BOND The World s Largest Active ETF Celebrates Its First Birthday PIMCO Total Return ETF

Post on: 21 Сентябрь, 2015 No Comment

By Timothy Strauts

BOND at 1

Today marks the one-year anniversary of the launch of PIMCO Total Return ETF (NYSEARCA:BOND ). We think it’s fair to say it was a good year for the world’s largest actively managed exchange-traded fund.

BOND is the younger sibling of the $285 billion PIMCO Total Return (PTTRX ). Morningstar’s Fixed Income Manager of the Decade for the 2000s, Bill Gross, manages the ETF following the same strategy he has been employing at PIMCO Total Return since 1987.

The PIMCO Total Return strategy follows a top-down investment process that is rooted in Bill Gross and the PIMCO investment committee’s outlook on the global economy and interest rates. The PIMCO team forecasts future interest-rate volatility, yield-curve movements, and credit trends to guide its portfolio allocation decisions.

BOND was launched on Feb. 29, 2012. In the year since it was launched it has produced solid results. From BOND’s inception through Feb. 28, 2013, it returned 12.45%, which trounces the benchmark’s return of about 3%. BOND has also bested PIMCO Total Return since its inception. The mutual fund returned 7.60% over the same period.

As you can see in the chart below, BOND has outperformed both its index and PIMCO Total Return on a fairly consistent basis since inception. Bill Gross has been outperforming his competition for a generation, so it’s not entirely surprising the ETF outperformed its index. But what is interesting is the degree of outperformance versus PIMCO Total Return.

What’s Driving BOND’s Outperformance?

When BOND was launched with about $100 million in assets, Bill Gross was able to start fresh with a brand-new portfolio. The recent outperformance shows how a highly skilled active manager can add tremendous value in a little portfolio. It pays to be small. PIMCO Total Return has $285 billion in assets versus BOND’s $4.3 billion. PIMCO Total Return has more than 20,000 holdings, whereas BOND has just shy of 800. Because the ETF’s portfolio is relatively lean and nimble, PIMCO’s best individual bond ideas can make up relatively larger portions of BOND than PIMCO Total Return. Effectively, the ETF is performing like Bill Gross’ best ideas list. In the mutual fund, if a PIMCO credit analyst finds a mispriced corporate bond, adding it to the large portfolio won’t do much to move the needle. Add that same bond to the ETF’s portfolio and it’s far more likely to register.

As BOND gets larger, we would expect outperformance versus the mutual fund to narrow. Indeed, it already has to some extent. You can see in the chart above that BOND’s average outperformance in the first three months of its existence was far greater than it has been in the subsequent nine-month period. Currently, BOND’s $4.3 billion in assets amount to just 1.5% of those managed in PIMCO Total Return. Given the advantages implicit in managing a smaller portfolio, we believe BOND is the preferred way to access the PIMCO Total Return strategy over the next few years—especially for investors who would otherwise have opted for the A share class of the mutual fund. For current investors in the institutional share class, the decision is more difficult. BOND’s annual expense ratio is 9 basis points higher than PIMCO Total Return’s institutional shares’, but the potential for continued excess returns (net of fees) relative to the mutual fund could make the ETF relatively more attractive.

The outlook for the bond market is murky. The Federal Reserve’s plan to maintain the federal-funds rate near 0% until 2015 will keep rates low across the entire yield curve for the foreseeable future. In the near term, investors can expect total returns close to the yield to maturity of the fund. In fact, Bill Gross recently predicted on Twitter that he expected bonds to return less than 5% in 2013. Considering that the yield to maturity of BOND is 3.4%, that sounds about right. In the years ahead inflation will become a bigger risk as the Federal Reserve removes its monetary stimulus. In fact, PIMCO’s largest holding in BOND is Treasury Inflation-Protected Securities to protect against future inflation.

Portfolio Construction

The strategy seeks to outperform the Barclays US Aggregate Bond Index. As an actively managed strategy it has the flexibility to be over- or underweight in sectors and make interest-rate bets, but it does this with restraint and is subject to criteria that prevent it from deviating too widely from its benchmark. The fund has the ability to buy international bonds, high-yield bonds, Treasury Inflation-Protected Securities, and non-agency mortgage-backed securities. None of these sectors are represented in the Barclays index the fund has chosen as its bogy.

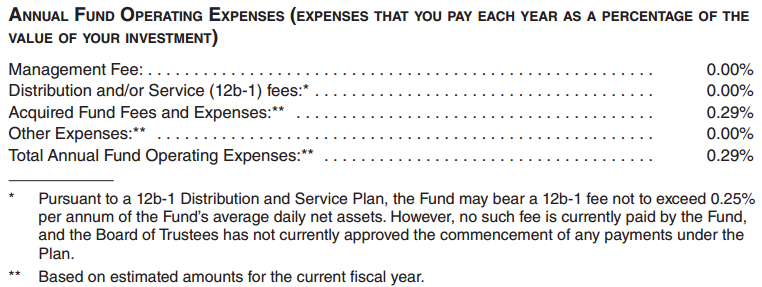

BOND charges an expense ratio of 0.55%. While much more expensive than an index-based aggregate bond fund, the fee is competitive with its mutual fund counterparts. The institutional share class of PIMCO Total Return charges an annual fee of 0.46%, and the A share class levies a fee of 0.90% per annum. Investors for whom the institutional share class is out of reach should find BOND a very good deal.

Disclosure. Morningstar, Inc. licenses its indexes to institutions for a variety of reasons, including the creation of investment products and the benchmarking of existing products. When licensing indexes for the creation or benchmarking of investment products, Morningstar receives fees that are mainly based on fund assets under management. As of Sept. 30, 2012, AlphaPro Management, BlackRock Asset Management, First Asset, First Trust, Invesco, Merrill Lynch, Northern Trust, Nuveen, and Van Eck license one or more Morningstar indexes for this purpose. These investment products are not sponsored, issued, marketed, or sold by Morningstar. Morningstar does not make any representation regarding the advisability of investing in any investment product based on or benchmarked against a Morningstar index.