BMO Capital Markets Cross Currency Swaps

Post on: 16 Март, 2015 No Comment

An effective solution to long-term currency hedging needs

Cross-currency swaps offer companies opportunities to reduce borrowing costs in both domestic and foreign markets. They are also a simple and effective solution to long-term currency hedging needs. Investors use cross-currency swaps to manage the currency risk in foreign investment portfolios and to create synthetic assets with a specific currency risk profile.

How Does it Work?

A currency swap involves the exchange of payments denominated in one currency for payments denominated in another. Payments are based on a notional principal amount the value of which is fixed in exchange rate terms at the swap’s inception.

Periodic swap payments are made in the appropriate currencies based on specified reference interest rates. When the swap matures, a final payment representing the change in the value of the swap notional principal is made between parties to the swap. Alternatively, the principal values can be re-exchanged at maturity at the original exchange rate.

Because currency swaps involve exchange risk on principal, the credit risk associated with these transactions is substantially greater than with interest rate swaps.

Applying Currency Swaps

Corporations and financial institutions use currency swaps to manage the exchange and interest rate risks associated with foreign currency financing and investing. Currency swaps are also valuable as long term hedges of translation risk and in many instances represent an attractive alternative to long-dated forward foreign exchange cover.

Currency swaps can be used in a variety of situations. By using them companies can:

Tap Foreign Capital Markets for Low Cost Financing.

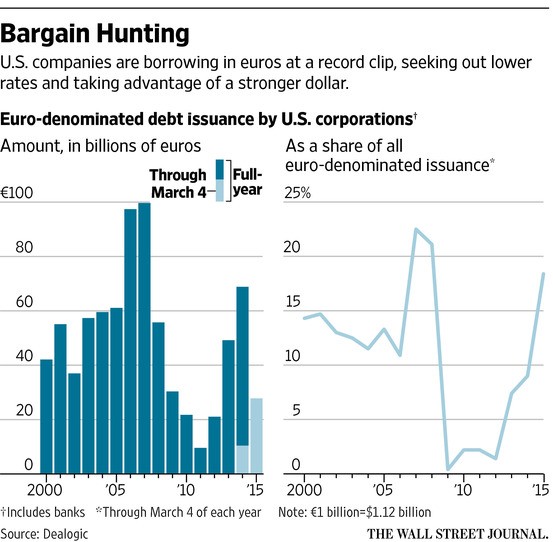

The ability to swap interest payments related to financing denominated in foreign currency allows domestic debt issuers to tap new markets, expand the investor base, and lower borrowing costs.

Foreign debt issues by top-rated companies are well-received by foreign investors seeking to diversify credit risks and can be quite cost-effective compared to domestic issues. Through cross-currency swaps the debt is converted to the issuer’s domestic currency, eliminating currency risk while preserving the cost advantages achieved by issuing off-shore.

Lower Financing Costs for Foreign Subsidiaries.

Companies operating foreign subsidiaries typically prefer to finance operations in local currency to eliminate currency risk. While borrowing locally may sometimes be cost effective, the parent can often borrow more cheaply in its home market and base currency.

Currency swaps provide the bridge to exchange-protected least cost financing for off-shore operations.

Enhance Buyer Financing Programs.

Buyer financing is extended in the customer’s currency of choice then swapped to the seller’s local currency to eliminate exchange risk. In countries where export incentive programs are available, currency swaps allow borrowers to access incentive pricing without accepting unwanted currency and rate risk.

Cross currency swaps are an essential tool in managing cross-border business and investment activities. Their simplicity and flexibility in many different applications have made cross-currency swaps among the most frequently used derivative instruments in the corporate arena.