Bond Convexity What it is and How it Works

Post on: 16 Март, 2015 No Comment

Bond convexity is a measure of how the duration of a bond changes when interest rates change. The concept of duration and convexity are very related. However, the relationship is best explained with examples.

Bond Duration

When we say a bond or bond fund has a duration of 5, it means that a 1% move in interest rates will result in a 5% move in value of the bond or bond fund. For example, if interest rates rose 1% then the bond would lose 5% in value. Conversely, if interest rates declined 1% then the bond would gain 5% in value.

Bond Convexity

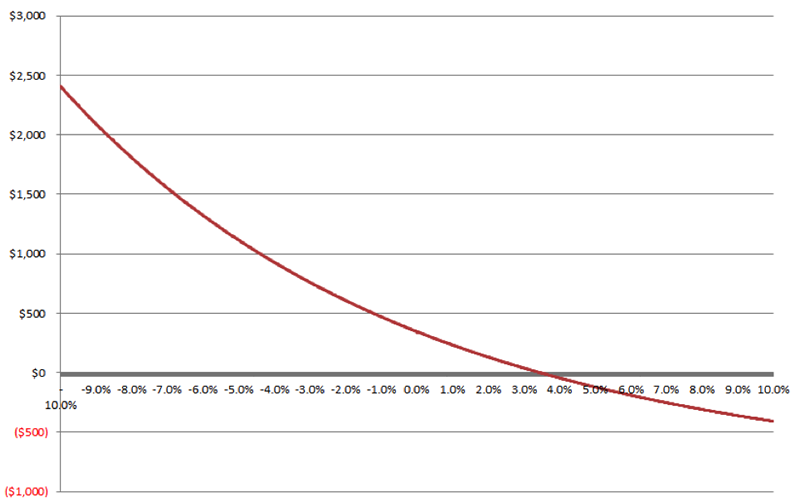

Duration works very well when interest rates move by small amounts. However it does not work as well when measuring the impact of large interest rate moves. As the value of a bond changes, so does the sensitivity of its price to changes in interest rates. When a bond becomes less valuable, the impact of changes in interest rates on its price becomes smaller. When a bond becomes more valuable, the impact of changes in interest rates on its price becomes larger.

Imagine two bonds, one with a value of $90 and one with a value of $110. They both pay a yield of 5%. The first bond pays $4.50 in interest per year. The second bond pays $5.50 in interest per year. If interest rate rise by 1%, the change in interest payment for the first bond would be 90 cents per year. For the second bond it would be $1.10. Even though interest rates changed by the same amount, there was a bigger difference in the amount of interest paid on the more valuable bond. In this example, we changed the amount of interest that the bonds pay. However, its not the amount of interest that the bond pays that changes (because there is fixed interest payment in terms of dollars) but, the value of the bond. The value of $90 bond has to change less than the $110 bond to generate 1% more interest.

The key idea behind bond convexity is that while the interest rate is changing, so is the underlying value of the bond. If an interest rate move is small, or the duration of a bond is low, a bond’s convexity will not matter very much. However, the bigger the interest rate moves and longer the duration of bond, the more important bond convexity becomes.

As interest rates rise and bond values fall, convexity reduces the impact of duration.

As interest rates fall and bond values rise, convexity increases the impact of duration.

Why bond convexity is important

With all investment decisions calculating risk and reward is essential to making sound investment decisions. Using duration to estimate potential returns or losses can be very misleading. Lets use the the popular long-term government bond ETF TLT as an example. It has a duration of around 17 years. In this example if you used duration to calculate your loss if interest rates rise by two percent, the loss calculated would be 34%. However, because of bond convexity, the real loss would be under 30%. Conversely, if yields fell 2% for long term bonds, the gain in the TLTs value would be around 40%.

For the definition and meaning of more bond related terms visit the Learn Bonds Glossary where we give the explanation of many more terms.