Beware of Investing Based on Rising Interest Rates The Experts

Post on: 16 Март, 2015 No Comment

yield curve

iStock

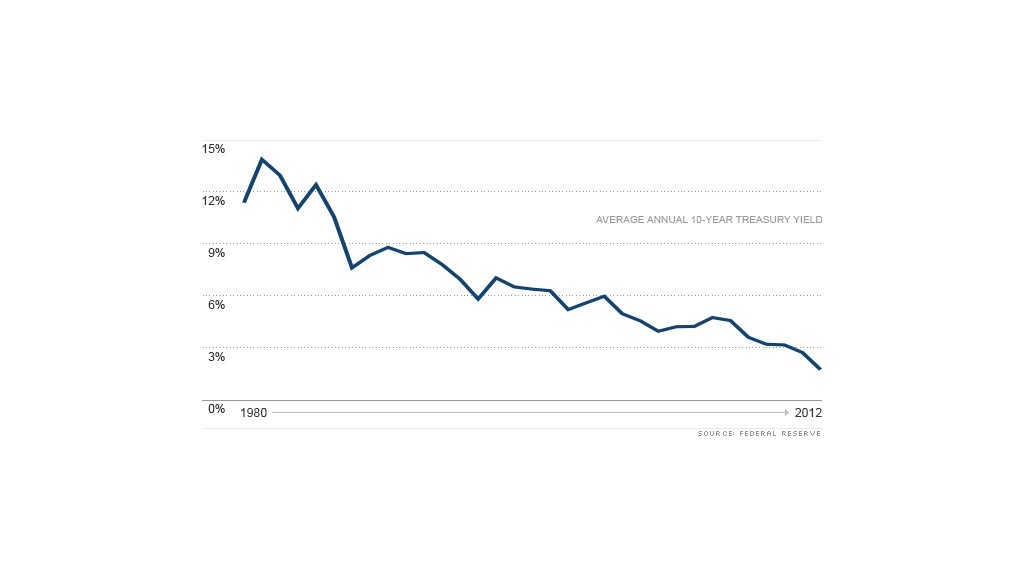

RICK FERRI: Short-term interest rates are low relative to historic norms. One-month Treasury bills have historically yielded about 0.3% over inflation prior to the financial crisis. This would put the T-bill at a 2% yield rather than where it sits at about 0.01%. The Federal Reserve has been keeping short-term interest rates well below inflation since 2008 to stimulate the economy. This policy of “financial repression” helped drive the economy forward.

2015 will likely be the year when short-term interest rates begin to rise toward a positive inflation-adjusted return. Recently published economic projections by Federal Reserve Board members and Federal Reserve Bank presidents show the median expected mid-point for federal funds rates rising from 0.125% to 1.0% during 2015, increasing again to 2.5% in 2016, and finally to 3.5% in 2017. These are projections and not certain to occur.

Many investors have been incorrectly predicting the rise in short-term interest rates for several years and have kept their fixed-income investments short term. They feared a rise in rates would harm the value of their portfolios if they held intermediate- and long-term bonds or bond funds. However, interest rates have not moved higher, and investors who avoided all but short-term bonds have missed out on higher interest payments. The opportunity cost of not investing in intermediate-term bonds has hurt investors who bet early on rising rates.

Given the Fed’s projections, is now the time to go short term? I’m not optimistic that this is the time. First, there’s no guarantee the economy will continue to perform at a rate that warrants higher interest rates. Second, even if short-term rates do rise there’s no guarantee that intermediate- and long-term rates will also rise.

As of Dec. 29, 2014, the yield curve is steep. There’s a 1.71% yield difference between one-month T-bills (0.01% recent yield) and the benchmark five-year Treasury note (1.72% recent yield). This spread grows to 2.21% when T-bills are measured against the benchmark 10-year Treasury note. These spreads are high historically. An argument can be made that rising short-term rates are already priced into intermediate- and long-term bond prices.

Bond investment decisions shouldn’t be based on the expectation of interest rates. They should be matched to one’s need. Short-term bonds make sense for cash needed over the next couple years and for an emergency fund. Longer-term bonds are best suited for investments meant to meet longer-term liabilities such as retirement accounts. Investors in retirement may wish to have a mix of both short- and intermediate-term bonds and bond funds.

Rick Ferri is founder of Portfolio Solutions LLC and the author of books on low-cost index fund and ETF investing. His blog is RickFerri.com .

Read the latest Investing in Funds & ETFs Report .