Bond ETFs v Mutual Funds Returns and Costs

Post on: 15 Август, 2015 No Comment

Getty Images / spxChrome

Those who wish to allocate some of their savings to bonds have a choice between mutual funds or exchange-traded funds (ETFs). While the two options are alike in that they provide investors with diverse exposure to various sectors of the bond market, there are a few key differences to understand:

Method of Purchase

There is a slight difference in the way investors can purchase mutual funds compared with ETFs. Mutual funds are typically purchased directly through the issuing company or through a financial advisor, but they are also available through brokerage accounts. While many fees have no loads, or up-front purchase charges, an investor who does pay this sales charge will be hard-pressed to keep up with the performance of ETFs once the deduction of this fee is factored into their returns. ETFs don’t have loads, which is a plus, but they do have transaction charges since they are bought and sold just like stocks. This also requires the investor to set up a brokerage account, which they wouldn’t necessarily have to do in order to buy a mutual fund.

Investors should factor all of these expenses (loads and brokerage fees) into their thinking when assessing the costs and benefits of mutual funds versus ETFs.

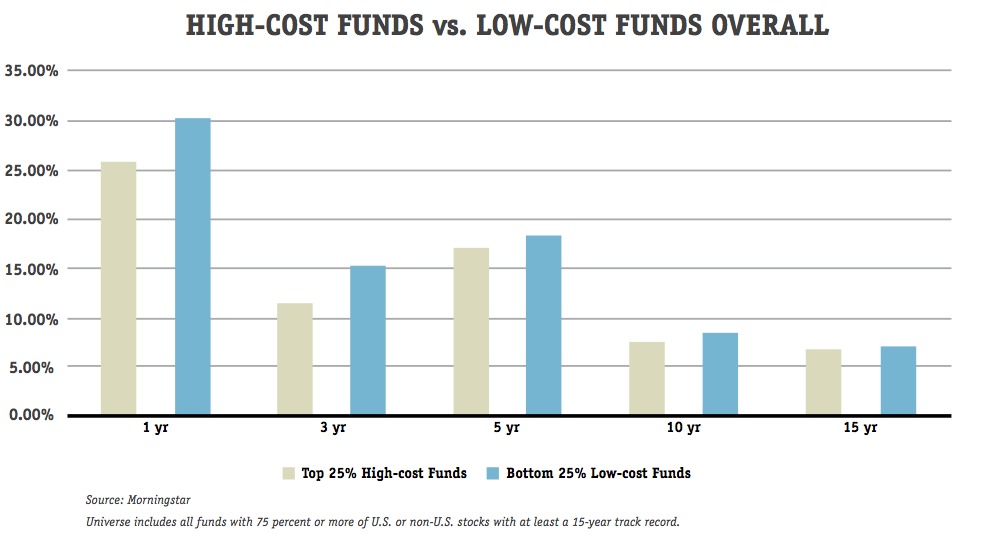

Costs are a key differentiator between mutual funds and ETFs. The average bond mutual fund has an annual expense ratio of 0.61%, but the average bond ETF has an expense ratio of 0.40%. A difference of 21 basis points (0.21 percentage points) may not sound like much, but over time it can have a meaningful impact on returns due to the compounding effect this added cost has on perfromance year after year. Higher fees are of particular concern with bond funds, where expected annual returns are modest and 0.21 percentage points can represent a sizeable bite out of an investor’s gain. This is even more of a consideration now given the ultra-low yields on higher-quality securities.

The table below shows the comparative returns of bond funds and bond ETFs within specific categories over the three- and five-year periods ended June 30, 2014.

Keep in mind that in some cases the returns are skewed by the small sample size in a given category during the five-year period. For instance, five years ago there were relatively few ultrashort term bond ETFs, which helps explain the large discrepency in performance in that category.

Mutual fund data is sourced from Morningstar’s category returns page, ETF returns are from the ETF center at Yahoo! Finance.