Best Investment Plans for Fixed Income in 2014

Post on: 18 Июнь, 2015 No Comment

Powered By

Details Written by PolicyBazaar Views: 2115 Published: 17 February 2014

There are many investors who can’t stand the volatility of market linked plans. They are in a constant hunt for investment options that could assure them of safe and steady returns and at the same time help them save their taxes. For such conservative investors, investing in a fixed income plan might be a good idea.

Further, the recent tumbling of the economy has brought the attention of investors from equity oriented plans to fixed income plans, especially of those who are on the verge of retirement. Simply put, fixed income plans yield regular returns in the form of fixed income.

Here’s out top pick of the best investment plans for fixed income for the year 2014.

1). Retirement Plans

Retirement plan is an insurance cum investment plan. Here’s how it works, the insured pays regular premium to the insurance company over the policy tenure. The corpus so build is used to make regular payouts to the insured in the form of annuities. However, if the insured dies during the tenure, his/her beneficiary becomes entitled to get the sum assured. So a retirement plan is a very effective tool to provide an individual a regular source of money when there are no more paychecks for him/her.

2). Bonds

Ever wondered from where do big corporations and government bodies get funds for their colossal projects and set ups? Well, they ask people like you and me to lend them the money. Once you do that, you become the creditor and in lieu of that, the corporation/government issue you bonds. As an investor holding a bond, the corporation/government becomes liable to pay you a sum of money (as per the profits made) at regular intervals. Plus you also get the principal loan amount at maturity. The key to get the most out of bonds is to hold the bonds till maturity.

3). Monthly Income Plans (MIPs)

Another valuable fixed income investment avenue is MIP. It is a debt oriented hybrid mutual fund which provides the insured with periodic payouts every month. Being a market linked product, the returns yielded by MIPs are not guaranteed. Rather, it depends upon the fund performance. MIPs are quite a hit among conservative investors as an ideal option to beat inflation while exposing the funds to minimal risk. The returns yielded are bigger (11-14%) than the conventional FDs. Top up that with the fact that there’s no upper cap on the investment amount and there’s no lock in period.

4). Public Provident Fund

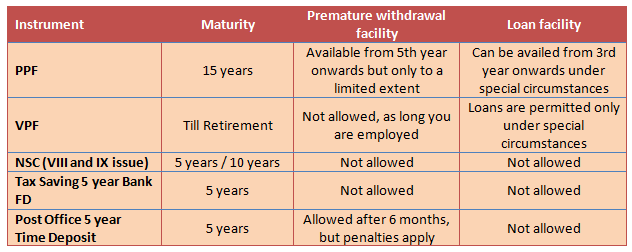

PPF has been an all time favorite investment avenue of investors with a low risk appetite. The returns are guaranteed and can reach up to 8.5% — 9.0% mark. Under section 80C the investment made towards PPF is tax deductible up to Rs 1,00,000. Another perk to PPF is that there is no upper limit on the amount you are looking to invest.

5). Bank Fixed Deposits (FDs)

Fixed deposits works more or less like a regular savings account, except that they offer a higher rate of return. There’s a lock-in period before which the investor cannot make any withdrawal. Bank FDs offer guaranteed returns while keeping the principal amount intact. It seems like FDs are never going to lose their sheen especially among risk averse investors.

The Indian rupee is constantly losing its value to the American dollar. Resultantly, the people are becoming increasingly wary of putting their money in high risk investments. Even the seasoned investors are averting the market and switching to safer avenues of investment. No wonder, fixed income investments have gained quite a momentum in 2013 and likely to stay like that in the future.