Bond Duration Calculation Bond Duration Calculation Example

Post on: 16 Март, 2015 No Comment

Bond Duration Calculation

Jo Said:

In financial terms, how do you define and calculate Duration ?

We Answered:

Duration: change of 100 basis points. Calculation is based on the weighted average of the present values for all cash flows.

Duration is measured in years; however, do not confuse it with a bond's maturity. For all bonds, duration is shorter than maturity except zero coupon bonds. whose duration is equal to maturity.

For more on duration:

Types of Duration

There are four main types of duration calculations, each of which differ in the way they account for factors such as interest rate changes and the bond's embedded options or redemption features. The four types of durations are Macaulay duration, modified duration, effective duration, and key-rate duration.

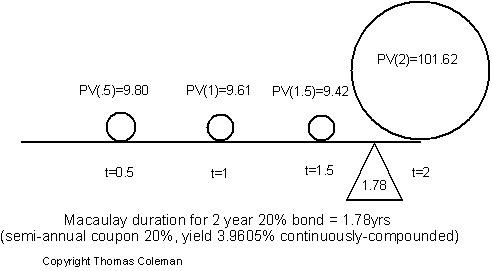

Macaulay Duration

The formula usually used to calculate a bond's basic duration is the Macaulay duration, which was created by Frederick Macaulay in 1938 but not commonly used until the 1970s.

Macaulay duration is calculated by adding the results of multiplying the present value of each cash flow by the time it is received, and dividing by the total price of the security. The formula for Macaulay duration is as follows:

(This link has the formula)

Olga Said:

What is bond convexity?how is it calculated?

We Answered:

convexity is a measure of the sensitivity of the duration of a bond to changes in interest rates.

Calculation of convexity

Duration is a linear measure or 1st derivative of how the price of a bond changes in response to interest rate changes. As interest rates change, the price is not likely to change linearly, but instead it would change over some curved function of interest rates. The more curved the price function of the bond is, the more inaccurate duration is as a measure of the interest rate sensitivity.

Convexity is a measure of the curvature or 2nd derivative of how the price of a bond varies with interest rate, i.e. how the duration of a bond changes as the interest rate changes. Specifically, one assumes that the interest rate is constant across the life of the bond and that changes in interest rates occur evenly. Using these assumptions, duration can be formulated as the first derivative of the price function of the bond with respect to the interest rate in question. Then the convexity would be the second derivative of the price function with respect to the interest rate.

In actual markets the assumption of constant interest rates and even changes is not correct, and more complex models are needed to actually price bonds. However, these simplifying assumptions allow one to quickly and easily calculate factors which describe the sensitivity of the bond prices to interest rate changes.

Why bond convexities differ

The price sensitivity to parallel IR shifts is highest with a zero-coupon bond, and lowest with in amortizing bond (where the payments are front-loaded). Although the amortizing bond and the zero-coupon bond have different sensitivities at the same maturity, if their final maturities differ so that they have identical bond durations they will have identical sensitivities. That is, their prices will be affected equally by small, first-order, (and parallel) yield curve shifts. They will, however start to change by different amounts with each further incremental parallel rate shift due to their differing payment dates and amounts. For two bonds with same par value, same coupon and same maturity convexity may differ depending on at what point on the price yield curve they are located. Suppose both of them have at present the same price yield combination; also you have to take into consideration the profile, rating etc of the issuers; suppose they are issued by different entities. See diagrams next. Though both the bonds have same p-y combination bond I may be located on relatively more elastic segment of the p-y curve compared to bond II. This means if yield increases further, price of bond II may fall drastically while price of bond II won’t change, i.e. bond II holder are expecting a price rise any moment and so reluctant to sell it off, while bond I holders are expecting further price-fall and ready to dispose it.

This means bond II has better rating than bond I.

So the higher the rating or credibility of the issuer the less the convexity and the less the gain from risk-return game or strategies; after all less convexity means less price-volatility or risk, less risk means less return.

More convex a portfolio higher the risk content.

Algebraic definition

If the flat floating interest rate is r and the bond price is B, then the convexity C is defined as

Another way of expressing C is in terms of the duration D:

frac

Therefore

CB = frac

leaving

C = D^2 — frac

How bond duration changes with a changing interest rate

Return to the standard definition of duration:

where P(i) is the present value of coupon i, and t(i) is the future payment date.

As the interest rate increases the present value of longer-dated payments declines in relation to earlier coupons (by the discount factor between the early and late payments). However, bond price also declines when interest rate increase but changes in the present value of all coupons (the numerator) is larger than changes in the bond price (the denominator). Therefore, increases in r must decrease the duration (or, in the case of zero-coupon bonds, leave it constant).

frac

Given the convexity definition above, conventional bond convexities must always be positive.

The positivity of convexity can also be proven analytically for basic interest rate securities. For example, under the assumption of a flat yield curve one can write the value of a coupon-bearing bond as scriptstyle B (r) = sum_^

frac = sum_^

Note that this conversely implies the negativity of the derivative of duration by differentiating scriptstyle dB / dr = — D B .

Application of convexity

1. Convexity is a risk management figure, used similarly to the way 'gamma' is used in derivatives risks management; it is a number used to manage the market risk a bond portfolio is exposed to. If the combined convexity of a trading book is high, so is the risk. However, if the combined convexity and duration are low, the book is hedged, and little money will be lost even if fairly substantial interest movements occur. (Parallel in the yield curve.)

2. The second-order approximation of bond price movements due to rate changes uses the convexity:

Delta(B) = Bleft[frac

Gladys Said:

Its related to Beta. can bonds have beta.

We Answered:

bkoo869:

You need to retake your MBA course in investments. 1. The beta is nothing more than the cov(asset,market)/v(market). There is no restriction on asset. In fact, the CAPM is the global mean-variance efficient potfolio, which includes optimal weights of EVERY asset. Bill Sharpe never restriced the math to include only equities. Consequently, ANY AND ALL assets have a beta. 2. Duration is not a measure of time. 3. Duration is an EXACT measure of volatility locally, but you are right about beta being an estimate.

==========================

To answer the question: any asset has a beta. It is the coefficient from regression the asset returns on the returns of the market portfolio. However, since the market portfolio only exists in CAPM theory, practitioners often use a diversified stock index as a proxy.

The only precaution that is needed is in the interpretation. The mechanics of the calculation are, well, mechanical.

The reason that you never see factor models used to price bonds is that DCF works INFINITELY better.

Lester Said:

how is duration affected by a fall in interest rates?

We Answered:

Duration is not affected by interest rates. It is a measure of a bond's sensitivity to a change in interest rates. For example, a 5-year zero coupon bond will have a duration of 5. It will remain at 5 regardless if rates rise or fall, gradually falling to zero as time passes toward maturity.

Now if you are talking about Macaulay Duration or Modified Duration, those are affected by falling interest rates as the price of a bond (which is affected by interest rates) is used in their calculation.

Jack Said:

Finance Calculations — Investments?