Bond Investing for Retirement An Overview of Bond Investing for Retirement

Post on: 20 Май, 2015 No Comment

Though They’re Not High-Fliers, Bonds Can Produce a Stable Stream of Money for Retirement Investing

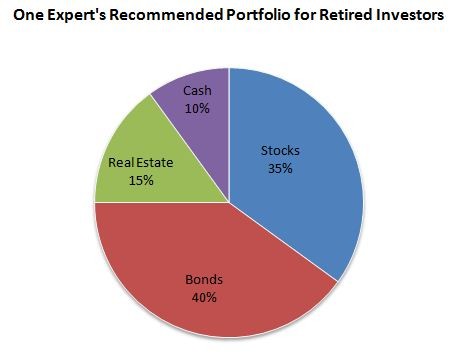

(LifeWire) — Bond investing should be part of nearly every retirement portfolio.

To understand why, it’s important to understand what a bond is and why it might perform differently from a stock.

What is Bond Investing?

A bond is simply a loan from an investor to the company or government agency that issues it.

Most bonds are issued with fixed interest rates. That means that bond-holders are paid a set percentage of the bond’s principal amount — 6% a year on $10,000, or $600 a year, for example — until the bond matures. When it matures, bond-holders’ original investments are returned.

Because bond-holders are lenders and not partial-owners as they would be if they bought stock in the company, the payment rate remains unchanged. If the company grows at a spectacular rate, it doesn’t matter — the bond payment remains the same. And if the company’s performance lags, it doesn’t matter — as long as the company remains solvent, it must make its regular interest payments to the bond-holders. No more and no less.

Bond Investing and Its Role in a Portfolio

Because of their stable income stream, bonds tend to be a stabilizing influence on a long-term investor’s portfolio.

In times of rapid stock market advances, bond values will tend to lag. But in times of stock price retreats, bonds will tend to hold their value far more reliably.

The relative stability of bonds is a big plus for investors who tend to fall into conservative or moderate risk-tolerance categories. But investors should be aware that rising interest rates can devastate bonds’ current resale values, resulting in value numbers that might not look great on a quarterly brokerage statement.

Types of Bonds

Bonds come in numerous types, including:

- Corporate bonds: Issued by private companies. Interest rates vary, based on the company’s credit ratings.

- Municipal bonds. Issued by local and state governments. They generally pay tax-free interest to those who live in their jurisdictions.

- Treasury bonds: Issued by the US government. They are guaranteed not to fail, because the federal government can always create money to redeem them.

- Agency bonds. Issued by government-sponsored agencies like Fannie Mae and Freddie Mac. Not overtly guaranteed, but government backing is implied.

- Zero-coupon bonds: No annual interest is paid, but the final value of the bond is higher than its purchase price.

- Junk bonds: Debt issued by low-rated companies that must pay high interest rates to attract investors.

LifeWire, a part of The New York Times Company, provides original and syndicated online lifestyle content. David Fisher is a freelance writer based in Bend, Ore. In addition to 25 years as a writer and editor, he has worked as a professional financial adviser.