Bond Market Perspectives

Post on: 26 Июль, 2015 No Comment

KEY TAKEAWAYS

Market-implied inflation expectations have increased after reaching a multiyear low in mid-January 2015.

Thus far in 2015, the inflation protection provided by Treasury Inflation-Protected Securities (TIPS) has provided a buffer, with TIPS outperforming Treasuries.

While TIPS outperformance of conventional Treasuries may persist, lower-rated corporate bonds may provide more opportunity if higher inflation expectations persist.

TIPS & RISING INFLATION EXPECTATIONS

Thus far in 2015, the inflation protection provided by Treasury Inflation-Protected Securities (TIPS) has provided a buffer in an up and down bond market compared with conventional Treasuries. The stabilization in the price of oil after its precipitous decline in 2014 led to a rebound, not necessarily in actual inflation (as measured by the Consumer Price Index [CPI]), but in inflation expectations as implied by TIPS pricing. The year-to-date rise in inflation expectations has been a tailwind for TIPS investors, helping the sector to outperform Treasuries handily.

CURSE ONE DAY, BLESSING THE NEXT

The inflation protection provided by TIPS in 2014 proved to be a curse over the latter half of that year, as the declining price of oil brought down inflation expectations and TIPS underperformed Treasuries. Inflation expectations continued to fall with the price of oil until hitting a multiyear low in mid-January 2015. Since then, the stabilization of oil prices near $50/barrel, as well as signs of improvement in the global economy, has been a blessing for TIPS investors [Figure 1].

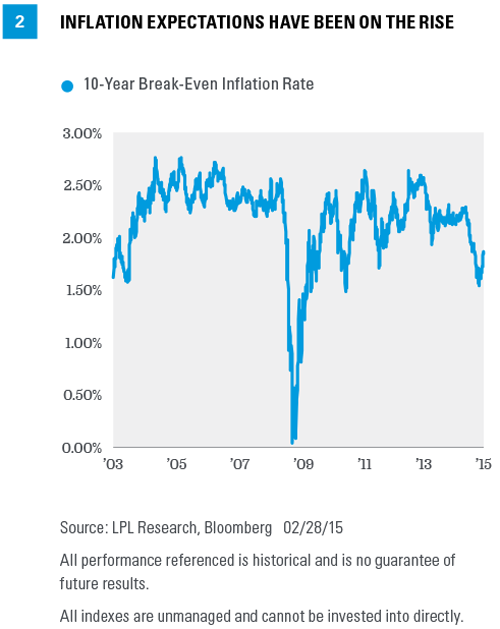

The break-even 10-year market-implied inflation rate, the difference between the conventional 10-year Treasury yield and the 10-year TIPS yield, rebounded from a multiyear low of 1.54% on January 15, 2015, a level not seen since August 2010, when global economic concerns, led by European recession fears, drove inflation expectations lower [Figure 2]. TIPS have outperformed conventional Treasuries by a notable 1.4% since inflation expectations bottomed on January 15, 2015, through the end of last week, March 6, 2015, as measured by Barclays Index data.

It is important to understand the difference between actual inflation, which is a lagging indicator, and forward-looking measures in financial markets, such as TIPS-implied inflation expectations. The decline in oil prices to well below the levels seen a year ago may help keep overall CPI inflation negative (on an annualized basis) over coming months, given the significant weight of energy prices in the CPI.

Forward-looking bond markets, on the other hand, are signaling that the bottom in inflation may already be in place and higher inflation expectations are a reflection of better economic prospects. Oil prices are only slightly above their January 2015 lows while inflation expectations have moved notably higher since the mid-January lows, suggesting rising confidence in the global economy, not oil prices, is behind the increase in inflation expectations.

The European Central Banks (ECB) large-scale bond purchase program, known as quantitative easing (QE), began Monday, March 9, 2015, and follows improving economic data out of Europe. Most notably, fears of a triple dip recession have faded as Eurozone fourth quarter 2014 gross domestic product (GDP) increased at a 0.9% annualized rate, up from 0.8% the prior quarter; in addition, recent economic data have more often surpassed forecasts, rather than fallen short, in recent weeks, according to the Citigroup Economic Surprise Index. Although not a robust economy, the stabilization in Europe—combined with still steady job growth in the United States—supports better global growth expectations.

In recent days, inflation expectations decreased due to the lack of wage growth in last weeks employment report and renewed U.S. dollar strength—both of which may keep inflation lower for longer. Still, we believe inflation expectations have bottomed.

WHATS NEXT FOR TIPS?

