Bond Ladders Good Idea

Post on: 14 Август, 2015 No Comment

I received the following from a reader:

My primary motivation for writing to you is this post by Jeff Miller:

In my mind, you are the foremost expert blogger when it comes to bonds so I wanted to get your take. It’s been a long time since my bond class getting my MBA and I haven’t dealt with bond math in quite awhile.

I’m wondering about this whole individual bond ladder versus bond fund issue. Maybe I am wrong so I wanted to ask you. Duration is duration. Whether one owns an individual bond ladder or a bond fund, if the duration is the same, the price sensitivity to an increase in interest rates is the same? If a person owns an individual bond ladder and rates move up, those bonds will be marked to market and show a capital loss even if they pay off at par at maturity, and you’ve locked in your cashflow. With a bond fund, you take a price hit to the fund, but those cashflows from the fund get reinvested in the fund at lower prices and higher yields?

I guess I am just wondering if someone is going to buy and hold and sit tight for say 5-7 years whether they construct a bond ladder or buy a bond fund if the duration is the same, they are going to end up pretty much in the same place 5 years later.

Anyways, I hope maybe you will do a post on the ins and outs of bond math vis a vis interest rate changes and the pros and cons of bond funds versus a bond ladder from the perspective of duration. Thanks.

From 1995-2001, I spent a lot of time doing interest rate modeling. With the growth in computer power and modeling techniques, we finally hit the barrier of the “Turing test” as far as interest rates went in 1995 with my modeling. As a part of our regular weekly meeting with the investment department, I brought examples of full yield curve interest rate modeling for a 30-year horizon. When I showed what the future yield curves looked like, the bond managers said to me, “This is the first time we have ever seen a random model produce interest rate scenarios that look reasonable.”

For a brief period, my model was the best that I knew of. By 2002 the actuarial profession as a whole came up with a better model, which they still use today for asset/liability management calculations. Once I used it, I accepted it as better than my model, and used it for other processes beyond regulatory compliance.

Regardless, I did tests using my model and the more advanced model to see what the best strategy was for individual investors in bonds. The only consistent result was that the ladder strategy was the second best strategy. Never best. Never worst. Reliable.

And I spent some time thinking about it. Structurally, ladders work well when you don’t know what is going to happen. If you are really, really smart, and you can consistently predict changes in yield curve steepness and levels, yes, you can do far better.

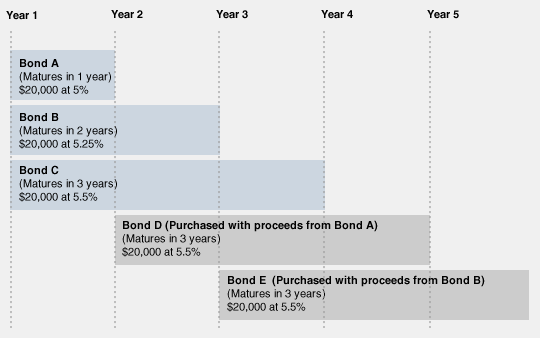

Ladders make sense from a cash flow standpoint because they are a sustainable strategy. Maturing proceeds are invested in the longest bonds that the ladder accepts. That keeps the interest rate risk even, and with a positively sloped yield curve, offers a relatively high yield.

I agree with the concept of ladders. But ladders are not incompatible with mutual funds. Over the years, I have run into mutual funds that embed a ladder concept into their interest rate management strategy, but it is far enough back in time that I can’t name any that do that now. In general, I think most bond mutual funds would be better off if they used some form of ladder to implement their interest rate strategy.

But to your question, yes, there is little difference, aside from fees, whether one owns a mutual fund with the same duration profile as a laddered portfolio. When you deal with short portfolios, the duration statistic is very descriptive of the interest rate risk.

If someone is looking to invest for many years, in the present environment, stocks may be the better choice, but if limited to bonds, choose a portfio that replicates the time horizon on average. Then as the horizon draws nearer, adjust to reflect the need for cash paid out.

That’s my best answer for now, though I am more than willing to answer other questions related to this.