At The Bullish Extreme Take The “Blue Pill” At Your Peril

Post on: 14 Апрель, 2015 No Comment

by Pater Tenebrarum January 4, 2015

We have always liked Eclectica fund manager Hugh Hendry for his sound views and outspoken manner. Below is a somewhat dated video compilation showing several moments in which he stunned his opponents in television debates by voicing uncomfortable and politically incorrect truths. Included in the video is a defense of speculators, entrepreneurs and other risk takers in the marketplace against statist interventionists and “champagne socialists”, which we wholeheartedly agree with. Speculators have a bad name, mainly because they always serve as a convenient scapegoat for politicians (in fact, speculators and merchants have served as scapegoats whenever economic policy failures became apparent since at least the time of the Roman empire). However, they fulfill an extremely important function, as Mr. Hendry points out to his debate opponents.

A few excerpts from televised debates with Hugh Hendry

Mr. Hendry runs the Eclectica Fund and in recent quarters has frequently stressed that being contrarian has been a losing bet over the past few years (there are a few notable exceptions to this, see further below), while investors and fund managers relying blindly on the “money illusion” provided by central bank interventions have done quite well.

This is undeniably true. A prime example of what absurdities have become possible is shown below. The chart shows the 10-year JGB yield; Japan’s monthly annualized CPI rate of change over the past year is also shown, as an inset in the chart. The red rectangle outlines the time period over which these CPI readings were reported. At no point over the past year was Japan’s CPI not at least more than twice as high as the 10-year JGB yield. Even if one disregards the fact that CPI has been boosted due to a sales tax hike in April, current JGB yields make no sense. Prior to the sales tax hike, CPI fluctuated between 1.4% to 1.6% annualized, or 1.5% on average. This would still be almost five times the current 10-year yield of 0.31%.

In past “reflation” attempts by the BoJ, investors tended to drive up JGB yields concurrently with stock prices. Reported CPI figures also happened to increase slightly on these occasions. Investors consequently demanded higher yields. However, nowadays the BoJ has “become the JGB market”. It is such a big buyer, that no-one dares to oppose it anymore. After all, it has theoretically unlimited amounts of money at its disposal, since it creates them with the push of a button. Trading volume in the JGB market has completely dried up. Shorting JGBs is still the “widow-maker trade” – for now, anyway.

10 year JGB yields since 2006 and Japan’s CPI rate of change over the past year (the period corresponding to the red rectangle). click to enlarge.

We are mentioning all this not to pick specifically on Japan’s policy makers (most others are by no means better), but mainly to confirm that Hugh Hendry does have a point. The prices of financial assets have been and continue to be massively distorted by loose monetary policy, and fighting these trends, no matter how absurd they appeared, has hitherto been a losing game.

The Fund Manager Conundrum

As we recall, Hugh Hendry mentioned in one of the Eclectica Fund’s previous reports that he has not only fully embraced the trends set into motion by central bank policy, but that he has also altered his short term tactics, by becoming more tolerant of short term losses. This was done because in recent years, every short term decline in the stock market was immediately recouped, so that “stop loss” strategies resulted in selling of long positions at exactly the wrong moment.

Zerohedge has recently reported on Mr. Hendry’s commentary accompanying the fund’s most recent results. These results were quite good, confirming that the current strategy works well, or at least that it has worked well in the most recent reporting period. Here are a few selected excerpts:

“There are times when an investor has no choice but to behave as though he believes in things that don’t necessarily exist. For us, that means being willing to be long risk assets in the full knowledge of two things: that those assets may have no qualitative support; and second, that this is all going to end painfully. The good news is that mankind clearly has the ability to suspend rational judgment long and often.

