Asset Managers 2014 Income Investing Strategies Buy These 4 ETFs

Post on: 25 Май, 2015 No Comment

What should income investors buy in an era of rising interest rates and falling bond prices? We asked several asset managers to offer their outlook and ETF strategy for 2014.

• Richard Kersting, senior vice president at Gary Goldberg Financial Services in Suffern, N.Y. with $800 million in assets under management: 2014 will likely look a lot like this past year, but with a little more volatility. In our view, as long as global growth remains below its long-term average of 4%, central banks around the world, including the Federal Reserve, will continue to be more concerned about the sustainability of the global recovery, and will therefore continue albeit with small alterations their current accommodative policies.

In spite of continued anticipation of a great rotation out of bonds, investors will likely remain committed to the asset class, even if there is a pickup in volatility for bonds. Smart investors will reduce their bond portfolio’s duration and average maturity to offset increased volatility due to rising interest rates. Yield-hungry investors should look at iShares Short-term High Yield (ARCA:SHYG ) (SEC yield 3.65%; inception date Oct. 15, 2013; average daily volume 19,750 shares).

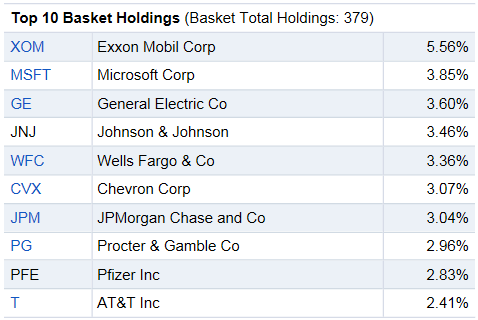

Asset managers Richard Kersting, Vern Sumnicht, Kevin Rich and Philip DeMuth recommend that income investors consider ETFs that invest in short-term. View Enlarged Image

• Vern Sumnicht, CEO of Sumnicht & Associates, Appleton, Wis. with $450 million in AUM: With single digit price-to-earnings ratios, the emerging markets’ upside potential is greater than the U.S. market’s in 2014. The Wall Street legend Jim O’Shaughnessy’s research shows that the best dividend-paying stocks in emerging markets outperform the emerging markets index on average by 10.6% annually.

The easiest way for most investors to purchase a portfolio of the best of the best dividend-yielding emerging market companies is by owning WisdomTree Emerging Markets Equity Income (ARCA:DEM ) (3.95% 12-month yield; -7.84% YTD; up an average annual 14.31% past five years). Dividend-paying emerging markets are: 1) An incredible value with P/E ratios in single digits; 2) Starting to trend up. These equities seem to have bottomed in the summer of 2013; 3) Sensitive to institutional buying. If this is the beginning of an upward trend and institutions begin buying these relatively small emerging markets, the upside potential is incredible; 4) The best risk-adjusted returns. Dividend-paying emerging market equities have the potential to provide the best upside returns and the dividends also provide a buffer on the downside risk.

• Kevin Rich, founder of Rich Investment Solutions in New York, with $33.4 million in AUM: The most likely scenario is for U.S. stock markets to be flat to slightly down in 2014. There could also be upward pressure on interest rates either because of Fed action or indications of inflation increases.