Bond Risk

Post on: 25 Апрель, 2015 No Comment

Bond Risk

Risk is an extremely important aspect of investing in bonds or any other financial instrument.

The effectiveness of a particular investment strategy can’t be determined just by looking at the rate of return. The amount of risk inherent in that strategy must also be taken into account. A 5% annual return for an investment strategy that takes very little risk, may be an attractive return, but a 5% return on a high-risk strategy would not be considered an acceptable rate of return.

The risk-adjusted return measures the rate of return for a portfolio or investment based on the amount of risk.

There are several types of risks that apply to bonds and understanding those risks will help you become a more skilled investor.

Interest Rate Risk

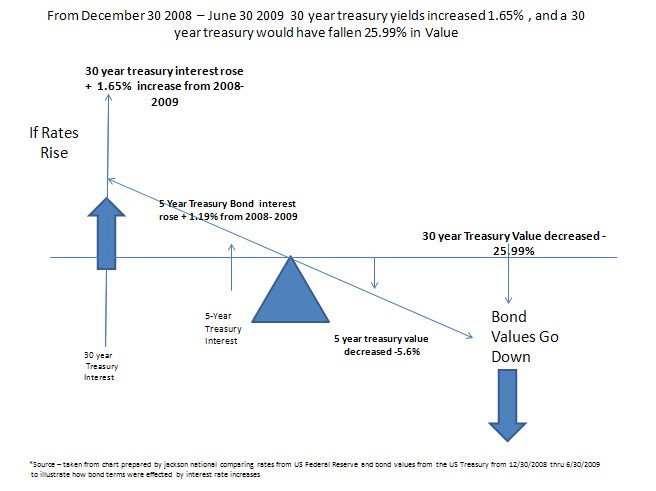

Changes in interest rates have a profound effect on bond prices.

This relationship is converse:

- When interest rates increase, bond prices decrease

- When interest rates decrease, bond prices increase.

This is often driven by the government using fiscal policy and/or the Fed using monetary policy to influence the growth rate of the economy and inflation. Interest rate risk also plays a major role in other bond related risks.

Interest rate risk does not affect all bonds equally.

Longer maturity bonds will experience a greater change in price than shorter maturity bonds for a given change in rate.

Lower coupon bonds will fluctuate more than higher coupon bonds.

Long-term zero coupon bonds experience the greatest price volatility when interest rates change.

Active bond traders looking to profit from changes in interest rates will seek out bonds whose interest rate sensitivity matches their particular strategy (usually they will seek higher sensitivity).

Credit or Default Risk

The second most significant risk for bond investors is credit risk. Because credit risk is the risk that an issuer will default on payments of interest and principal, it is also referred to as default risk.

A bond issuer does not have to default, however, for credit risk to affect investors. If one or more credit rating agency downgrades a bond issue (or the market has a perception this may happen), the price of a bond will drop.

The rating agencies will modify their ratings for several reasons including:

- Changes in the economy

- An issuer’s industry

- The financial and competitive standing of the individual issuer

- Anything that will impact the issuer’s ability to meet the financial obligation to bondholders including their ability to service their debt

Positive changes can result in an issuer’s ratings being upgraded. Many bond traders speculate by buying bonds of issuers that they think may be on the verge of a ratings upgrade. A downgrade does not necessarily mean an issuer is close to default, and a change of one level may not necessarily result in a significant price change for highly rated issuers. However, bondholders should view this as a warning sign and carefully monitor the company for possible further deterioration.

A downgrade that reduces an investment grade bond to non-investment grade can be particularly problematic. Many institutional investors are required to hold only investment grade bonds. If a bond that these institutions hold is no longer investment grade, they will be forced to sell the issue. Because of the large positions these institutions usually hold, this selling can cause significant downside pressure on the bond’s price. Also a downgrade of more than on level can have a significant impact on the bond’s price.

Reinvestment Risk

Reinvestment risk is strongly influenced by changes in interest rates. When a coupon payment is received, the funds will be reinvested at current market rates. This rate may be more than, less than or equal to the coupon rate. If the payment is reinvested at a rate lower than the bond’s yield, the investor will experience a lower total rate of return. Of course a higher rate of reinvestment will result in a higher total rate of return. It is the uncertainty of the ultimate rate of return that constitutes reinvestment risk.

The risk that rates may be lower than the bond’s yield to maturity at some point in the life of the bond is of concern to bond investors. Longer-term bonds make more coupon payments than shorter-term bonds, so there will be more reinvestment during the life of the bond. Also, the longer the maturity, the greater the chances that lower bond rates may be experienced during the life of the investment.

Therefore, longer-term bonds are more susceptible to reinvestment risk.

Inflation Risk

(Also known as purchasing-power risk )

Inflation risk is the risk that general prices will rise, thus reducing the purchasing power of the future dollars received.

This results in a rise in interest rates as investors require higher returns for deferring their purchases to the future when prices will be higher. Rising interest rates leads to lower bond prices.

Early Redemption Risk

(Also known as call risk )

Early redemption risk is also associated with interest rate risk. Many U.S. agency, municipal, and corporate bonds are subject to early redemption, and all mortgage-backed bonds pay principal prior to maturity. U.S. Treasury securities are no longer being issued with call provisions.

An imbedded call option is the equivalent of buying a bond and selling a call option on the bond to the bond issuer. Because it is the issuer’s option to call back the bond, they will do so when it’s to their advantage.

This will be when interest rates are low and they can refinance at lower rates and reduce their cost of capital. This is usually when the bondholder doesn’t want the bond called away, as they will have to reinvest at lower rates.

