Balance of payments_2

Post on: 16 Март, 2015 No Comment

namanjain221

Transcript

- 1. Balance of Payments

Nations continually carry out economic, commercial and financial transactions between residents of one nation and rest of world in the form of :

— exchange of goods for goods

— goods for services

— services for services

— goods and services for money etc.

Summary of these transactions for a period carries great economic significance for the nation.

The systematic record of all economic transactions between residents of a country and rest of world in a given period is called the Balance of Payment.

3/21/2010

Presentation by Prof. H.Ganguly.

Presentation by Prof. H.Ganguly.

BOP statistics are published monthly by RBI in India.

These are analysed by bankers, businessmen, economists

foreign exchange traders etc. to know international

economic performance of the country.

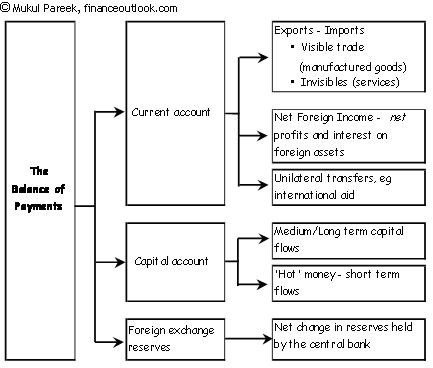

BOP is a double entry system statement of followings.

— all receipts for goods exported

— all services rendered

— capital received by residents* of the nation

services received in addition to capital transferred to

non-residents and foreigners.

* Residents mean individuals. businesses and govt. agencies.

— Military personnel, diplomats, tourists and workers who

emigrate temporarily are considered residents of the

country of their citizenship.

Presentation by Prof. H.Ganguly.

On the other hand, Balance of Trade considers the value of exports and imports of visible items i.e. merchandise only.

* Official Settlement accounts

Presentation by Prof. H.Ganguly.

* Balance Of Payment on Current Account

— It includes value of exports and imports of visible items

and receipts and payments on invisibles i.e. services like

banking, insurance, travel, tourism, transportation etc.

— Balance of Payment on current account is added to

determine nations’ Gross Domestic Product (GDP).

Presentation by Prof. H.Ganguly.

ii) Banking capital covers the external financial assets and

liabilities of commercial and co-operative banks who

deal in foreign exchange.

Official capital are RBI’s holding of foreign currency,

SDRs etc. on behalf of Govt. of India in the form of loan,

miscellaneous receipts, payments etc.

* Unilateral Transfers Account

It comprises of uni-directional transactions like ‘giving of

gifts’. Disaster relief, foreign aids, govt. grants, pension

paid to and received by Indian citizens for services

rendered abroad.

* Official Settlements Account

It represents official sales of foreign currencies and other

Presentation by Prof. H.Ganguly.

Equilibrium in Balance of Payment of Nations

— When demand for and supply of foreign currency in a

Presentation by Prof. H.Ganguly.

* Economic Factors may cause

1) Development Disequilibrium

2) Cyclical Disequilibrium

3) Secular disequilibrium and

4) Structural Disequilibrium

Presentation by Prof. H.Ganguly.

2. Cyclical Disequilibrium

Due to fluctuations in business cycle in a country. value

of imports of consumer goods and then consumer goods

go up or down periodically, both of which lead to

disequilibrium in BOP.

3. Secular Disequilibrium

4. Structural Disequilibrium

— Sometimes notable shift comes in nature of economy of

countries e.g. from agricultural to manufacturing or

services.

— These may call for structural changes in developing

alternative items, sources of supply, changes in transport

Correction of BOP Disequilibrium

When BOP becomes surplus, nations enjoy the same as it

offers a number of desirable situation like increased

purchasing power and influence in global market.

— In cases of disequilibrium due to deficit, countries adopt

measures to eliminate the same completely, if not possible

1. Automatic Correction of BOP Disequilibrium

2. Deliberate Measures

Govt. also adopts certain measures to control deficit BOP

called ‘Deliberate Measures’ as indicated.

A. Monetary Measures

* Reduction in Money Supply.

— RBI takes to control credit so that money supply in

the country is reduced which leads to decline in income,

purchasing power, aggregate demand and consumption.

— Thus imports decline and hence outflow of foreign

In case of deficit BOP, purchasing power of local currency

reduces, the Govt. delebarately devalues currency. Thus

Presentation by Prof. H.Ganguly.

* Export Promotion Measures

Govt. of India endeavour to boost exports by reducing

export duties, providing incentives, encouraging EOUs,

forming EPZs, FTZs etc.

* Import Control Measures