Banking crisis

Post on: 16 Март, 2015 No Comment

Related Articles

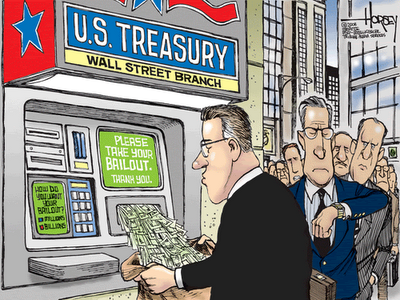

I read an article in CNN Money by Colin Barr wondering why there havent been any subprime perp walks:

Where are the perp walks for the subprime mortgage executives that dragged us into this mess?

Three years after the housing bubble popped, federal prosecutors have yet to bring a case against the executives whose firms took part in some of the worst excesses of the subprime mortgage market.

It’s not like there’s a shortage of abuses to investigate. The landscape is littered with the wreckage of financial institutions that crashed under the weight of bad loans, costing shareholders and taxpayers billions of dollars.

Many lenders that went bust were cooking their books before they collapsed, according to a 2007 FBI report. Meanwhile, top officers at many mortgage shops were pocketing hefty paychecks and stock sale proceeds.

And though it may be early to judge the law enforcement response — corporate fraud cases can take a long time to assemble, thanks to their complexity and limited enforcement resources — some observers are nonetheless struck by the lack of high-profile prosecutions.

The perp walk has been remarkably absent during this crisis, said Steven Ramirez, a law professor at Loyola University Chicago, referring to the practice of parading a criminal defendant before the press on the way to court. I don’t think it’s because of a lack of criminal activity.

The author goes on to address the lax prosecutorial follow-up on behalf of the Justice Department, citing a lack of evidence and the difficulty in clearly connecting back office corruption to the executive suite. The conclusion seems to be that the Justice Department lacks sufficient funds and resources to cope with the sheer volume of financial fraud cases. I agree, but, unlike the author, I don’t have any expectation of imminent justice.

The Justice department cites Bernie Madoff and the impending case against Allen Sanford as indicative of their commitment to prosecute.

- I dont think the Madoff conviction is a particularly good example, because no one seriously believes that he executed that scheme alone. He may have been the primary instigator, but the other participants are probably still working within the financial markets and his conviction didnt necessarily make any of them sprout ethics.

- I dont think that there will be a large number of perp walks associated with the sub-prime meltdown. With all of the other issues clamoring for attention, the events (and evidence) associated with the meltdown are quickly becoming a bitter memory that people want to banish from their minds.

- There would be no equitable way to dispense justice. The nets of justice would probably gather many of the small fish while missing most of the big fish. Those up the upper levels of management are unlikely to leave evidence of file tampering. Also, mortgage executives pocketing enormous annual compensation have access to better legal counsel.

Throughout 2007 and 2008, I read countless articles seeking to place blame on Alan Greenspan, the Federal Reserve, President Bush, mortgage professionals (all of them) and bank executives (all of them). The tone utilized often inspired images of mobs, with pitchforks, looking for a scapegoat.

Justice isnt that easy or that cut and dried. When the entire market fails, it is indicative of a systemic breakdown. Its not one individual or one company that caused the meltdown. It is a combination of variables that culminated in the perfect storm financially. There is no effective way to pursue all of the culprits. Human greed and the social correlation between wealth and success exacerbated this phenomenon. Many are guilty. Many dont recognize their guilt or complicity.

I think that the individuals who deserve to be prosecuted are so wealthy that they are largely immune or they have already moved on to other branches of finance, leaving little, or no, trail. Perhaps I am jaded. Every decade seems to have a major financial scandal: Junk bonds, the S & L scandal and the mortgage meltdown leap to mind. As long as wealth and corporate entities are allowed to promote their political self-interests through lobbyists, it seems likely that the same financial wizards behind the Ponzi schemes, derivative trading abuse and mortgage fraud are likely to find a new niche to exploit.

P. 866.626.4565, ext. 239

E: solardiva@comcast.net