A look back at previous lows in inflation expectations suggests that improvement in TIPS relative to conventional Treasuries may be far from over. Figure 3 lists the four other periods over the past 10 years when inflation expectations bottomed after a sharp decline. The Great Recession-induced rally of late 2008 to 2009 is included, but while inflation expectations did hit an extreme level of almost 0% on November 20, 2008, much of this was due to nonfundamental factors, specifically forced selling and deleveraging, that exacerbated TIPS weakness; we do not expect such an aberration to be repeated.

Nonetheless, in each of the cases other than 2008, history shows that TIPS meaningfully and notably outperformed conventional Treasuries for months after inflation expectations bottomed, as measured by the Barclays U.S. Treasury Inflation-Protected Notes and Barclays Index data.

Historically Outperformed Treasuries.

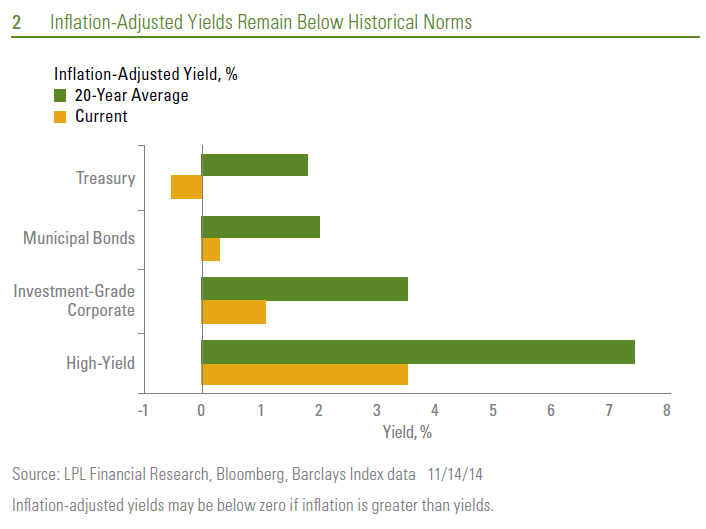

Although the outperformance of TIPS relative to Treasuries is noteworthy, the outperformance of high-yield bonds is more impressive. If inflation expectations do, in fact, signal better economic growth prospects ahead, lower-rated corporate bonds, such as high-yield bonds and bank loans, may be more attractive for bond investors. As we stated in our December 16, 2014, Bond Market Perspectives, Tempting TIPS, inflation protection offered by TIPS was priced cheaply on a historical basis, but lower-rated debt could provide more opportunity in a rising-rate environment in response to better economic growth and coming Federal Reserve (Fed) rate hikes. The bottom line is that rising inflation expectations augur well for defensive bond positioning against gradually rising rates in what may be a challenging 2015.

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Treasury Inflation-Protected Securities (TIPS) help eliminate inflation risk to your portfolio, as the principal is adjusted semiannually for inflation based on the Consumer Price Index (CPI)-while providing a real rate of return guaranteed by the U.S. government. However, a few things you need to be aware of is that the CPI might not accurately match the general inflation rate; so the principal balance on TIPS may not keep pace with the actual rate of inflation. The real interest yields on TIPS may rise, especially if there is a sharp spike in interest rates. If so, the rate of return on TIPS could lag behind other types of inflation-protected securities, like floating rate notes and T-bills. TIPS do not pay the inflation-adjusted balance until maturity, and the accrued principal on TIPS could decline, if there is deflation.

Investing in foreign fixed income securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with foreign market settlement. Investing in emerging markets may accentuate these risks.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

Bank loans are loans issued by below investment-grade companies for short-term funding purposes with higher yield than short-term debt and involve risk.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

The break-even inflation rate is the difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

INDEX DESCRIPTIONS

The Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (agency and non-agency).

The Barclays U.S. Treasury Index is an unmanaged index of public debt obligations of the U.S. Treasury with a remaining maturity of one year or more. The index does not include T-bills (due to the maturity constraint), zero coupon bonds (strips), or Treasury Inflation-Protected Securities (TIPS).

The Barclays U.S. Treasury TIPS Index is a rules-based, market value-weighted index that tracks inflation-protected securities issued by the U.S. Treasury.

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The Citigroup Economic Surprise Indexes are objective and quantitative measures of economic news. They are defined as weighted historical standard deviations of data surprises (actual releases versus Bloomberg survey median). A positive reading of the Economic Surprise Index suggests that economic releases have on balance beat consensus. The indexes are calculated daily in a rolling three-month window. The weights of economic indicators are derived from relative high-frequency spot FX impacts of one standard deviation data surprises.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by Any Government Agency | Not a Bank/Credit Union Deposit

Tracking #1-362129 (Exp. 03/16)

This newsletter was created using Newsletter OnDemand, powered by Weath Management Systems Inc.