Best Performing Mutual Funds

Post on: 25 Июль, 2015 No Comment

How would you go about selecting the Best Performing Mutual Funds to add to your investment portfolio ? Would you select funds that have had a good record in the past ? The trading volume of such funds ? Not an easy decision to make. But a good guideline to help you select the funds, would be to first decide on the risks you can take, and then specifically decide whether you would like to invest in stocks or bonds. Every investment portfolio should have a quota of mutual funds, as it boosts your chances of success .

Having decided to add some of the best performing mutual funds to your portfolio, you would thenneed some expert guidance to choose from the thousands of funds available on the exchange. Companies like Morningstar and Lipper Leader Fund, give valuable guidance and help in this connection. Morningstar uses the popular ‘star’ rating for the different funds – like one star, two stars, three stars, etc. to indicate the standing of the particular fund. Lipper Leader Fund rates each fund by its consistent return, tax efficiency, total return, expense, and preservation. But both companies are geared to guide you through the complex route of selecting the best performing mutual funds. Information on the different funds in the market can also be got from some business magazines like Wall Street Journal and Business Week. Whichever company you consult regarding funds to purchase, ensure they have the experience and expertise to give you the right guidance. After checking out all sources as to which funds you would like to invest in, you can make your decision.

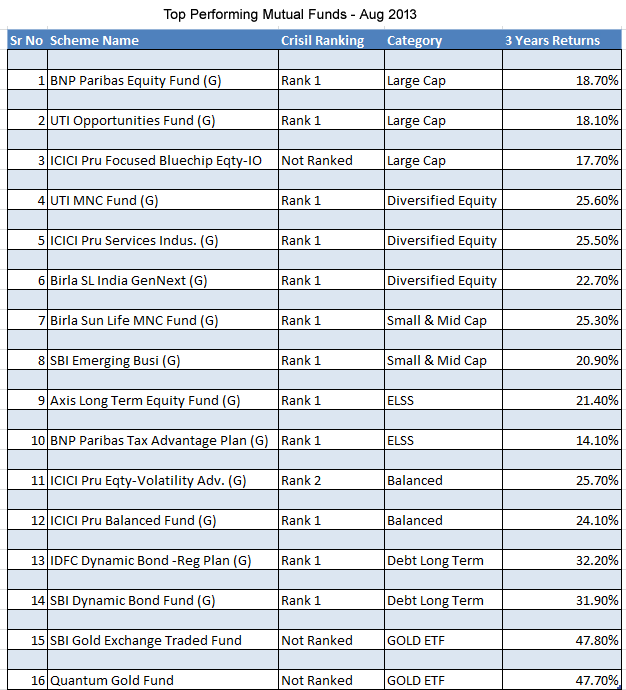

A few best performing mutual funds are mentioned below:

- DSP Blackrock : This Fund manager invests only in companies that have good management resources, and companies holding good standing in their particular business categories. The fund managers has shown a steady standing on the Exchange, and their buying/selling techniques have a good track record.

- ICICI Prudential: The Fund basically invests in large cap stocks, its strategy being to buy and hold. Bets are taken on potential companies, which are liable to give high returns. The key sectors ICICI Prudential invests in, would be Information Technology, Refineries and Power, Pharma, and Banking.

- Franklin India: This Fund manager looks at large cap stocks that have value and growth potential. Like ICICI, their strategy is to buy and hold. Investments made by this fund manager would be in holdings such as Reliance Industries, HDFC Bank, Bharti Airtel, Grasim Industries.

So take your pick – study, consult, choose. But make sure you include some of the best performing mutual funds in your investment portfolio, a decision you will not regret.