Fidelity, Franklin, and Vanguard single-state lineups fit the bill, says Morningstar.

Young is a Personal Business editor for BusinessWeek