Bond Fund Types Types and Categories of Mutual Funds

Post on: 4 Июль, 2015 No Comment

Understanding Bond Fund Types and How They Are Categorized and Identified

You can opt-out at any time.

Please refer to our privacy policy for contact information.

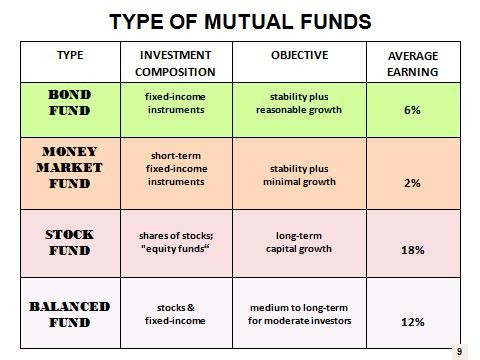

What are the types of bond funds? How are bond mutual funds categorized? Bond mutual fund investing can appear complex but understanding the basics of bond categorization will help determine which bond fund type is best for you.

Bond funds, also called fixed income funds. are essentially baskets made up of dozens or hundreds of individual bonds. The bond fund type will give you an idea of what types of bonds are held in the fund (the basket). For more basics, you may also want to look at how bond funds work.

How Bond Funds Are Categorized

If you are analyzing a bond mutual fund, named XYZ Intermediate-term Corporate High Yield Bond, you won’t have much of an idea about how the fund works or what level of performance to expect from it if you don’t know how bond funds are categorized, classified or identified (how they get their names).

Here are the basic ways bond funds are categorized/classified/identified:

Average Maturity/Duration: Another way to describe this categorization is amount of time. The maturity and duration of a bond may be loosely and simply translated to mean the amount of years of the bond’s term. For example, XYZ corporation may issue bonds (loans to be paid back to the buyer in fixed increments) to raise capital (money) for the operations of that issuing corporation. The period to pay back the loan (the term) to the bond buyer typically ranges from 90 days all the way up to 30 years. The fixed payments end at maturity (the end of the term or time period).

In the case of bond mutual funds, the bond fund manager buys the individual bonds and the bond fund investor simply buys shares of the bond fund. Most bond funds only buy bonds with maturities within a certain range of time, expressed as the term :

- Short-term Bond funds primarily invest in bonds that have maturities of less than 4 years. A sub category of short-term bond funds is Ultra Short-term Bond funds, which will typically invest in bonds with maturities of less than one year. Conservative investors tend to like short-term bond funds because they have lower interest rate sensitivity. However, short-term bond funds have lower relative average returns over time than intermediate and long-term bond funds.

- Intermediate-term Bond funds primarily invest in bonds that have maturities averaging between 4 and 10 years. These bond funds offer a combination of reasonable returns for reasonable interest rate risk. which is why many investors like this basic category of bonds: Economic conditions are difficult to predict. Therefore an investor may ride the fence of risk by investing in intermediate-term bond funds. If, for example, interest rates go up, bond prices will go down. The longer the maturity or duration, the more bond prices will fluctuate (in opposite direction of interest rates). Short-term bond funds will perform better in rising interest rate environments but long-term bond funds will perform better in falling interest rate environments. Intermediate-term bond funds find an acceptable middle ground.

- Long-term Bond funds primarily invest in bonds that have maturities longer than 10 years. Therefore these bond funds have greater interest rate risk. When interest rates are expected to fall, long-term bonds are an investor’s best bet for higher relative returns compared to short and intermediate-term bond funds. The opposite is true in rising interest rate environments (long-term bond prices will fall faster compared to shorter maturities and will likely cause negative returns for a long-term bond fund investor).

Entity Type: This is a broad categorization that can be subdivided into other general categories or classifications by the type of entity — Corporate, Government and World:

- Corporate Bond funds primarily invest in bonds issued by corporations.

- Government Bond funds primarily invest in bonds issued by a government or municipality. This general category or classification most often refers to US Treasury Bond funds, which invest in bonds issued by the US government. Municipal Bond funds are government bond funds that primarily invest in bonds issued by state, city or county governments. Municipal bonds can also be issued by publicly-owned entities, such as utilities or schools. Another sub-category of government bonds is Treasury Inflation-Protected Securities (TIPS). Many investors choose government bonds for potential tax benefits or as a hedge on inflation.

- World Bond (also known as Foreign Bond or International Bond) funds primarily invest in bonds issued outside of the United States. Bond funds in this general classification can concentrate on the larger more developed countries, such as Germany, France and United Kingdom (Great Britain), or they may invest more in emerging markets, such as Brazil, Mexico and Indonesia.

Credit Quality: This broad categorization reflects the underlying issuer’s ability to repay the bond investors. You can think of credit quality as a company’s or country’s credit score. The score is expressed as a rating, which is generated by a ratings agency, such as Standard & Poor’s, on a scale of ‘AAA’ for the highest credit quality down to ‘D’ for default. Low credit-quality bonds are usually identified as High Yield or Junk bonds because of the greater risk of default (and therefore higher yields to compensate bond investors for the associated risk involved).

How to Identify Bond Funds

Now that you know how bond funds are categorized or classified, you can identify bond funds (and how they invest) by looking at the name and or objective of the bond fund. For example, at the beginning of this article, I mentioned a fictitious bond fund, called XYZ Intermediate-term Corporate High Yield Bond. Judging by the name, this bond fund likely invests primarily in bonds that have maturities between 4 and 10 years (intermediate-term) and the bonds are issued by various corporations (corporate) with low credit quality and therefore pay higher relative interest rates to investors (high yield) to compensate for higher relative risk of default.

Not all bond funds have such descriptive names, which is why you should do your own research by reading the fund’s prospectus using tools from an independent mutual fund research organization, such as Morningstar .

Disclaimer: The information on this site is provided for discussion purposes only, and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.