Benefits And Disadvantages Of A Deferred Compensation Plan

Post on: 24 Июль, 2015 No Comment

Benefits And Disadvantages Of A Deferred Compensation Plan

What Are The Benefits, Disadvantages Of A Deferred Compensation Plan?

Deferred compensation is a process where a percentage of a person’s salary is held elsewhere and paid out later, usually when they retire. Some examples of deferred compensation plans are pensions, life insurance plans or retirement plans such as a 401k plan, or stock options.

Who Do Deferred Comp Plans Help?

Deferred comp plans can provide benefits to both business owners and their employees. These benefits are mainly from tax breaks since the money is held from the salaries prior to being taxed. It also means that it acts as a savings account that the employee can’t use without incurring major tax penalties, so the employee is helping themselves to save up a nest egg by the fact that it would be very costly if they broke into it and took out any of the funds. The employer can pick between a qualified or unqualified comp plan, and the employees will be entered into the resulting pick if they choose to accept that choice.

What Is A Qualified Deferred Comp Plan?

Qualified deferred compensation plans let a business owner get a tax deduction on the contributions which are made to the plan. As these contributions increase, the taxes are deferred until they get paid out to the employee. The employee can also put them into an IRA or other qualified plan to get even better tax deductions.

Disadvantages Of A Qualified Deferred Comp Plan

With all of the benefits of a qualified deferred comp plan, the requirements of them include nondiscrimination requirements that keep an employer from giving benefits for highly salaried employees and not covering the lower salaried ones. Plus, there is a limited amount that an employee can contribute and there are requirements of regular reports.

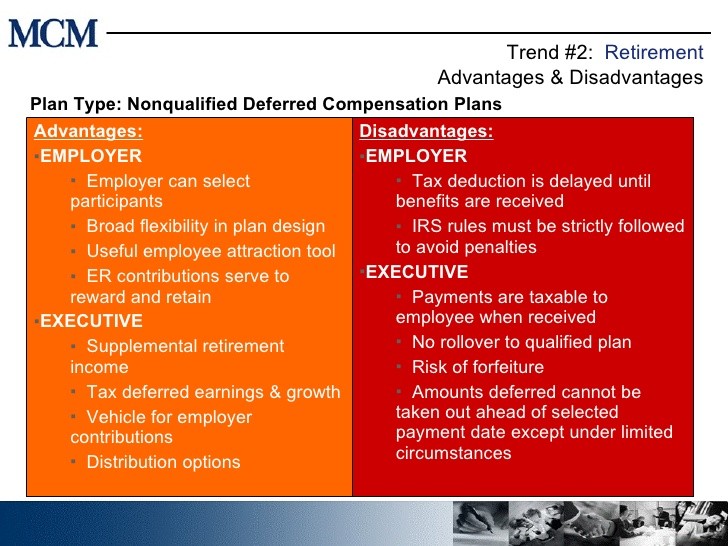

What Is A Non-Qualified Deferred Comp Plan?

Non-qualified compensation plans allow businesses more flexibility to offer a specialized package to their employees. This allows the business to choose who gets a plan and what each plan is worth. These are given based on factors such as an employee’s tenure with the company. These plans are less costly to start and don’t fall under the same reporting rules as a qualified plan.

A non-qualified deferred comp plan can also provide benefits instead of or as an add-on to a qualified deferred comp for a pension plan. This might be something an employer creates if they want to avoid the price and administrative issues that can occur in a qualified deferred comp plan or to avoid the price and complications of finding and administering a type of qualified deferred comp plan for all of the employees in a business.

Disadvantage Of A Non-Qualified Deferred Comp Plan

There are also disadvantages to a nonqualified deferred comp plan such as the fact that these plans don’t receive any tax benefits like a qualified plan does. This means that the employer also doesn’t get any favorable tax benefits either. Plus, this type of plan can require that the employee pay taxes on the funds held even if he doesn’t get them paid out if the funds are held in the plan after the employee reaches retirement.

Other Types Of Plans

Other types of deferred comp plans include what is called a “Rabbi Trust.” It is named that due to the fact that the first one that was approved by the IRS was set up for a rabbi. It involves an irreversible grantor trust, but the trust is subject to any claims that an employer’s creditor might have.

There is also what is called a “Taxable Trust.” This can’t be affected or lessened by an employer’s creditors, however, taxes must be paid on its income when the contributions are made and so there isn’t a tax benefit.

Yet another type of plan is bonds, which lets the employer coordinate the employee’s retirement with the bond’s maturity dates.

Ways That Deferred Comp Are Used

Here are ways that deferred comp plans are used:

Retirement Income

The main benefit of a deferred comp is that it can provide the employee with an income after they retire. It allows them to build up monies they can draw on later in life. For example, one type of deferred comp comes from a 401k plan that would pay out a certain amount of funds for a certain amount of time. Another example is if the deferred comp plan was funded through stock options, and then at retirement the employee can sell it all for a lump sum or just keep it and let the stocks gain more over time and take the resulting profits as a flow of income.

Savings Plans

Some types of deferred comp plans can be paid out in the form of savings so that the funds can be used to pay for things like helping family members with college, paying off a mortgage, or holding it as an inheritance.

The majority of deferred comp plan contributions come from pre-tax money and aren’t taxable by either federal or state taxes until they are paid out to the employee. That goes for the initial money put into the fund, and the interest it gains until it is taken out of the fund. After someone retires, they can take money out of the account and use it or it can be put into an IRS to give more tax benefits.

Earnings Potential Of Deferred Compensation Plans

Deferred comp plans can increase dramatically in value depending on how they are funded. For instance, if they are funded by stocks or bonds, and these increase in value, then the amount of funds in the deferred comp plan will also rise. Of course the opposite can also happen, and if the stocks or bonds go down, the amount of funds in the plan could go down as well.

Another problem that could affect a deferred comp plan is if the company it is based with goes bankrupt, as that could mean that the employees enrolled in it could lose all of their investments and monies held in that plan. I hope you enjoyed these tips and gained new insights.