Bond ETF Idea Commercial Mortgage Backed Securities (NYSEArca CMBS NYSEArca AGG)

Post on: 20 Июль, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

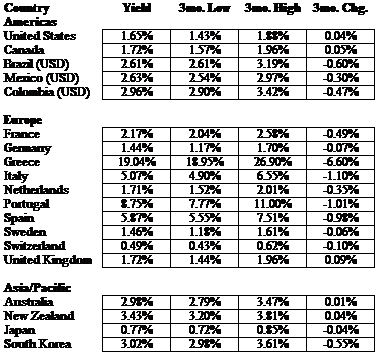

CMBS also have a compelling income component – compared to sectors that have a similar duration (a measure of bond risk), investment grade CMBS are currently offering a higher yield. Note that in the chart below, CMBS is represented by the Barclays Capital US CMBS Index, which only includes investment grade bonds – there are no subprime bonds in the index.

Fixed Income Sector Comparison

With the recent launch of the iShares Barclays CMBS Bond Fund (NYSEArca:CMBS), the first ETF dedicated solely to CMBS, investors now have the ability to gain diversified access to this sector in a single trade. We expect to see clients using this fund in a few different ways. One idea: if the investor prefers an overweight to CMBS, they can use it to complement a diversified bond index fund such as the iShares Barclays Aggregate Bond Fund (NYSEArca:AGG). Or they may use it in conjunction with other bond index funds to build a customized fixed income portfolio.

Source: Bloomberg

Chart Source: Barclays Capital and iBoxx as of 2/21/2012. Past performance does not guarantee future results. Fixed income sectors are represented by the following indexes – Barclays Capital U.S. CMBS (ERISA Eligible) Index, Barclays Capital U.S. Agency Index, Barclays Capital 3-7 Year US Treasury Index, Barclays Capital U.S. MBS Index, Barclays Capital Intermediate U.S. Credit Index, iBoxx $ Liquid High Yield Corporate Bond Index, Barclays Capital U.S. Aggregate Index

Bonds and bond funds generally decrease in value as interest rates rise. In addition to the normal risks associated with investing, narrowly focused investments typically exhibit higher volatility. Commercial mortgage-backed securities (“CMBS”) represent interests in “pools” of commercial mortgages and are subject to credit, prepayment and extension risk, and therefore react differently to changes in interest rates than other bonds. Small movements in interest rates may quickly and significantly reduce the value of CMBS. Diversification may not protect against market risk.

Index returns are for illustrative purposes only and do not represent actual iShares Fund performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. For actual iShares Fund performance, please visit www.iShares.com or request a prospectus by calling 1-800-iShares (1-800-474-2737).

Matthew Tucker has spent the past 16 years focused on fixed income analytics, portfolio management and strategy. As managing director of U.S. fixed income strategy at BlackRock, Inc. and a member of the Fixed Income Portfolio Management team, Mr. Tucker leads both product strategy for ETFs and North America and Latin America iShares strategies, as well as product delivery and client sales. He previously worked with Barclays Global Investors before it merged with BlackRock, and he led the U.S. Fixed Income Investment Solutions team responsible for overseeing product strategy for active, index, enhanced index, iShares and long/short products. Mr. Tucker was also a portfolio manager and a trader in fixed income focused on U.S. government securities.

He began his career at Barra, where he supported clients using the company’s fixed income analytics. Mr. Tucker holds a bachelor of business administration degree from the University of California, Berkeley, and is a Chartered Financial Analyst charterholder.