[…]

However since Draghi spoke, the role of market Disneyland has increasingly been taken on by the equity and fixed income markets. So the S&P has massively outperformed what has proven to be a tepid recovery in nominal GDP and a global real economy that is beset by deflation; just this month, European swaps contracts began to price in near term deflation. Yet equity markets are ignoring that reality in favor of the idea that the deflationary fallout from the collapse in the oil price will almost certainly mean even more monetary accommodation. The worse the reality of the economy becomes, the more we take on the reflexive belief in further and dramatic monetary expansion and the more attractive the stock market looks.

What is one to do with such a situation? In my view there are really only two responses. On one hand we have today’s bears. Remember the film The Matrix? Morpheus offered Neo the choice of two pills – blue, to forget about the Matrix and continue to live in the world of illusion, or red, to live in the painful world of reality. They, as the “enlightened”, chose red, and so are convinced that they understand everything which has become illusory about today’s markets. Their truth is Austrian economics. They know that today’s central bankers are spinning a falsehood of recovery; they steadfastly refuse to be suckered in by the euphoria of a monetary boom; and they are convinced that they will therefore be spared the consequences of the inevitable crash. Everyone else, currently drugged by the virtual simulation of prosperity and its acolyte QE, will be destroyed, leaving them alone, to re-invest when markets finally get cheap. They will once again be masters of the universe.

This sounds good. Really good. I have long thought of myself as one of the enlightened. My much thumbed copy of Kindelberger’s Manias, Panics and Crashes aided and abetted my thinking as I correctly anticipated and monetised profits from the crisis of 2008 for example. But it isn’t always good. Kindelberger has been absolutely detrimental to my investment performance for the last six years and as a result I have changed. I still believe that the attempt by central bankers to prevent the private sector from deleveraging via a non-stop parade of asset price bubbles will end in tears. But I no longer think that anyone can say when. Look back on the last five years and I think that it is indisputable that mass injections of loose monetary policy have both fueled asset prices and staved off further crisis. I am also absolutely persuaded that the global economy remains so fragile that modern monetary interventions are likely to persist, if not accelerate. They will therefore continue to overwhelm all qualitative factors in determining the course for stock prices in the year ahead.

So I have come to embrace the French philosopher Baudrillard’s insight. “Truth is what we should rid ourselves of as fast as possible and pass it on to somebody else,” he wrote. “As with illness, it’s the only way to be cured of it. He who hangs on to truth has lost.” The economic truth of today no longer offers me much solace; I am taking the blue pills now. In the long run we will come to rue the central bank actions of today. But today there is no serious stimulus programme that our Disney markets will not consider to be successful. Markets can be no more long term than politics and we have no recourse but to put up with the environment that gives us; the modern market is effectively Keynesian with an Austrian tail.

(emphasis added)

We would agree that Mr. Hendry describes the current financial market reality quite well. At present, bad news seem to promise more monetary stimulus, hence they don’t represent a reason to sell. We would however add to this that good news have also not been seen as a reason to sell over the past year. One could therefore be tempted to conclude that there is actually nothing that could prompt a sell-off in risk assets. It seems possible that there is a catch.

As to the “Austrian” position, Mr. Hendry is correctly characterizing it in that Austrians are no doubt convinced that the artificial boom cannot last. Monetary pumping has distorted relative prices in the economy, which has far-reaching consequences. Since these distortions falsify economic calculation, many of the earnings reported by companies in recent years will later turn out to have been hiding capital consumption. Interventionism inspired by Keynesian (and monetarist) tenets has set the boom into motion, but the false reality and distortions this has created will eventually be unmasked. Insofar, the image of a “Keynesian boom with an Austrian tail” is not incorrect. However, it should be noted that the focus of Austrian business cycle theory is really on the boom, its chief causes and effects, and the fact that instead of increasing prosperity, it will lead to impoverishment in the long run.

Mr. Hendry’s brief characterization of Austrian investment philosophy strikes us as far too narrow though. The major difference between someone simply taking the blue pill and an “Austrian” investor in the current situation is probably that the latter attempts to incorporate all possible outcomes in his strategy, instead of trusting that central bank interventionism will continue to “work” for investors. It may well work for a while yet, but as Mr. Hendry himself points out: “I still believe that the attempt by central bankers to prevent the private sector from deleveraging via a non-stop parade of asset price bubbles will end in tears. But I no longer think that anyone can say when.”

