Bond Portfolios Made Easy

Post on: 17 Апрель, 2015 No Comment

Why choose bonds?

- Capital stability — Priority over hybrid and equity holders in the event of liquidation. Generally know maturity dates.

- Cashflow — Regular income stream through coupon or interest payments

- Liquidity — A deep and active market for secondary trading

- Diversity — Diversification from the two cyclical asset classes — equities and property

Email us or call 1800 01 01 81

New to bonds?

Learn about bonds in our Fixed Income Basics section.

Buying and selling bonds

The vast majority of bonds available are not traded through an exchange, rather they are bought and sold over-the-counter. This means that in order to buy and sell bonds, investors must find a broker who matches buyers and sellers in the market — a service provided by FIIG.

Fixed income brokers in Australia are licensed and regulated by the Australian Securities and Investments Commission (ASIC).

Australias retail bond market, although healthy, is under-developed compared with international bond markets. Traditionally bonds were only accessible to institutional and corporate investors as minimum investment amounts were $500,000. Yet in other countries investors can buy bonds in $500 parcels and they are widely available much like investing in a term deposit.

FIIG provides investors with the opportunity to purchase Australian and international bonds in parcels starting from $10,000 (with a minimum portfolio balance of $50,000) through the DirectBonds service. This allows private investors to build their own portfolios, including SMSFs and individual accounts, according to their own risk and reward parameters.

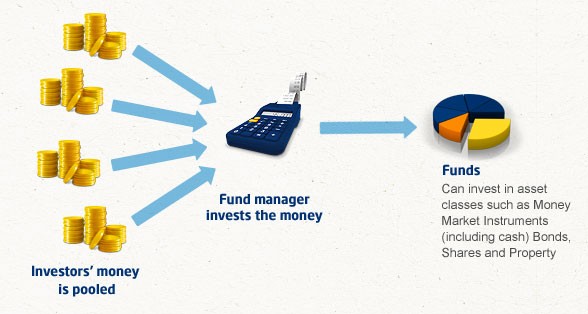

Direct ownership versus managed funds

Many investors seek to invest in bonds through managed funds. At FIIG we like to think that weve created a better way to invest in bonds one that puts you in control through direct ownership.

There are a number of advantages to investing directly in bonds over managed funds:

- You have a direct investment in specific bonds rather than units in a managed fund

- You can choose individual bonds to suit your specific requirements including:

- The quality of the issuer of the bonds

- The quality of the bonds (e.g. investment grade)

- The rate or level of return of the bonds

- The cash flows from interest reciepts to match your requirements

- No pooling of money or assets

- No risk that the investment will be frozen as you are the beneficial owner with the right to buy, sell or hold the bonds

- No entry, exit or management fees .