Bitcoin Liquidity What The Stakes Are_1

Post on: 16 Апрель, 2015 No Comment

Can You Really Beat the Market?

Jeff Brown Don’t assume everything you read in financial journals is true, says Duke University finance professor Campbell Harvey.

Turns out the smart money isn’t always so.

We put the question to Duke University finance professor Campbell Harvey, 56, former editor of the Journal of Finance and president-elect of the American Finance Association. Harvey is known for taking unorthodox positions when it comes to academic research, portfolio rebalancing, and Bitcoin.

MONEY writer Taylor Tepper interviewed Campbell for the March 2015 issue of the magazine, where this edited interview originally appeared.

Q: Can you really beat the market?

A: Theres all this academic research out there that attempts to explain why stocks do well or poorly by focusing on investment factors, such as momentum or low price/earnings ratios. In all, 316 different factors were identified in the papers I studied, including things like the amount of media attention a company gets or how much it spends on advertising. My research found that of all the published papers in finance, over half are likely false. The problem is the researchers were applying the tools of statistics as if there was only one test going on when there are multiple variables. Some factors are going to look statistically significant just by chance.

Q: Can you help us understand?

A: Theres a cartoon that explains this well. Lets say somebody has a hypothesis that jelly beans cause acne. So researchers conduct a controlled experiment where some people get jelly beans and some dont. It turns out that theres no significant difference. Then somebody says, Well, maybe were looking at this incorrectly. We should look at this by the color of the jelly bean. So then 20 new experiments are undertaken. Again, some people get jelly beans and others dont. But the jelly beans are just red. A separate experiment uses just yellow beans. Then all purple. Each time theres no effect. On the 20th try, which happens to test green jelly beans, they find theres a difference that is statistically significant by the usual rules. And then in the newspaper the next day, theres this headline: GREEN JELLY BEANS CAUSE ACNE.

Q: What should the standard be?

A: Usually youre looking for 95% confidence, which means theres a 5% chance the result was a fluke. But thats true only if youre conducting a single test. As soon as you go to multiple tests, its like the jelly bean problem. You do 20 experiments and youre likely to get a hit by chance.

Q: To be fair, youve made this mistake yourself.

A: Some of the papers we analyzed are my own. This actually gives me a bit of a pass when Im talking to my colleagues and saying, Half of what you guys published is false. And they kind of push back: How could you say that? And I say, Well, it also holds for me, okay?

Q: What does this mean for the average investor?

A: For individual investors the best thing to do is to just go with an index fund. Dont believe these claims of using this or that factor to beat the market. Invest in the broad market, and go with the lowest possible fee.

Q: But so-called smart beta index funds claim to capitalize on these factors.

A: Imagine there are 316 of these smart beta index funds, each chasing one of the factors that I detail. It is likely that more than 50% of them are destined to disappoint.

Suppose theres an ETF investing only in stocks beginning with the letter H. The managers claim historical outperformance for H stocks based on simulations going back to 1926. They claim their results are significant. Theyre likely using the wrong statistical method to declare their strategy true. They might have tried 26 letters and H worked by chance.

Dont believe these claims of using this or that factor to beat the market. Invest in the broad market, and go with the lowest possible fee. The insight is the same for 316 factors. If you try enough strategies, some will work by luck. In many cases its not about being smart.

Q: Speaking of smart, rebalancing has been recommended as a prudent approach. Youve done research on this topic, right?

A: Rebalancing is like mom-and-apple-pie sort of finance, in that we just assume its a good idea. We dont think through what it involves. In my research I detail the risk that is induced by a rebalancing strategy.

Q: Dont you rebalance to reduce risk?

A: Lets say youve got a portfolio of 60% stocks and 40% bonds. Now, imagine stocks drop and youre in a prolonged bear market. If youre rebalancing, you have to buy equities to get that proportion back up to 60%. So as stocks are falling, youre buying more and more. Your portfolio is going to have a bigger drawdown than another portfolio where you didnt rebalance.

It works in bull markets too. If equities are going up and up and youre rebalancing, youre dumping stocks. The market goes up. You dump more. All of a sudden your portfolio has done worse than if you had just let it run.

Q: So how should investors think about rebalancing then?

A: It is not smart to rebalance the last day of the year or the last day of the quarter by rote. It means youre ignoring all of the information in the market. Theres lots of information out there, so use that

information. Use your judgment.