If no-one can say when, then the “blue pill” strategy has a major weakness. It means that things could just as easily go haywire next week as next year. Monetary pumping is not operating in a vacuum. The higher asset prices go, and the bigger the distortions in the underlying real economy become, the more likely it becomes that a continuation of the asset price bubble will require accelerating monetary inflation. However, US monetary inflation has been slowing for some time, and continues to do so. The y/y growth rate of the broad money supply measure TMS-2 stands at a still brisk 7.57%, but this is actually one of the lowest readings of the past 6 ½ years:

This growth rate could accelerate again if private banks were to step up their lending, but if they fail to do so, then the end of “QE” implies that the slowdown will continue. In that case, the air could rapidly get quite thin for currently still extant asset price bubbles. We will definitely concede though that there is nothing that can tell us with absolute certainty that recent trends won’t continue for a while yet. However, numerous technical warning signs have piled up as well in the course of the past year (most notably, market internals have deteriorated and trend uniformity has decreased) and sentiment has become extremely lopsided.

We understand the conundrum faced by Mr. Hendry. Being contrarian hasn’t paid, and he is running a fund that must report results every month. If he doesn’t deliver a certain level of performance, his fund will suffer redemptions; moreover, the fund’s earnings are tied directly to its performance. Mr. Hendry is essentially saying: “I don’t get paid for being right and not making any money”, which is fair enough.

We would however be remiss not to point out that investment funds run by dedicated “Austrians” such as Mark Spitznagel’s Universa fund and the still young Incrementum Fund run by Ronald Stoeferle and Mark Valek (which has just won the FERI Euro Rating Award for “most innovative new fund” ) have had a quite successful year as well. It is definitely not the case that “Austrians” don’t know how to make money in distorted markets. Even though these fund managers are well aware of the dangers associated with the boom and are frequently warning about them, they are still delivering great returns for their investors.

Contrarianism and the Danger of Taking the Blue Pill

We believe that there is a grave danger associated with simply “taking the blue pill”. First of all, in the context of “risk assets”, having faith in central bank magic is most definitely not a contrarian position anymore – less so than at any other time in the past six years. Contrarian views have actually worked very well in treasury bonds and crude oil in 2014, so it would also be quite wrong to state that “contrarianism no longer works” as a general proposition. The majority is of course always right during a strong trend. However, there inevitably comes a time when a trend has lasted long enough and gone far enough that the ranks of doubters have been thoroughly thinned out and the majority ceases to be correct.

We perceive a “greater tolerance for short term drawdowns” as quite dangerous in connection with risk assets at this juncture. In asset bubbles there are usually a number of short term breakdowns that are immediately followed by prices moving to new highs, a fact that greatly cements the confidence of market participants – usually to the point where it becomes fateful overconfidence. The main problem with this “tolerant” approach is that one simply cannot differentiate a run-of-the-mill short term correction from a short term downturn that ends up heralding something far worse. Initially, all corrections look similar.

To see how dangerous overvalued and extremely stretched markets can be, one only needs to study how prices have behaved following previous major historic peaks. The initial downturn is never seen as a cause for alarm. Sometimes this can however be followed by a decline so swift that having a tolerance for drawdowns can end up leaving one with very big losses in a very short time period.

Such sudden reassessments of market valuation can rarely be tied to specific fundamental developments. Rather, anything that is reported is all of a sudden interpreted negatively and becomes a trigger for more selling, even though similar news would have been shrugged off a few days or weeks earlier. After all, nearly every economic news item can be interpreted in a number of different ways, so that even superficially good news can become a problem (in the current situation they could e.g. create fears of a faster tightening of monetary policy).

