Bond issue

Post on: 16 Март, 2015 No Comment

A bond issue as it applies to ballots is when a state government, or a local unit of government (city, county, school district), places a question before the voters as a ballot measure. asking them to approve or deny additional proposed spending. School districts and municipalities often make the most use of bond election authority, but state governments utilize bonds as well.

Bonds issued by state governments and municipalities are both generally referred to as municipal bonds. Laws and regulations stipulating how and when bond issues go to a vote vary from state to state, and from locality to locality within states.

State legislatures or local units of government may place such a question before the voters in their political jurisdiction because of laws that prevent the unit of government from raising taxes or spending beyond a certain level without the approval of voters, as well as laws that require voter approval for the creation of any new public debt.

Bond basics

In finance, a bond is a debt in which the authorized issuer owes the holders a debt and is obliged to repay the principal and interest at a later date, termed maturity. Other stipulations may also be attached to the bond issue, such as the obligation for the issuer to provide certain information to the bond holder, or limitations on the behavior of the issuer.

Bonds are generally issued for a fixed term longer than ten years, and are as such categorized as long-term debt. New debt between one year and ten years is categorized as a note, and new debt less than a year is categorized as a bill.

A bond is simply a loan, but in the form of a security. Bonds can be issued by corporations, non-profits, the federal government, as well as state and local governments. In the case of a bond issued by a unit of government, the unit of government receives a loan from a private lender that is secured by the unit of government’s assets, including its ongoing ability to generate income through taxation or the revenue from the financed project such as a bridge. The unit of government then owes principal and interest on that loan to the private lender.

Bonds and long-term debt

Bonds (long-term debt) play an important role in both private and public sector finance. State and local governments utilize bonds to finance numerous types of capital and infrastructure projects, such as roads, schools, prisons, and libraries. The use of bonds is increasingly popular with cash-constrained governments because it allows for the financing of projects without having to raise taxes immediately.

Issuance of bonds by state and local governments has ballooned over the years. As such, they are becoming increasingly scrutinized by voters across the nation as the subjects of taxes and debt become ever more important in the wake of continued economic trouble. Many state and local governments have laws and provisions that require taxpayer approval for the issuance of new bonds or bonding authority.

Combined, state and local governments had approximately $322 billion in outstanding long-term debt in 1980 and over $2.5 trillion in 2008 — a 777% growth. [1] [2]

The graph below plots the growth in state and local government long-term debt over the last 30 years.

Types of bonds

There are two generally used types of bonds — revenue bonds and general obligation bonds . Revenue bonds are bonds whose payback provisions are tied to a specific revenue stream, such as tolls, fees, etc. General obligation bonds are backed by the full faith, credit, and taxing power of the issuing body (state government, city, etc.) and are considered public debt. Given that general obligation bonds have a wider backing (full taxing power), they generally carry lower interest rates than revenue bonds as they are considered a lower risk. That said, both forms of bonds are considered safe investments.

General obligation bonds

Since general obligation bonds constitute public debt, it is very common for states and municipalities to require their issuance be approved by voters at the ballot box.

An example of a general obligation bond that was approved by voters is Rhode Island Question 3, Transportation Bonds (2004). That bond issue allowed the state of Rhode Island to issue general obligation bonds in order to match federal transportation funds.

An example of a general obligation bond that was defeated by voters is California Proposition 81, Bonds for Libraries (June 2006). which would have authorized the state of California to sell $600 million of general obligation bonds to improve local library facilities.

Revenue bonds

Revenue bonds are not backed by the taxing power of the issuing authority and are instead paid back through earnings from the specific project for which they were issued. As such, revenue bonds are not considered public debt. This means that, in general, revenue bonds do not have to go before voters as ballot propositions.

But revenue bonds are not without controversy or scrutiny. In recent years, taxpayer advocates have been calling for voter accountability in regards to revenue bonds as they are perceived as forms of unaccountable forms of government spending with too little checks on their growth and issuance.

Government or quasi-government entities that issue revenue bonds — such as a transportation authorities, water boards, and education commissions — generally have legislative authority to do so and the decisions are made internally.

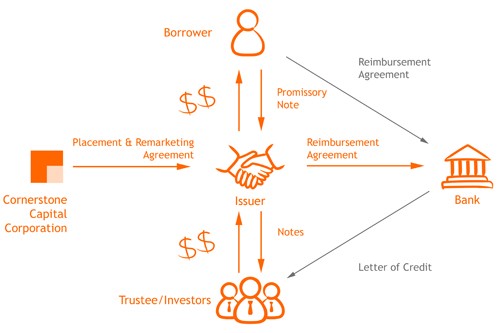

Here is an example of a revenue bond that was proposed by the Illinois Student Assistance Commission in 2005. In this example, the bonds are being issued to fund student loans. Interest revenue from the student loans is the only source available for payback of the bonds.

If for some reason the student loans do not generate sufficient revenues for repayment, the bonds will go unpaid — as the issuing entity cannot tax or raise other revenue to pay them back.

Bond issues on statewide ballots

Below are statistics and analysis of bond issues that have appeared on statewide ballots since 2000. Even-numbered years historically have more statewide measures, bond issue or not, on the ballot than odd-numbered years.