Barclays Plans to Introduce Family of TargetDate ETFs

Post on: 17 Июль, 2015 No Comment

Ian Salisbury

Updated July 23, 2008 12:01 a.m. ET

NEW YORK — In a bid to help exchange-traded funds catch on among mom-and-pop investors saving for retirement, ETF giant Barclays PLC plans a family of target-date and target-risk iShares ETFs.

Conventional mutual funds that follow these strategies have been a big hit with investors, particularly in 401(k) retirement accounts, since the government made it much easier for plans to use the funds as default investments as part of the Pension Protection Act of 2006. But the move could represent a gamble by Barclays, because many experts regard these strategies as particularly ill-suited to ETFs.

Exchange-traded funds, which resemble open-end mutual funds but trade on an exchange like a stock, are rarely available in tax-advantaged retirement plans. Efforts to put them there haven’t caught fire, in large part because ETFs are more expensive than conventional funds for investors who sock away a little money each month — exactly the strategy retirement plans encourage.

Maybe someday ETFs will work in the 401(k) market, but it’s not their natural home, Matt Hougan wrote last week on IndexUniverse.com. a Web site that chronicles the ETF industry. ETFs’ biggest advantages. are either neutralized or turned into problems in the 401(k) platform.

A Barclays spokeswoman declined to comment on the specifics of the ETFs outlined in filings to the Securities and Exchange Commission. She did say she thinks ETFs will play a significant role in retirement plans, especially in smaller plans in which investors’ alternatives are currently limited to conventional mutual funds that carry expensive sales loads (a type of fee investors pay to financial advisers) rather than plans that include low-cost index funds.

Barclays will also take the long view. The retirement market does not move quickly, she said. It took target-date funds 10 years to catch on.

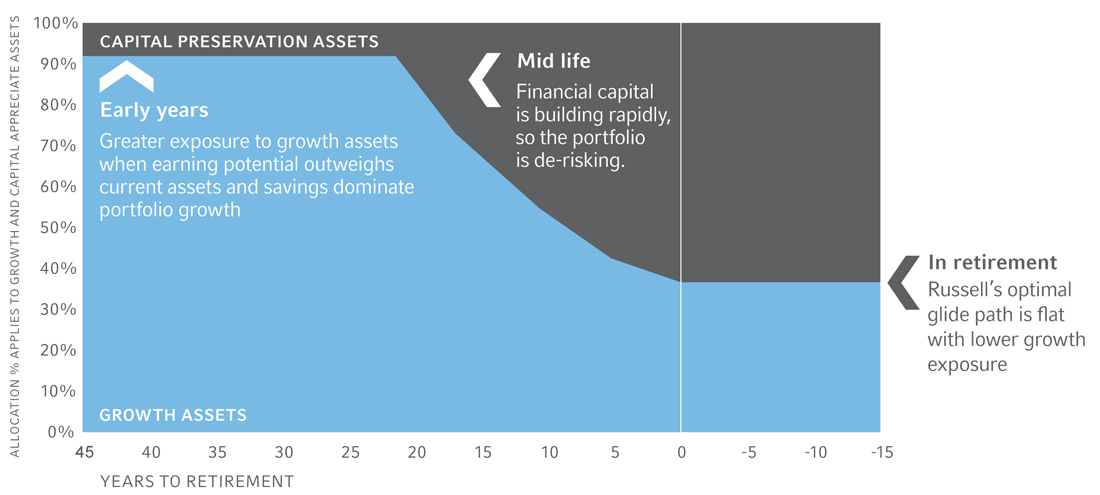

Barclays’ eight proposed target-date ETFs will hold a mix of other iShares stock and bond ETFs. The funds are designed to slowly shift their holdings from volatile stock-heavy strategies to more conservative fixed-income-oriented strategies as the target date approaches. IShares is the name Barclays gives its ETFs.

For instance, according to the filing, the most aggressive fund, iShares S&P Target Date 2040 Index Fund, would have 91% of its assets in other iShares equity funds and 9% in fixed income. For the most conservative option, designed for retirees, the mix is 42% stocks and 58% bonds.

A group of four funds will also hold a mix of iShares stock and bond ETFs, but keep their strategies steady rather than adjust them over time. Among these are iShares S&P Conservative Allocation Fund and iShares S&P Aggressive Allocation Fund.

It isn’t clear whether the new Barclays ETFs of ETFs would charge investors a fee on top of what they pay for the underlying iShares ETFs. Conventional life-cycle funds from fund giants such as Vanguard Group and Fidelity Investments don’t charge investors those extra fees.

Other ETF firms have already launched target-date and target-risk ETFs, although none have collected a large share of assets. Generally funds are thought to need $100 million to $200 million each to sustain themselves.