Below is an update of Rydex assets and Rydex ratios. As can be seen, although the stock market is actually not very far above the peak it attained prior to the October correction, there has been a major rush by Rydex traders out of bearish and into bullish positions:

Rydex bear fund assets have ended the year right at an all time low, while the bull-bear asset ratio has continued to soared in blow-off like fashion. Remarkably, the ratio has moved from a level just below 12 at the low of the October correction to a high of nearly 30, in spite of the market not making a great deal of headway above its September peak, click to enlarge.

We were recently asked whether Rydex ratios are still meaningful nowadays. Although the assets invested in these funds are very small relative to the market’s size, we believe the data are akin to those gathered in e.g. political polls: the replies of a few thousand people can deliver statistically quite meaningful results applicable to the population at large. Similarly, the positioning of Rydex traders does tell us something meaningful about general market sentiment.

The most recent development strikes us as actually as especially meaningful. Bullish positioning has taken off like a rocket in the last quarter from an already high level (bull and sector assets rose by nearly 40%), while battered bear assets have plunged nearly by another 40% in just the final ten weeks of the year. The last quarter is especially noteworthy, as a massive surge in the bull-bear ratio occurred while the SPX gained only 70 points relative to its September peak. Comparing the two data points peak-to-peak, the SPX rose from about 2,020 at the September peak to 2,090 at the December peak (a gain of 70 points or 3.47%) while the Rydex asset ratio rose from approximately 18 points to 29,81 points over the same stretch (a gain of 11.81 points, or 65.6%). From its October low the ratio notched a gain of nearly 153%. In short, there is quite a big divergence between the actual gains delivered by the market at year end and the extent of conviction regarding further gains expressed by the positioning of Rydex traders.

Conclusion

We will readily admit that one cannot know with certainty whether the bubble in risk assets will become bigger. However, it seems to us that avoiding a big drawdown may actually be more important than gunning for whatever gains remain. One can of course endeavor to do both, but that inevitably limits short term returns due to the cost of insuring against a potential calamity.

We don’t know what, if any, insurance the Eclectica fund has in place, or whether Hugh Hendry’s trader instincts will help him to sidestep the eventual denouement; we are certainly hoping so and are wishing him all the best. However, we don’t think it is a good idea to simply “take the blue pill” and rely on the idea that the effects of the money illusion will last a lot longer. It is possible, but it becomes less and less likely the higher asset prices go and the more money supply growth slows down.

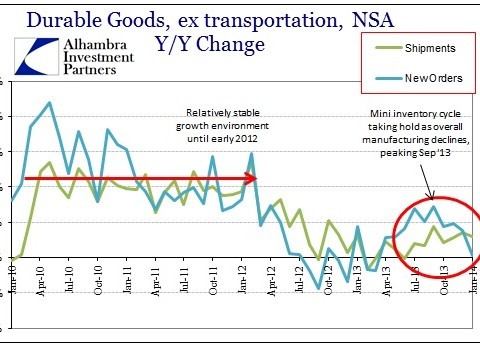

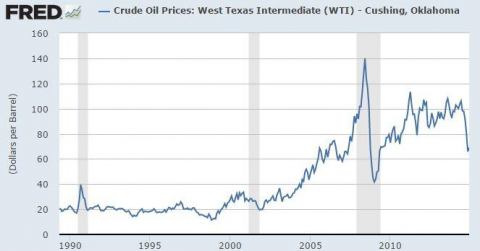

Lastly, the crude oil market strikes us as quite a pertinent example in this context, because everything that is these days mentioned as a cause of its enormous decline (such as the economic slowdown in China and Europe and the greater supply due to fracking) was already known many months before the sell-off started. The only thing that actually changed were market perceptions. No market is magically immune against such a change in perceptions.

Charts by: BigCharts, Tradingeconomics, Stockcharts, St. Louis Federal Reserve Research

This is a syndicated repost courtesy of acting-man.com. To view original, click here .