Q: If you dont have time to figure this out, isnt rote rebalancing worth the risk to keep from being overly exposed to stocks before a bear market?

A: If you have a very long time horizon, you may be able to bear the extra risk by rote rebalancing. You will still have bigger drawdowns in the value of your retirement portfolio, but you dont need the money in the short term and you can ride out the risk. My point is all investors need to understand that rote rebalancing is an active investment decision that increases risk.

Q: Youve also done research on Bitcoin. The smart money is pretty sure its a worthless currency. What dont people get?

A: Almost everything. For instance, part of the misunderstanding is the focus on the price of the Bitcoin. You see that it was at $1,000, then its down to $200. People say, Well, the bubble has burst, and stuff like that.

They are looking at just one aspect of Bitcoin. These critics dont start by asking themselves, What problem does Bitcoin solve?

Q: What problem does it solve?

A: I am tired of constantly getting phone calls from my credit card companies, having to go online to fix the 20 things Ive got auto-debits for, and dealing with charges that are not mine on my card. These are problems that many people encounter.

Q: Bitcoin is safer?

A: Bitcoin is much safer. When you go to buy something, the retailer actually is able to check a common ledger of all transactions to make sure you actually have the money to spend. The public ledger, which is almost impossible to hack, solves the problem of double spendingusing the same Bitcoin to buy two things. Merchants, such as restaurants, which are paying 3% to the credit card companies, love this.

For me, though, I look at Bitcoin not just as a currency, but what it could do in the future in other applications. Think of the Bitcoin technology as a way to exchange and verify ownership. Its like getting into your car with your smartphone. You present cryptographic proof of ownership. Youre the owner, and its verified through this common ledger. The car is able to identify that it is your car, and so the car starts. Youre done.

Now suppose you borrow money from the bank for the car and youre three months behind in your payments. You present your key, the car doesnt start. The bank has the key that starts the car. So this is a very cool idea, right?

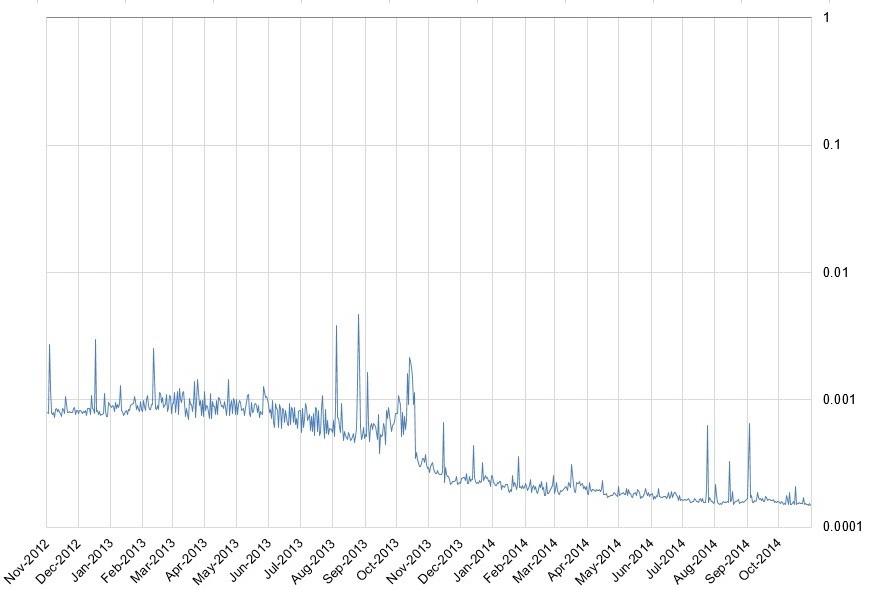

Q: Theres still a problem with the roller-coaster ride in Bitcoin prices, right?

A: There is, and Bitcoin currently is not a reliable store of value because of it. But the price swings could be solved with more liquiditymore money in the market. The recently launched Bitcoin exchange, which is fully regulated, insured, and backed by the New York Stock Exchange, should help with this. Bitcoin price fluctuations are a factor of it being so young.

The best way to judge Bitcoin is not to look at the price progression, but to look at the vast amount of money thats being invested by venture capitalists into Bitcoin-related companies. Thats what I look at.