Become Better Diversified and Get Higher Stock Market Returns

Post on: 13 Июнь, 2015 No Comment

by Darwin on February 10, 2013

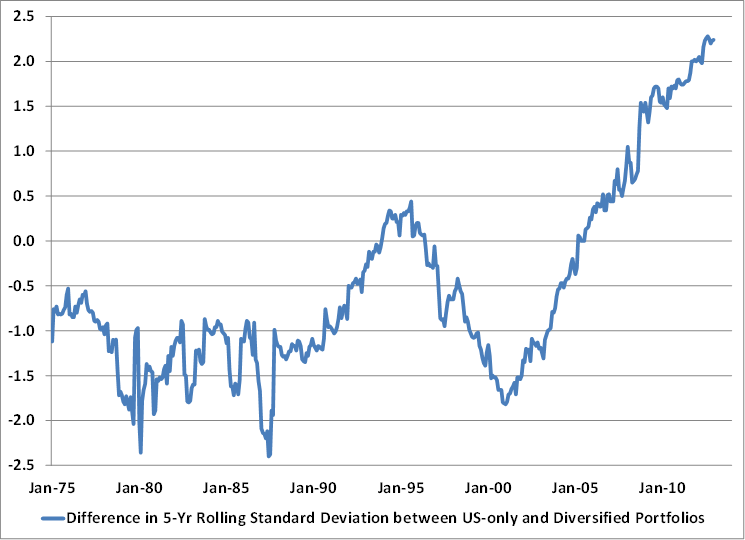

Every investor knows that diversification is the most fundamental and important part of a good, long-term investment strategy. However, there is no clear cut definition for what “diversification” really means. How far do you take the idea of diversification? Do you stop at the number of stocks or bonds your hold, or do you look at how you allocate your money between those stocks and bonds?

Which variables do you consider insignificant and ignore entirely? Basically, just how far should we take the idea of true diversification?

The Case for Stronger Diversification

There is a good case for throwing out everything we ever thought about diversification. Most funds, even index funds that hold several hundred stocks, are very heavily concentrated.

When one buys an index fund based on the S&P 500 index, they own holdings in 500 different stocks. This sounds like exceptional diversification – your investment capital is likely much safer in 500 stocks than in 3 stocks, for example.

But just how diversified is your average S&P 500 index fund? Not as diversified as you might think. The S&P 500 is a market capitalization weighted index. Therefore, the largest companies make up the most of the index. The smallest by market cap make up only fractions of the index. Apple (AAPL) makes up nearly 5% of the index; Exxon Mobil (XOM) makes up 3.3% of the index. Apple and Exxon are just two of 500 S&P 500 components, but they make up 1/12th of the indexes total return each year.

If one were to diversify into the 500 stocks in the S&P 500 perfectly, he or she would put .2% of their investment into every single stock. Market cap weighted funds are diversified in the sense they own a lot of different stocks, not in the sense that every company has an equal impact on the returns of the fund.

Market Cap Weighting vs. Equal-Weighting

Investors should think very seriously about buying equal-weighted indexes over market cap weighted indexes. In an equal-weighted index, all of the companies in the index receive the same proportion of investment capital. Therefore, each company in an equal-weighted S&P 500 fund would make up .2% of the total fund.

In the last 9 years, equal-weighted funds were more volatile, but returns were exceptional. Take a look at the performance for an equal-weighted S&P 500 fund vs. a market cap weighted S&P 500 fund:

(The equal-weighted fund in blue recorded returns of 100% over the period from capital appreciation. The market cap weighted fund in red returned only 53.25%.)

The equal-weighted fund absolutely destroyed the fund weighted by market cap. Total historic performance is never a good reason to switch strategies, though. Consider the following:

- Equal-weighted is better diversified – There’s no way around this; equal-weighted funds are better diversified because the strategy requires diversification. Market cap weighted funds disproportionately allocate funds so that a handful of stocks outweigh the performance of hundreds of smaller companies. Both strategies buy the same number of stocks, but they do not keep the same allocation per stock.

- Equal-weighted funds sell on the way up, buy on the way down – Equal-weighted funds are rebalanced based on the calendar. The RSP ETF that uses and equal-weighted index rebalances every quarter, selling shares in the runaway stocks and adding to losers. Market cap weighted funds sell the losers upon rebalancing while buying stocks that had their best periodical performance.

- Equal-weighted funds favor small caps – Equal-weighted funds include far more exposure to small cap stocks than large cap stocks. Over the long haul, small companies tend to provide much better returns as a group than large cap stocks but with slightly more volatility. In your earlier years when you can handle more volatility, an equal-weighted index would be ideal.

So far we’ve established that equal-weighted funds provide better performance in the long haul, reward investors with true diversification, and have a strategy (rebalancing frequently) to take advantage of temporary swings in the market value for stocks in exchange for slightly more volatile returns. Academic research of historic stock databases reveals that this trend has existed throughout stock market history. For some diversified ETFs that have been shown to consistently beat the market, check out the buyback ETF and for the only stock Ive bought so far this year, see why I think 3D Printing is the only game in town (and this stock has the gains to prove it!).

What are you waiting for? A better diversified portfolio that has historically provided better returns should be a no brainer!