Bill Gross Explains His New Unconstrained Fund s Strategy

Post on: 1 Октябрь, 2016 No Comment

Former PIMCO CIO Bill Gross made his first appearance and released his first Investment Outlook as Janus Unconstrained Fund manager today, and while he didn’t get into any details about what happened at PIMCO (did anyone really think he would?), Gross answered the most important questions about how he sees his new role.

“An unconstrained strategy sounds very open-ended, and it is. But it allows a professional and experienced investment firm like Janus Capital Group Inc (NYSE:JNS ) to select the most attractive alternatives across many asset categories while hopefully diminishing the risk of bond and stock bear markets,” writes Gross. “The strategy seeks to protect principal while providing an acceptable return in this low yielding, low returning world.”

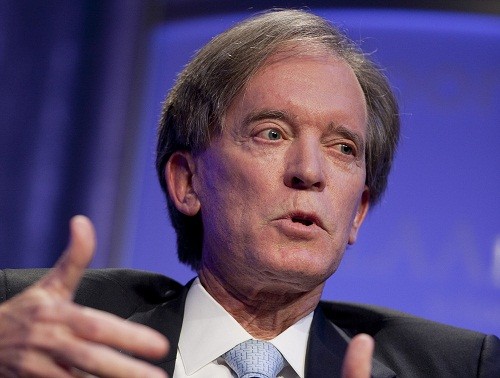

Bill Gross at the Morningstar conference in Chicago June 19th 2014

Gross will focus on shorter duration ideas

As Gross has explained in the past, he believes that the combination of low interest rates into the foreseeable future and high stock valuations means that investors who buy the market are going to have much lower returns than they’re used to: 3-4% for bonds and 5-6% for stocks if nothing else goes wrong. Gross isn’t really a market bear per se, he isn’t calling a market top or imminent crash, but he thinks that anyone planning on hitting 7%+ returns for the next decade (eg many pension funds) is fooling themselves as we’ve now left the proverbial seven years of fat behind and will have to make it through seven year of lean, though looking back at the thirty year bond bull market that Gross reigned over, we’ll have to hope the lean doesn’t last quite so long.

In that context, the Janus Unconstrained Fund is going to look for good investments basically anywhere, with the constraint of keeping duration in the 1-2 year range to keep rate sensitivity low. Since Gross will be working with a smaller fund (much, much smaller at the moment) he’ll be able to investigate a larger universe of securities, and he no longer has to split his time between investing and managing a large financial company. This also means he won’t have to hunt in the same part of the market as the fund he left behind.

Today’s webcast mostly covered the same ground (check Ben Eisen’s liveblog at MarketWatch ), reiterating the seven years of fat/seven years of lean that Gross believes investors need to mentally prepare themselves for.

Gross excited to work ‘with people I trust’

And in case you were worried recent events might have changed him, Gross’s personality came through in his latest letter loud and clear. He started this investment outlook with the admission that he had never danced with his wife until last month before diving into macroeconomic analysis.

He also made some perfunctory remarks about leaving PIMCO. “Slowly and with great hesitation, I came to understand that it was time for me to leave… I don’t plan to address it further,” Gross wrote. But despite some kind words about the company he founded, Gross’s description of Janus reads like a subtle sleight. “I am excited to work in a true partnership environment with people I trust.”