Having a bond called is not always a bad thing for an investor. If a bond was purchased at a discount and is called at par or premium within a short period of time, the investor may experience an attractive total return. However, bonds purchased at a premium would result in a loss of some principal if called at par or a lower premium.

Because of this call risk, callable bonds trade at a discount, or yield spread, to equivalent non-callable or bullet bonds. This can make callable bonds an attractive investment for investors who don’t believe that interest rates will drop in the foreseeable future. Many bonds offer a period of call protection, which means the bond is not callable until some date in the future.

Typically, such bonds will be initially callable at a premium. This premium will decline with each subsequent call date until it eventually reaches par.

The complicated nature of call (and sinking fund) provisions makes callable bonds more complicated to analyze than bullet bonds. It is important to analyze yield to worst when considering bonds with early redemption provisions.

Prepayment Risk

Prepayment risk is the early redemption risk associated with mortgage-backed bonds.

As homeowners are aware, monthly mortgage payments consist of both interest and principal. This means that the principal is paid off monthly over time, rather than at maturity like a bullet bond. Because mortgage-backed securities (MBSs) consist of pools of mortgages, prepayment risk is inherent to mortgage-backed bonds.

Some homeowners may prepay their mortgages in order to move to a new house or to refinance their current mortgage. This will accelerate the prepayment rate of a MBS and shorten its maturity. This is known as contraction risk. Like bond issuers, homeowners will refinance their mortgages when interest rates decline. Unlike callable bonds, however, not all homeowners will refinance, and they will not all refinance at the same time (some homeowners may hold off if they think interest rates will decline further.)

There are a number of reasons for homeowners to prepay their mortgages:

- Upgrading their home

- Downgrading their home if they experience financial difficulty

- Employment relocation

- Retirement

This makes contraction risk very difficult to anticipate, though some MBS investors employ sophisticated analysis of the regional demographics and economic conditions of individual pools of mortgages in order to more accurately assess contraction risk.

Some homeowners choose to pay back their mortgage early by including an additional amount of principal with their monthly mortgage payment. This is early accelerated prepayment is known as curtailment but is not a significant factor for most MBSs.

When interest rates rise, mortgage holders have no incentive to prepay their mortgage if they don’t have to. This is known as extension risk, as it extends the life of an MBS.

MBS investors can never be sure of the actual yield to maturity they will experience because the actual life of the bond is not known. The investment decision is based on an expected life and yield to maturity. Investors that purchase MBSs at a discount would prefer the life of the bond to be shorter, as this will mean their capital gain occurs sooner, and this will increase their yield to maturity.

Investors who purchase their bonds at a premium, would prefer that the life of the security will be longer than expected.

Investors that bought at a discount, welcome contraction and fear extension.

Investors that bought at a premium welcome extension and fear contraction.

This is the risk that a significant event will seriously impact an issuer’s credit rating and ability to repay their debt obligations. This most often happens as the result of a leveraged buyout, merger, recapitalization or other corporate restructuring that greatly increases the issuer’s debt load and stretches its financial resources. This makes it vulnerable to an economic or business downturn. Less often, event risk can also result from natural disasters, industrial accidents or even acts of terrorism.

Liquidity Risk

Liquidity risk is the risk that a seller will not be able to find a buyer for their bond, or will have to sell it at a substantial discount to attract a buyer.

This usually occurs with:

- Small issues of bonds

- Lesser-known issuers that do not come to market often

- Lower rated or downgraded issues

With tens of thousands of bond issues available to investors, not all issues are going to be familiar to most investors. This problem is exacerbated by the fact that very few bonds trade on organized exchanges and the vast majority trade over-the-counter between dealers.

Most bond trades occur in round lots of $100,000 or $1 million dollars. Smaller lots are referred to as odd lots and are much less liquid than the round lots. Individual investors are more likely to trade in odd lots.

The recent economic crisis that resulted from the bursting of the housing bubble provides a perfect illustration of liquidity risk. The dramatic increase in the number of mortgage foreclosures caused a panic that virtually froze the markets for mortgage related securities.

Currency Risk

(Also known as exchange rate risk )

Currency risk occurs only when an investor purchases a bond that is denominated in a foreign currency. The exchange rate between any two currencies is constantly changing due to such factors as the two countries’ relative balance of payments and level of interest rates.

If a U.S. investor purchases a euro denominated bond, his future payments of interest and principal are made in Euros. Because the investor will have to exchange those Euros for U.S. dollars when they receive the payment in the future, changes in the dollar/euro exchange rate will affect how many dollars the investor receives in the future.

There is a risk that the investor will get back less dollars than they anticipated, which would adversely affect the actual yield to maturity that they will realize.

For example, if one euro is worth $2, a bond payment of 100 Euros will be worth $200. If the euro strengthens relative to the dollar to be worth $2.50, that same payment will be worth $250. So investors that purchase bonds denominated in a foreign currency hope that the currency increases in value relative to their home currency. The risk to U.S. investors is that the currency weakens and the investor is paid back with fewer dollars.

Political Risk

(Also known as country or sovereign risk )

Political Risk is associated with the government or corporate debt of countries that have an unstable government. This is most often found with lesser-developed and emerging market countries. The risk to corporate bonds comes from the risk of the government seizing the assets of a bond issuer by privatizing certain companies or industries.

There is also the risk that an administration may default on government debt, especially if there is a coup or other change in leadership.

Some investors are attracted to the risk and potential high rewards from speculating in the debt of emerging economies because of the high rate of interest that such issues have to pay to attract capital. Some bond traders and investors specialize in speculating in the issues of especially troubled regimes, but this is not for the faint of heart!